Investors worried about the next pullback for stocks might want to pause and consider this: the decline in equity valuations since the start of the year already has exceeded the average pullback of other recessionary periods since the early 1990s, according to JPMorgan Chase & Co.’s equity quant Marko Kolanovic.

While more Wall Street analysts have been painting a grim picture of the trajectory of corporate profits this year, Kolanovic, who successfully called the summer stock-market rebound, said investors might be pricing in too dire of an outcome for stocks, even if the American economy falters.

Instead, U.S. equity valuations already were seeing a dramatic re-rating lower, even by the standard of a typical recession, he argued, in a Monday research note.

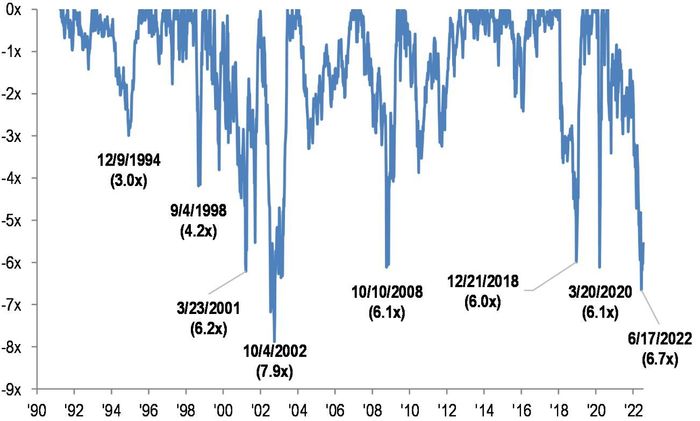

As part of his bullish argument, Kolanovic looked at the next-twelve months (NTM) price-to-earnings ratio — perhaps the most popular ratio used to express equity valuations — and found that it exceeded the average pullback in recessionary periods over the past 30 years.

Kolanovic also found that this year’s pullback would be the second-biggest to follow a recession, should one be declared. To be sure, valuations (using NTM earnings expectations as the denominator) occasionally have been lower, like when stocks bottomed in March 2020 in response to the COVID pandemic.

During said pullback, the S&P 500’s NTM price-to-earnings multiple bottomed out around 15.5x, marking a drop of nearly 7x (see chart) from its January peak. By comparison, in March 2020 the S&P 500’s NTM price-to-earnings ratio hit a low of 13x.

Source: JPM

The findings would seem to support Kolanovic’s view that U.S. stocks already priced in a mild recession.

His analysis comes after the busiest week of the second-quarter earnings season, with corporate performance holding up surprisingly well considering the U.S. economy has contracted now for two consecutive quarters.

See: U.S. economy shrinks in the second quarter, GDP shows, and invites talk of recession

According to FactSet, 73% of S&P 500 companies that reported second-quarter through Friday had beaten profit expectations set by analysts on Wall Street.

That’s just shy of the five-year average of 77% (since corporate earnings routinely surpass Wall Street’s conservative guidance), but it hardly has been the disaster some market strategists feared.

That being said, analysts already have been busy cutting their guidance for the third quarter.

However, if Kolanovic’s outlook plays out, investors shouldn’t be too worried about the impact of a recession (should the National Bureau of Economic Research decide to declare one) on corporate profits, since this year’s selloff stocks has been primarily driven by multiple compression inspired by rising interest rates.

Kolanovic and his team have been bullish on stocks for months now. And so far, their calls for stocks to experience a summer rebound has proven accurate.

While that may bode well for investors heading into the end of the year, rising bond yields still could derail stocks — at least, in theory.

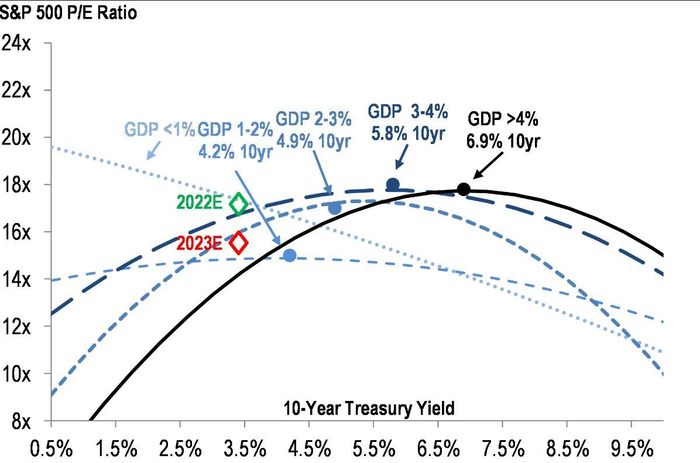

Higher Treasury yields historically have been associated with lower equity valuations, and Kolanovic and his team warned that a 10-year Treasury

TMUBMUSD10Y,

yield north of 3.5% could spell trouble for stocks. The chart below measures the relationship between stock valuations and Treasury yields during periods of high, low and average GDP growth.

Source: JPM

When GDP growth has been relatively low, stocks become especially sensitive to rising Treasury yields. Fortunately for investors, Treasury yields tend to decline during recessions as investors look for “safe haven” assets.

As of Monday, the yield on the 10-year stood at 2.605%, down from a high so far this year of 3.482% in mid-June, according to Dow Jones Market Data.

Still, Kolanovic argued that equity valuations should be more robust this time around if a recession hits, given the shift toward higher quality companies in the S&P 500.

“While the current equity multiple of 16.9x is in-line with historical median, we believe the market multiple is better than fairly valued given the shift in industry mix to higher-quality companies over the last two decades,” he wrote.

The S&P 500

SPX,

finished Monday’s session 0.3% lower at 4,118, while the Dow Jones Industrial Average

DJIA,

retreated 0.1% to 32,798, according to FactSet data. The Nasdaq Composite

COMP,

dropped 0.2% to 12,368.