A couple of months ago, our five-year-old son was relieved to find out that he could have two best friends. For weeks he’d been stuck in an innocent adolescent triangle where both kids wanted him to be their exclusive bestie. They would pull his arms at the playground and he would come home agonizing about which one to pick. We told him he didn’t have to, and the moment he actually believed us, he was thrilled.

Over the years, we’ve seen a similar false choice plague the FIRE (Financial Independence, Retire Early) community. Both spectators and enthusiasts have been at odds about the acronym and whether the “FI” or the “RE” holds the most weight.

For some, it’s all about financial independence. They love the work they do, are fulfilled by it, and can’t even entertain the idea of retiring early. For others, early retirement is the entire point. They boast super-high savings rates with the hopes of quitting forever before they turn 40 years old.

But this obsession with making either side a permanent state instead of an ongoing process prevents us from acknowledging all the solutions that fall in the middle. Once you realize you don’t have to pick one or the other, like our five-year-old discovered, you put yourself back in control of your financial plan.

1. Cashing out is a viable alternative to retirement

We all tell ourselves stories about money, but the story of the “ideal retirement” has persisted for decades, despite the fact that the number of people working past retirement age has consistently grown since the 1990s. For most people, the idealized concept of retirement is a deal between you, your employer, and the federal government. You do your part to work a long career and consistently set aside 10% and if you’re lucky, your company will do its part and match a portion of that. When you turn 65, you get to quit your job and live off your nest egg with a little help from Social Security as a safety net.

This idealized narrative is burrowed into our cultural lexicon, reinforced through corporate benefits, public policies and financial planning tools, even though each party in truth has failed to hold up their end of the bargain. With an average savings of $25,000, most retirees aren’t wholly living off money they saved during their working years. For many of us, retirement will include earning income in some form.

And while most corporations now offer employer-sponsored retirement funds, stubborn gender- and racial wage gaps still create inequitable contributions for a large number of employees. As for the future of Social Security? Uncertain at best. According to the 2021 annual report from the Social Security board of trustees, the fund’s cash reserves will be fully depleted by 2034.

Modern concepts like gap years, semi-retirement and sabbaticals all foreshadow how the world is changing. We all play a role in ushering work and retirement away from being binary terms with rigid definitions, and to become terms that are more relevant to these times. You do not need to wait until your golden years to enjoy a lifestyle that isn’t dependent on work, and you do not have to approach earning income with an all-or-nothing attitude. You do have to think differently about your career.

2. The myth of meritocracy hurts everyone

It only takes a few years of working in an office to realize that meritocracy is a noble lie that we are paid to believe. We know the only thing hard work guarantees you is more work. It’s OK to take pride in our work ethic, but it becomes problematic when we make it our identity and continue to push past the limits of our physical and mental health.

Fundamentally, we all deserve to live a life that puts our needs ahead of the endless list of unsolvable problems at work and that starts with setting a solid target for the length of your career. We recommend 15 years, broken into three distinct five-year sprints.

3. If you don’t give your income a purpose, someone else will.

The first five years of your 15-year plan should be spent paying off debt and establishing healthy financial habits to mitigate the paycheck-to-paycheck cycle that nearly half of Americans who make more than $100,000 find themselves in. Sure, five years may not be enough time to eliminate all of your debt, but there is little downside from committing to a focused period of time to paying it off.

Frugality isn’t anything to be ashamed about. If you can make frugality a core part of your life and embrace it, you can avoid the consumerism traps that we encounter daily.

Think about it this way: Every time you get rid of a debt, you essentially increase the amount of surplus cash you have. Doing so early and often during your working years is like giving yourself a raise. Imagine no longer waiting for someone to decide you’re worthy of more money. That mindset shift alone does more for self-empowerment than most run-of-the-mill employee development programs ever could.

4. Traditional savings rules weren’t created with all of us in mind

The second five years — years 6-to-10 — are critical and should be spent on acquiring skills and finding your superpower. A superpower is a skill that can support you in the long run — well-beyond your full-time working years. Whether it’s your ability to manage a team or your ability to close a sale quickly, the competencies you develop in your career can and should be used to create income streams outside of your primary job.

This is particularly important if your identity is one that is marginalized in the workplace. Most traditional financial rules of thumb do not reflect the lived experience of people of color and other marginalized groups. Experts talk about saving 10%-15% of income, but there’s little mention of wage gaps or biased hiring practices. Whether your boogeyman is racism, sexism, nepotism or ageism, you have to incorporate externalities, such as the “Black tax” and the motherhood penalty, that are conveniently left out.

Nowadays savers are up against enormous challenges such as record inflation, volatile financial markets and the threat of automation. The good news we have enough information to incorporate history and data into our decision-making. Establishing an income that is independent of your employer will not only give you a safety net, but can also accelerate your timeline to financial independence.

5. There’s more to do with money besides watching it grow

This brings us to the final five years — years 11-to-15 — which should focus on building an escape hatch and your departure from the working world. At this point, you’ve got a decade of experience under your belt and have developed financial muscle memory around investing.

Portfolio

Then what? Perhaps the biggest reason to walk away is to learn the deeper purpose beyond what financial independence can buy. Conflict over money is the leading cause of divorce in the U.S.; two-thirds of working parents in this country suffer from parental burnout, and there is no shortage of organizations and non-profits that are underfunded and lacking leadership.

What do you want your life to look like once you’ve cashed out? Ideally the financial freedom will help you become a better partner, a more empathetic and energized parent, and someone who adds to their community.

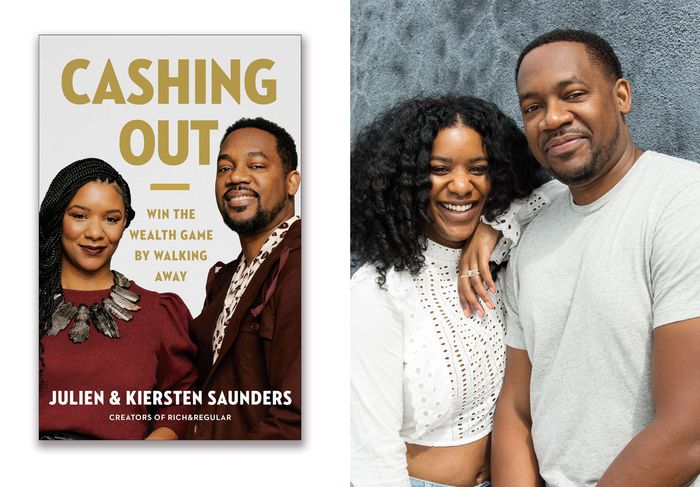

Julien and Kiersten Saunders are the authors of “Cashing Out: Win the Wealth Game by Walking Away,” (Portfolio, 2022). They are the co-creators of the lifestyle blog Rich & Regular, and host a series called Money on the Table.

More: This teacher who retired early at age 29 is navigating FIRE after divorce divided his assets