What if before you lay down thousands for a downpayment or sign a 30-year mortgage in today’s uncertain housing market you had a clearer idea of the flooding, extreme heat or wildfire risk that could threaten your dream home or drive insurance premiums uncomfortably high?

And what if the snapshot of the property not only digitally drew and explained the future flood, wildfire or heat that could damage the dwelling, but offered cost estimates to repair or replace your home, even before you buy it?

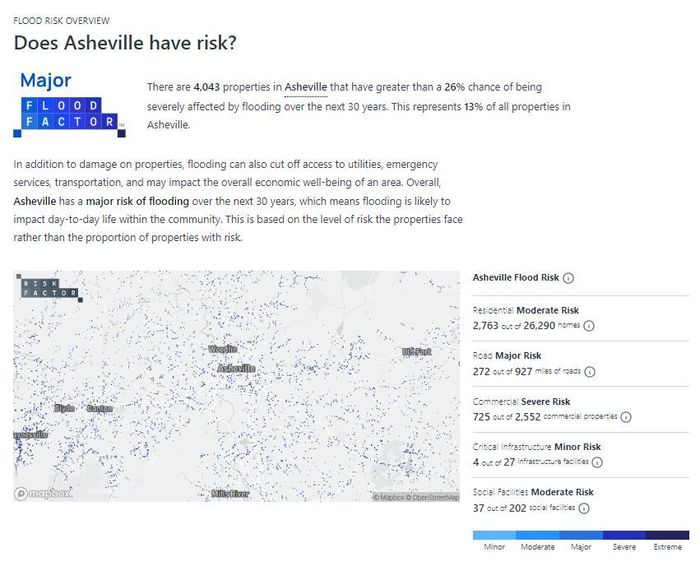

First Street Foundation, a mostly donation-funded research nonprofit whose detailed interactive maps and data, tracks the impacts of climate change on homes or land eyed for development. The group uses climate-adjusted data to understand the 30-year risk profile for more than 140 million U.S. homes and properties.

First Street’s tool was already increasingly a feature on sites like Realtor.com, Redfin

RDFN,

and other listing services. Now, First Street offers its most-robust online tool and app to a wider audience — and for free.

The information available through its Risk Factor Pro, as the unlocked tool is known, includes damage cost estimates, and enhanced analysis of the consequences of flood, extreme heat and wildfire to a building. It uses visual graphics and interactive maps to paint the helpful picture, and allows users to customize building characteristics — how close to the property is natural fuel like timber or what roof material is used, for instance.

And, Risk Factor allows users to widen the view to help would-be homeowners better sum up the future health and reliability of recreational features, transportation infrastructure and other amenities that face the same uncertain future brought on by climate change.

The Pro feature was previously reserved for large institutional investors or mortgage banks and packs data that can cost tens of thousands of dollars to access. Instead, the findings of data scientists using climate modeling will be clickable to anyone interested in an assessment of their own property or one they’re targeting to buy, the organization announced this week.

“First Street is democratizing this data for all and helping level the playing field between large mortgage institutions and the average American homeowner,” said Matthew Eby, the founder and CEO of First Street Foundation.

Risk factors, which are searchable by property, or ZIP code or state, are meant to help homeowners, real estate agents and eventually, insurers, get a better handle on how climate change is impacting home values and the cost of homeownership.

Flood insurance, for instance, has traditionally been covered by a federal program and research finds most homeowners underinsured when it comes to floods, even after FEMA updated its maps and as more private carriers push into flood insurance.

North Carolina State University researchers have said federal flood maps underestimate the risks of flooding in Florida and other states. That can lead many homeowners to ignore buying flood insurance — a decision many might be regretting as they try to clean up water-damaged homes after the latest devastating storm to hit the Gulf Coast, Hurricane Ian.

First Street Foundation

Whether it’s heat, fire, floods, eroding shorelines or air quality, climate-change considerations are slowly factoring into homebuying decision-making, a shift not lost on the real estate industry.

Compass, the largest residential real estate brokerage in the U.S., said over the summer it will begin integrating climate risk analytics as part of the home buying and selling process for both agents and clients.

Buyers and sellers, and importantly, their real estate professional, must all ask themselves if a home is priced to reflect immediate risk, such as from floods, but also the odds that property damage, energy costs, or a limited ability to enjoy the outdoors might be looming in coming years. And given these rising risks, homeowners must consider whether the home is properly insured, including accurately reflecting replacement value.

“For those buyers preparing to put what amounts to their life savings into a home purchase, understanding that particular home’s true flood risk is far more sophisticated today than checking antiquated FEMA flood maps or asking a lender whether flood insurance will be required,” said David Worters, principal and founding broker/agent at Compass in Raleigh, North Carolina.

“Today’s buyers understand that hyper-local factors such as impervious surfaces, elevations, slopes of streets and so many other factors must be considered,” he said.

First Street first rolled out flood, then wildfire, data and most recently added extreme heat risks, which can be a learning curve for homeowners who might not consider themselves vulnerable to heat’s long-term impact on property and the livability of the region where that property exists.

Importantly, even areas that experienced only a few hot days each year will see changes.

First Street’s mapping shows that across the U.S., on average, the local hottest seven days are expected to become the hottest 18 days by 2053. By that year, 1,023 U.S. counties are expected to exceed 125°F, an area that is home to 107.6 million Americans and covers a quarter of the U.S. land area.

Read more: A quarter of the U.S. will fall inside an extreme heat belt. Here are the states in the red zone.