Kwasi Kwarteng was ousted by U.K. Prime Minister Liz Truss as chancellor of the exchequer on Friday, capping a chaotic spell after planned tax cuts were rejected by financial markets.

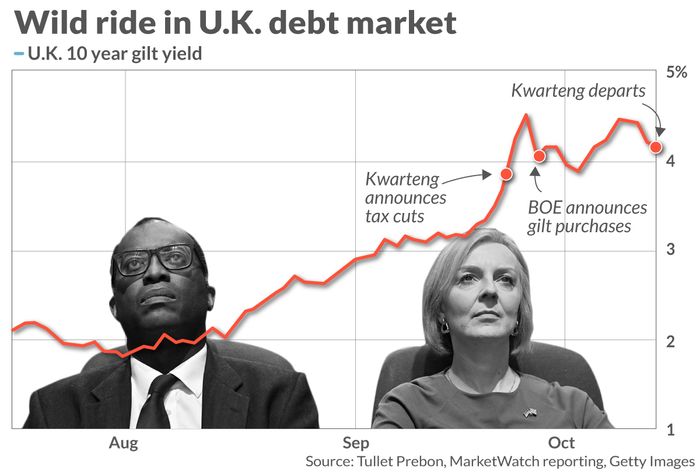

Kwarteng’s tenure — the second shortest ever, except for a previous U.K. finance minister who died in office — collapsed after his plan for £45 billion of tax cuts alongside a massive energy support package resulted in a huge spike in bond yields.

U.K. debt yields did end up stabilizing after the Bank of England intervened, deciding to buy securities when it had planned to sell them as part of its policies to restrain inflation. The central bank however stuck to a timeframe to end its temporary support on Friday, effectively forcing the U.K. government into a choice of either sticking with the tax cuts or risk blowing up pension funds that have put £1 trillion into a strategy leveraged to the performance of government bonds.

Charlie McElligott, a strategist at Nomura, called Truss’s move a “bending of the knee” to financial markets.

Kwarteng’s replacement as chancellor, Jeremy Hunt, was a supporter of former treasury chief, Rishi Sunak, who had warned that Truss’s economic plans would rock financial markets during the Conservative leadership contest to replace Boris Johnson.

Both Kwarteng, in a letter accepting his dismissal, and Truss, acknowledged the role financial markets played. Truss, as Kwarteng had done in recent days, tried to shift the blame to issues impacting the global economy, and specifically the surge in energy prices in the wake of Russia’s invasion of Ukraine.

“The Energy Price Guarantee and the Energy Bill Relief scheme, which made up the largest part of the ‘mini’ Budget, will stand as one of the most significant fiscal interventions in modern times,” she wrote.

Kwarteng wasn’t the only departure, as Chris Philp was shifted from chief secretary to the Treasury to minister for the cabinet office. Edward Argar, who held that role, takes over from Philp.

The pound

GBPUSD,

was volatile on the day, and traded below $1.12 shortly after the Truss press conference ended. The yield on the 30-year gilt

TMBMKGB-30Y,

turned higher but was well below the peak of this week.