Crude oil is are near a “clear inflection point” after a selloff pulled the U.S. oil benchmark back below $100 a barrel, a technical analyst said Wednesday, leaving prices on the cusp of a move that could have implications for Federal Reserve policy makers as investors grapple with another hotter-than-expected inflation reading.

“The Oil/Energy trade has been central to the post-pandemic events, most especially inflation. It would stand to reason the unraveling of the Energy uptrend would be equally central to a decline in growth and inflation and, by inference, rate policy,” said William Basa, president of Global Market Research, in a note.

West Texas Intermediate, or WTI, crude for August delivery

CL.1,

CLQ22,

rose 46 cents, or 0.5%, to close at $96.30 a barrel on the New York Mercantile Exchange Wednesday, but had dropped nearly 8% on Tuesday, for its lowest close since early April. Brent crude

BRN00,

BRNU22,

dropped below $100 a barrel on Tuesday, also posting its lowest close since early April.

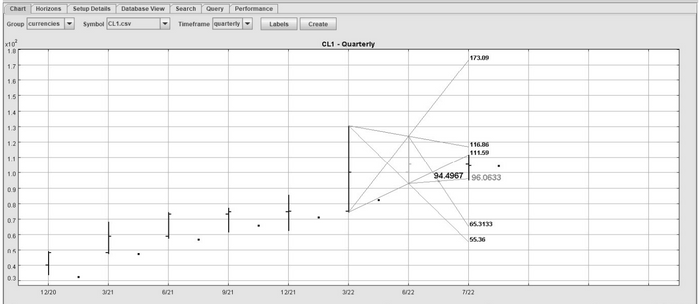

Pointing to the WTI chart below, Basa said it’s hard not to argue that the $96/$94 area “is the clear inflection point of the long-term trend. The Q3 uptrend zone extends from $96.06 to $94.49.”

Global Market Research

The 200-day moving average, meanwhile, stood at $93.21 a barrel during Wednesday’s session. Other than a few days in December, oil hasn’t been below the 200-day average — viewed by traders as an indication of a market’s long-term trend — since clearing it in late 2020, Basa noted.

The June consumer-price index released Wednesday morning showed a 9.1% year-over-year rise, its largest in 41 years, driven in part by a surge in gasoline prices, which have subsequently pulled back from record levels.

The data, which also showed a stubborn rise in core prices, which exclude volatile food and energy, saw U.S. stocks slide and short-term Treasury yields jump. Investors see the data ensuring the Fed will continue to hike interest rates aggressively as it attempts to stamp out inflation, risking a sharp economic downturn.

Some investors have argued that a steep fall in commodity prices recently, including crude and industrial metals, point to prospects for a significant economic slowdown ahead that, in turn, could see the Fed reversing course by next year.

Read: Why the stock market and bonds may be at the mercy of oil prices the next 6 months