Like some sort of M.C. Escher painting, strategists at Goldman Sachs say it’s time to pivot from the talk of a pivot.

Last week saw Federal Reserve pivot hopes, and fears, determine the direction of trade — stocks rallied on falling job openings data, only for those gains to fade in the face of an OPEC+ decision to cut production and then better-than-expected payrolls numbers.

Another chance for a pivot will come on Thursday, when consumer price index data gets released by the U.S. Labor Department.

Strategists at Goldman Sachs led by Cecilia Mariotti say don’t bet on it.

“With gasoline prices on the rise and until a broader set of macro data suggest more material weakness in the economy, we would generally lean against markets’ dovish repricing of the Fed,” they said.

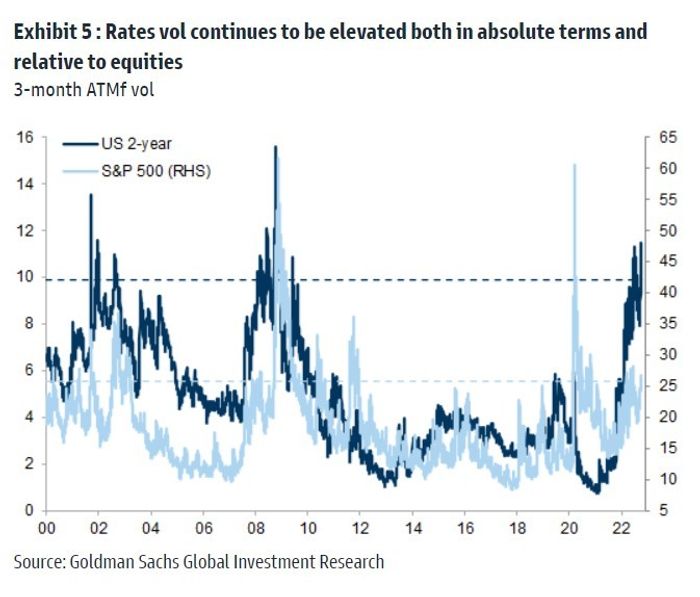

The strategists add that short-term rates remain volatile, both in absolute terms and also relative to stock-market volatility

VIX,

The S&P 500

SPX,

down 24% this year, ended Monday at 3612.39.

The tech-heavy Nasdaq Composite

COMP,

closed Monday at the worst level since July 28, 2020.