In an economic slowdown, investors should own stocks that return cash to shareholders, rather than shares of companies that invest in capital expenditures and in research and development, said Goldman Sachs strategists.

“Investors have historically been skeptical of companies making large capital investments at a time when the economy is slowing and potentially on the verge of recession,” wrote a Goldman team of strategists led by David J. Kostin, chief U.S. equity strategist, in a Friday note. “Stocks with high cash returns outperformed stocks with high capex and R&D around the last three recessions.”

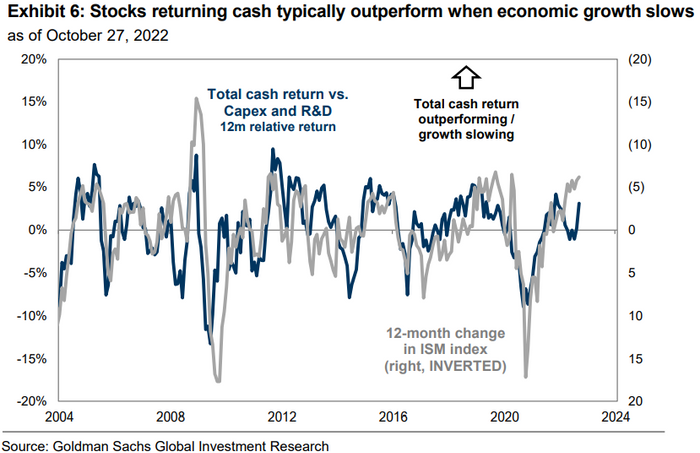

The below chart shows that in past periods since 2004 when the ISM manufacturing index fell sharply, a proxy for economic growth, stocks that returned cash to shareholders typically outperformed those focused on capex and R&D.

SOURCE: GOLDMAN SACHS GLOBAL INVESTMENT RESEARCH

Given the uncertain economic backdrop as the Federal Reserve raises rates, Kostin’s team said investors should now focus on stocks offering investors cash returns since those offering high dividend yields (another use of cash by companies) struggled to compete with rising cash returns and lagged the S&P 500 in the mid-1970s.

A cash return calculates the total cash earned on the cash invested in equities, whereas a dividend yield shows how much a company pays out in dividends relative to its stock price, which adds to gains in the value of the shares.

Goldman strategists last week cut their outlook for S&P 500 buybacks to $869 billion for 2023, after share repurchases set a record in 2021.

In a soft landing scenario, the team expects recession uncertainty to result in $3.2 trillion of S&P 500 cash spending next year, or roughly a zero growth rate, as weak buybacks will be offset by research and development, or R&D (+10%), dividends (+5%) and cash mergers and acquisitions, or M&A (+3%). However, if a hard landing is the baseline for the economy, they expect buybacks would fall by 40% and cash M&A would drop 20% in 2023.

See: 20 dividend stocks that may be safest if the Federal Reserve causes a recession

Beyond using cash to reward shareholders, another longstanding strategy for investing in an environment of higher interest rates and economic uncertainty it to own “quality” stocks, though many investors still struggle to define what “quality” means and, more important, how to generate excess returns.

Scott Chronert, Citigroup U.S. equity strategist, defined “quality” as the intersection of high profitability, low financial risk and business stability, while conceding that it is complicated to consistently identify it from a quantitative perspective.

“The starting ground across indices is typically a return metric, notably Return on Equity (ROE) or Return on Invested Capital (ROIC). From there, debt ratios or accrual measures are often layered in. Lastly, some type of measure of stability, whether it is fundamental, like EPS or cash flow growth standard deviation, or technical, such as return volatility, is added into the equation,” a team of strategists led by Chronert wrote in an October note.

“We find that there is a wide variety of metrics considered in Quality approaches… Ultimately, we see a lack of consensus around any of the three key Quality pillars in quantitative index construction.”

U.S. stocks opened lower on Wednesday as investors awaited the Federal Reserve’s decision on interest rates at 2 p.m. Eastern. The S&P 500

SPX,

shed 0.2%, while the Dow Jones Industrial Average

DJIA,

lost 0.3% and the Nasdaq Composite

COMP,

opened 0.1% lower.