For investors willing to risk wading into the equities option market, BofA Global Research analysts suggested there’s still time to consider strategies tied to exchange-traded funds that could pay off in what may be a volatile week.

It’s “not too late to hedge the most catalyst-packed week of the summer” as some option markets are “still underpricing event risks,” said equity-linked analysts at BofA, in an equity derivatives note Tuesday. “This week promises to be one of this year’s most consequential for markets.”

The analysts pointed to megacap tech earnings reports due out this week, the Federal Reserve’s policy decision on interest rates after concluding its two-day meeting on Wednesday, U.S. growth figures for the second quarter on Thursday and inflation indicators on Friday.

“The risk of a volatile week has not been lost on markets,” with option markets maintaining “a prominent kink” in the term structure of S&P 500 volatility for more than a month, the BofA analysts said in the note. “However, we think there’s still value in owning vol into all these catalysts if one knows where to look.”

For example, the Energy Select Sector SPDR Fund

XLE,

iShares China Large-Cap ETF

FXI,

and SPDR S&P Homebuilders ETF

XHB,

have median returns around the four past Federal Open Market Committee meetings this year that “far surpass the cost of a straddle expiring this Friday,” the analysts said, noting that the past Fed meetings didn’t coincide with as many other catalysts seen this week.

A straddle is a strategy that involves buying put and call options for the same underlying security at the same strike price and expiration date, with the put contract indicating a bearish view and the call option representing a bullish take.

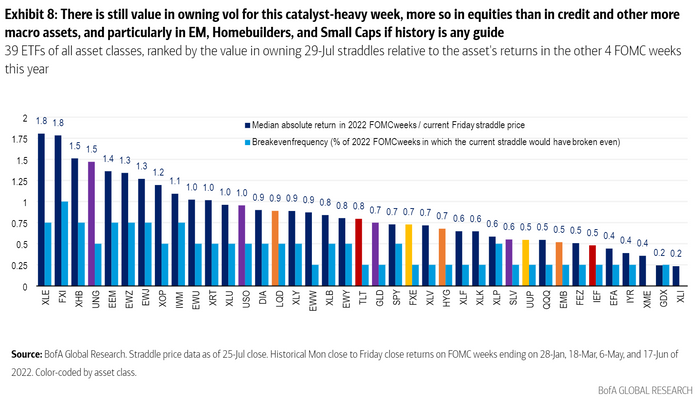

In comparing 39 exchange-traded funds across asset classes, the BofA analysts said they considered the current price of this Friday’s “straddle” and the underlying asset’s returns during the four prior FOMC weeks in 2022.

“If history is any guide,” they wrote, “there is still value in owning vol for this catalyst-heavy week, more so in equities than in credit and other more macro assets, and particularly in EM, Homebuilders, and Small Caps.”

BOFA GLOBAL RESEARCH NOTE DATED JULY 26, 2022

“But among assets with the best value in this framework, rates-sensitive Homebuilders may be the most direct FOMC play,” the analysts wrote. “With expectations for a slower hiking path from here, a key risk this week is the Fed opening the door” to more interest-rate increases of 0.75% in coming meetings.

The analysts suggested buying “XHB 29Jul 59.5-57.5 put spreads for $0.40 (5-to-1 max payout),” referring to the ticker of the SPDR S&P Homebuilders ETF. “Risk to the trade is loss of the upfront premium paid,” according to their note.

Read: ‘Lots of stagflation in the new home market’: Homebuilder ETFs are struggling

Many investors expect that the Fed will announce on Wednesday that it’s hiking its benchmark rate by three quarters of a percentage point. That’s amid concerns that large rate increases by the central bank to curb inflation risk triggering a recession.

Key Words: Here’s what Bill Ackman says Powell should tell traders about Fed rate-hike plans

Economists at BofA estimate that gross domestic product in the U.S. shrank 1.2% in the second quarter, according to the equity derivatives research note Tuesday.

Meanwhile, shares of retail giant Walmart Inc.

WMT,

were sliding around 8% Tuesday afternoon after the company lowered its profit forecast, saying in a statement Monday that high food inflation is hurting customers’ spending on general merchandise such as apparel.

The U.S. stock market was trading down Tuesday, with Walmart being among the worst performers in the blue-chip gauge Dow Jones Industrial Average and S&P 500 index, according to FactSet data, at last check. The Dow

DJIA,

was down around 0.6% Tuesday afternoon, while the S&P 500

SPX,

fell 1.2% and the tech-heavy Nasdaq Composite

COMP,

dropped 1.9%, FactSet data show.

Investors will be watching this week for quarterly earnings reports from Google parent Alphabet Inc., Amazon.com Inc.

AMZN,

Apple Inc.

AAPL,

Facebook parent Meta Platforms Inc.

META,

and Microsoft Corp. Alphabet

GOOGL,

and Microsoft

MSFT,

will report their earnings results after the market’s close Tuesday.