The rally in bond markets of late has been startling. As hopes grow that inflation may have peaked, and evidence of a U.S. economic slowdown build, benchmark 10-year Treasury yields

BX:TMUBMUSD10Y

fell from around the 3.5% level touched in mid-June, to near 2.5% at the start of this week.

A 100 basis point retreat in less than two months is a very sharp move, and unsurprisingly it had some observers questioning whether the market had overshot. Sure enough, some hawkish commentary from Federal Reserve officials on Tuesday saw yields bounce in one of the biggest shifts in five years. Little wonder the MOVE index that tracks Treasury volatility remains elevated.

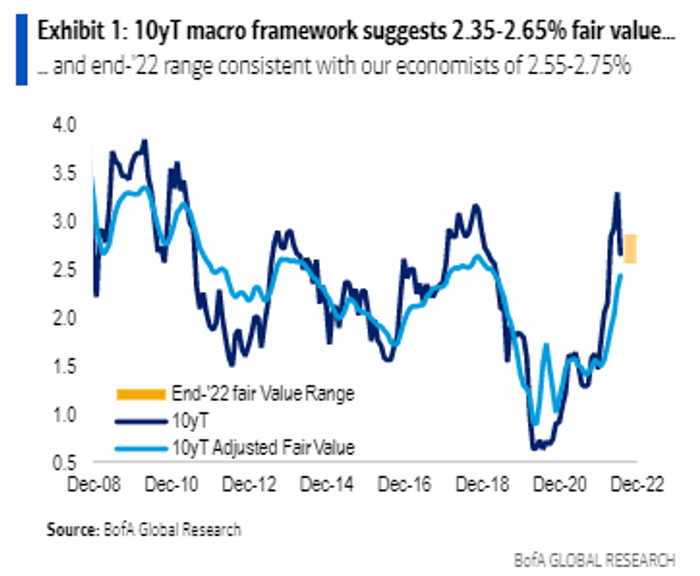

But Bank of America rates strategist Bruno Braizinha says that though “the easy part of the rates rally is behind us” it’s likely benchmark yields could drop further.

“The recent pivot in market focus away from inflation and towards deteriorating growth fundamentals pushed 10-year Treasury yields towards its fair value range faster than we had anticipated,” says Braizinha in a note.

Source: Bank of America

“A further rally from here is possible and even likely, but how much further depends on a series of fundamentals and more technical drivers,” he adds.

One of these is the likelihood that the bond market is underestimating the risk of an economic hard landing. Another is that riskier assets, which have yet to accept such a scenario, are vulnerable to a sell-off, with funds moving into havens. And Treasuries may receive more of those flows because of a perceived safe-haven scarcity.

“Gilts have not been seen as a safe haven for a while, the role of JPY has been shaken lately, and the utility of bunds as defensive is put into question by the likely impact of sanctions linked to the Russian invasion of the Ukraine,” says Braizinha.

All told, BofA reckons that 10-year yields could fall to 2% under a more significant economic slowdown. But even in what it terms a soft-landing scenario the longer duration bond will be comfortable in the 2.25-2.5% range.

“We recommend trading rates with a bullish bias, adding to longs on backups in yields,” says Braizinha.

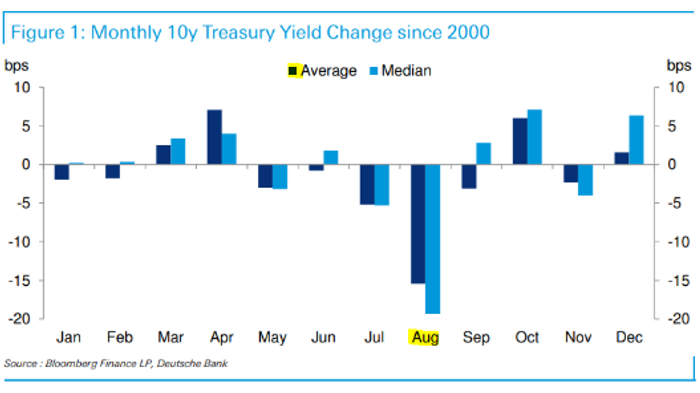

Separately, support for the trade may come from seasonal factors in the short term, too. The chart below from Deutsche Bank shows how August tends to be a good month for bond prices, and falling yields.

Source: Deutsche Bank

Markets

S&P 500 futures

ES00

are up 0.4% to 4,110 and Nasdaq 100 futures

NQ00

are adding 0.4% to 12,977 as traders regather their poise after the latest dip. The dollar index

DXY

is giving up some of the previous session’s gains, easing 0.1% to 106.18. Gold

GC00

is down 0.4% to $1,782 an ounce and Bitcoin

BTCUSD

is climbing 1.6% to $23,385.

The buzz

PayPal shares

PYPL

are jumping 11.6% in pre-market action after the payments group revealed stock buyback and cost saving programs, a new chief financial officer, and confirmed that activist group Elliott Management had built a stake.

Investors are swiping left on Match Group stock

MTCH,

down 21.8%, after the Tinder owner delivered disappointing results following the market close on Tuesday.

Earnings reports on Wednesday include Moderna

MRNA

and Under Armour

UA

before the market open; eBay

EBAY

and Qorvo

QRVO

after the closing bell.

U.S. crude futures

CL

are slipping 0.7% to $93.81 a barrel, near a five-month low, as traders await the outcome from Wednesday’s OPEC meeting.

U.S. economic data for Wednesday: the July ISM non-manufacturing survey and June factory orders, both due for release at 10 a.m. Eastern.

Stock markets in Taiwan

TW:Y9999,

Japan

JP:NIK

and Hong Kong

HK:HSI

were steadier as regional tensions eased in the wake of House Speaker Nancy Pelosi’s visit to Taipei. The Taiwan National Stabilization Fund said it was on standby to intervene in the market if needed.

Best of the web

The U.S. ‘friendshoring’ experiment risks making enemies.

Lessons from the Great Inflation of 1973-81.

The Capitol riot trial that tore a family apart.

The chart

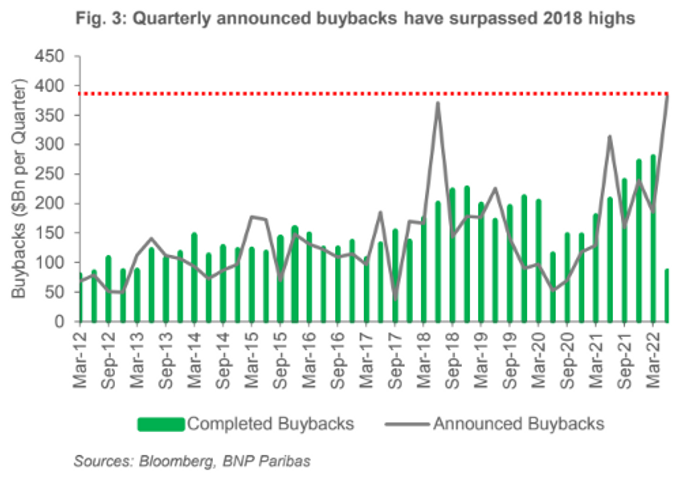

Respect the corporate put says BNP Paribas. Companies purchasing their own stock provides a useful underpinning to the market, and the chart below shows announced buybacks at more-than-a-decade highs.

Source: BNP Paribas

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security name |

| TSLA | Tesla |

| AMC | AMC Entertainment |

| GME | GameStop |

| AMTD | AMTD IDEA Group |

| HKD | AMTD Digital |

| AMD | Advanced Micro Devices |

| NIO | NIO |

| PYPL | PayPal |

| AMZN | Amazon |

| APDN | Applied DNA Sciences |

Random reads

Holy millions down the drain, Batman.

If you thought the meme stock craze was dead….