TIPS in recent months have become an increasingly attractive option for the fixed-income portion of your retirement portfolio.

I’m referring, of course, to the Treasury’s Inflation-Protected Securities. They are similar to traditional Treasury notes and bonds except that their quoted yields are above and beyond the Consumer Price Index. Real yields, in other words.

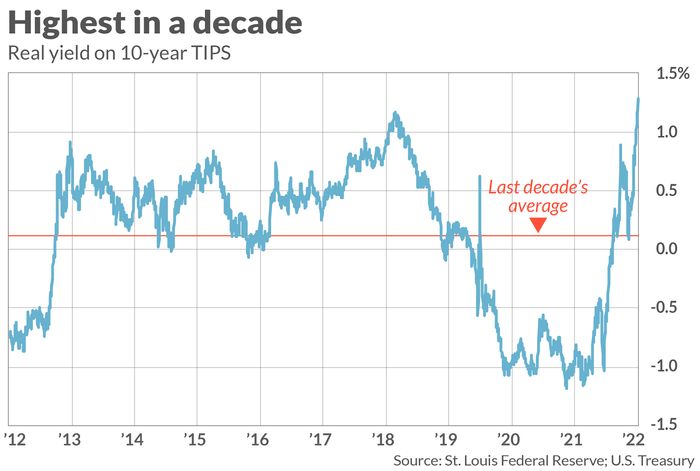

Right now, 10-year TIPS are yielding 1.29%, which means that you are guaranteed to make at least that much more than inflation over the next decade if you purchase them today and hold until maturity.

The reason that TIPS have become more attractive in recent months is that after trading for several years with negative real yields, in May those yields began rising above zero and are now well above 1%. As you can see from the accompanying chart, the 10-year TIPS yield currently is the highest of any over the last decade.

In fact, TIPS’ positive real yield makes them in some ways more attractive than I-Bonds—U.S. savings bonds whose yields are based on the prevailing inflation rate. I-Bonds’ rates are combination of the CPI’s trailing rate of change and a fixed rate that is set when purchasing. Though the U.S. Treasury may change this fixed rate in the future, it currently is set at zero—which means that, for now, I-Bonds’ real yield is precisely zero.

Because the I-Bond fixed rate is precluded from ever being negative, I-Bonds were more attractive than TIPS during those periods over the last decade in which TIPS’s real yields were negative. That situation has now reversed itself.

To be sure, there’s no guarantee that TIPS’ yields won’t in the future slip back into negative territory. But if that happens you would have the option of selling your TIPS in the secondary market before maturity, since they would now be trading above par—and, to the extent possible, reinvesting the proceeds in I-Bonds with a zero real yield.

Selling before maturity

The only major risk when investing in a TIPS, therefore, is the possibility you’ll need to sell it before maturity and its yield is higher at that point than when you purchased it. I-Bonds don’t have that risk, since their value doesn’t fluctuate; after an initial period in which you can’t sell without penalty, you can sell your I-Bonds at any time at the same fixed (real) rate set when you purchased it.

How big a risk is it that TIPS therefore have over I-Bonds? As the accompanying chart illustrates, the 10-year TIPS’ yield is well above the 10-year average. On the assumption that its yield is mean-reverting you might feel comfortable betting it’s more likely to be lower in the future rather than higher.

The choice between TIPS and I-Bonds boils down in large part to your tolerance for risk. As Zvi Bodie, who for 43 years was a finance professor at Boston University, said in an email, “you can lose money on TIPS, but not on I-Bonds. With I-Bonds there is no downside risk… That is hugely valuable.”

In contrast, Harry Sit, of The Finance Buff, thinks TIPS are preferable right now. “When the yield on 5-year TIPS is at 1.27%,” Sit wrote in an email, “it’s hard to justify holding the fixed rate of I-Bonds at 0%.”

In any case, Sit added, “Because I-Bonds have an annual [purchase] limit, you don’t have to choose between I-Bonds and TIPS. Buy both, and you won’t have to wonder which is better.”

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at [email protected]