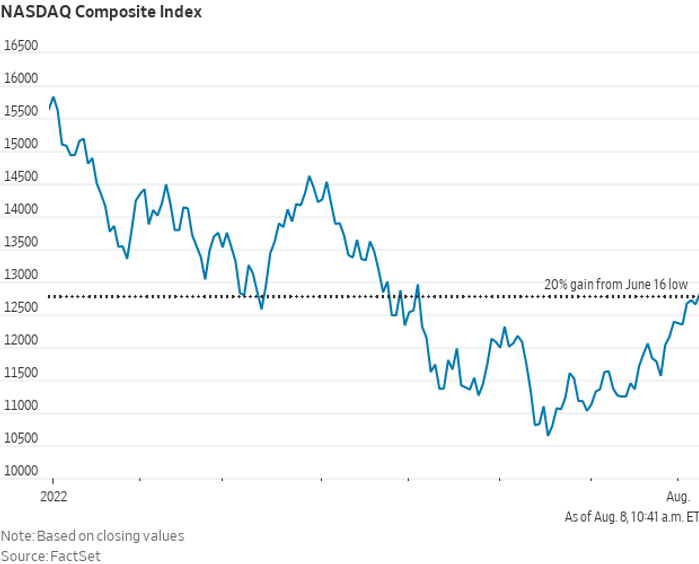

The Nasdaq Composite flirted with leaving bear market territory earlier this week as the tech-heavy index continued a bounce off the June lows before suffering a setback — but even a renewed push back above the exit threshold wouldn’t convince some strategists the bear has been vanquished.

According to Dow Jones Market Data, a finish at or above 12,775.32 would mark a 20% rise from Nasdaq’s

COMP,

June 16 closing low at 10,646.10, meeting the general condition for entering a bull market (see chart below).

SOURCE: FACTSET

The Nasdaq traded above the threshold Monday, but didn’t close above it. The index was down 1.3% Tuesday afternoon near 12,480. But there’s more to a bull market than an arbitrary threshold.

“One of the most enduring signals for when we leave a bear market is when 90% of the S&P 500 stocks shoot through their 50-day moving average, then it moves towards escape velocity,” Quincy Krosby, chief global strategist at brokerage LPL Financia, told MarketWatch by phone on Tuesday.

According to Dow Jones Market Data, as of Monday, only 77.3% of S&P 500

SPX,

stocks and 74.2% of Nasdaq Composite

COMP,

stocks closed above their 50-day moving average.

“A good portion of the S&P 500 has been in bear market territory since February of 2021. Technical bear didn’t hit until the bear gobbled up what we call the leadership in the market, which is big tech,” Krosby said. She believed that bear may not last that long as it has been in the system before it hit the bottom in June.

See: We’re in a bear-market rally and you can expect the June 2022 lows to be broken

The Nasdaq fell 33.7% from its recent high to bear market low, and has been in bear market territory for 107 trading days. The decline marks the deepest and longest bear market since 2008, when the index fell 54% and the period lasted 218 trading days, according to Dow Jones Market Data.

For other indexes, of course, it’s the S&P 500

SPX,

— the U.S. large-cap benchmark — that really counts when it comes to U.S. equities. The index has also bounced, but remains in a bear market after completing a slide of more than 20% from its record finish on January 3.

Morgan Stanley’s Michael Wilson, one of Wall Street’s most vocal bears, also believed the best part of the rally was over.

“The rally in stocks has been powerful and has investors believing the bear market is over and looking forward to better times,” the chief investment officer said in a Monday client note. “However, we think it’s premature to sound all-clear simply because inflation has peaked. The next leg lower may have to wait until September when our negative operating leverage thesis is better reflected in earnings estimates. However, with valuations this stretched, we think the best part of the rally is over.”

See: Veteran strategist Dennis Gartman says it’s still a bear market with no Fed pivot in sight

Meanwhile, the Dow Jones Industrial Average

DJIA,

the popular gauge of 30 so-called blue-chip companies, has not only dodged a bear market, but has traded on the cusp of exiting correction territory. The Dow hasn’t suffered a 20% drawdown — the arbitrary market used in a popular definition of a bear market. It’s slide of more than 10% from its early January record finish, however, did qualify for a market correction.

A finish at 32,877.66 or above would mark a 10% rise from the Dow’s 2022 low finish at 29,888.78 on June 17, meeting popular criteria for exiting a correction. The index lost 61 points, or 0.2%, to trade at 32,769 on Tuesday. after paring an earlier gain of more than 300 points on Monday morning.

Corporate earnings have come out stronger than expected for the second quarter, with more than 77% of S&P 500 companies beating earnings estimates, according to I/B/E/S data from Refinitiv, fueling some of the market’s gains.

“A better-than-feared 2Q earnings season has supported the 10% equity market rally during the last three weeks,” wrote Goldman Sachs’ strategists led by David J. Kostin, in a Monday client note. “S&P 500 EPS grew by 10% in 2Q year-over-year, faster than the 6% growth analysts expected at the start of reporting season. 52% of S&P 500 firms beat the consensus EPS forecast by more than one standard deviation of estimates, below the pattern of the past four quarters. Margins and sales contributed equally to the upside surprise.”

See: A surging stock market is on the verge of signaling a ‘huge’ move — but there’s a catch

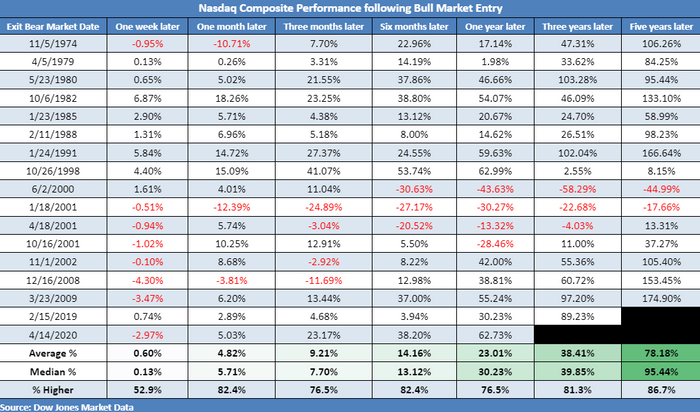

What history tells us

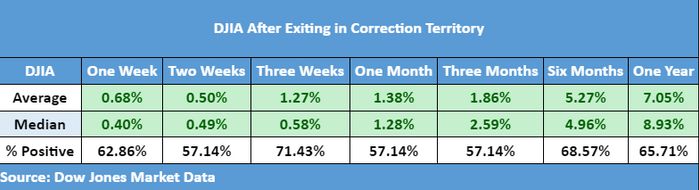

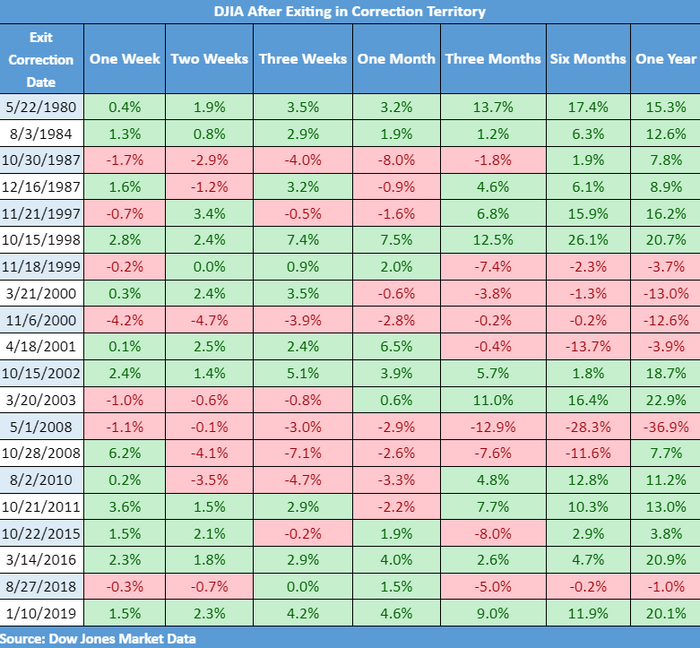

So, what does history tell us about the Nasdaq if it enters bull market territory, and what it says about the Dow when it leaves a correction?

Dow Jones Market Data compiled the tables below:

Nasdaq performance following an entrance into a bull market.

SOURCE: DOW JONES MARKET DATA

The table below is based on all corrections since 1950, but it excludes corrections that later turned into bear markets.

SOURCE: DOW JONES MARKET DATA

The last 20 corrections and the following performance in the DJIA

SOURCE: DOW JONES MARKET DATA