Sometimes it pays not to dismiss market lore. They said September was usually bad. They were right.

The S&P 500

SPX

will enter the last trading day of the month having shed 7.95%. Worries over inflation and higher borrowing costs – not to mention a bond crisis in the U.K. – took their toll.

But if traders adhere to seasonality there is good news. October enjoys an average gain of 1%, and according to Dow Jones Market Data, after a September loss of 7% or more the coming month sees a 1.8% advance.

Is that feasible without help from the big beasts, though?

Consider Apple

AAPL,

which commands a roughly 7% weighting in the S%P 500. There are days when the market can shrug off weakness in the iPhone maker, but they are rare. Thursday’s market battering came after Bank of America downgraded Apple, and its stock slid to a near 3-month low.

Don’t worry, says Mark Newton, head of technical strategy at Fundstrat, Apple can likely bottom next week – as another bounce in yields and the dollar pushes the broader equity market down – but then it will trend higher into mid-November.

“I continue to believe that October approaching should be a time when many various asset classes experience a change in trend, with equities and Treasuries turning higher (yields fall) while the U.S. Dollar takes a reprieve from its parabolic rally. The risk/reward should be favorable for bulls to buy dips on declines into next week,” says Newton in his latest note.

He gives a number of reasons why Apple is unlikely to negatively impact the market in coming weeks.

First, Apple has held up better than most tech stocks and even after a bad several days it still trades roughly 9% above its June lows of $129.04.

Next, “daily momentum is now reaching oversold levels and DeMark exhaustion looks to be two-to-three days away from forming on AAPL stock on daily charts. Note: this likely should cause a possible trend reversal in AAPL before it breaks June lows at higher levels,” Newton says.

Source: Fundstrats

Also, though Apple is 21% down from its all-time high at the start of the year, “its pattern has been anything but bearish in the last year, but sideways as its trading at roughly the same levels as it was last October”.

Finally, Newton argues that unless the June lows of $129 are breached then the recent retreat doesn’t carry much technical significance and “and should be a buying opportunity heading into next week with optimal levels to consider at $135-$138 on weakness”.

In summary, Apple’s decline is not as bad as many fear it is, reckons Newton, and the tech sector has held up much better than many give it credit for in recent days. “Both factors should be important reasons why markets might be in position to bottom out at a time when many least expect it.”

Markets

Wall Street was in line for a firm start to the day, with S&P 500 futures

ES00

up 1% to 3692. The 10-year Treasury yield

BX:TMUBMUSD10Y,

which at one this week touched 4%, dipped 7.5 basis points to 3.71%, helping push the dollar index

DXY

down 0.6% to 111.63.

The buzz

Nike shares

NKE

are tumbling 9.5% in pre-market trading after the company released results after Thursday’s close and said margins would be hit by discounts to sell old stock.

There’s a big batch of economic data and Fed chatter for traders to consider on Friday. One of the central bank’s most closely watched inflation gauges, the PCE price index, for August, will be published at 8:30 am. Real consumer spending and real disposable income data, also for August, will be released at the same time, Eastern.

The Chicago PMI survey for September should be released at 9:45 am followed 15 minutes later by the University of Michigan consumer sentiment index and the 5-year expected inflation numbers for August.

Fed talkers: Richmond Fed president Tom Barkin at 8:30 am; Fed vice chair Lael Brainard at 9 am; Fed governor Michelle Bowman at 11 am; Barkin again at 12:30 pm; New York Fed president John Williams at 4:15 pm.

Eurozone inflation hit 10% for the first time, September data showed. High fuel costs have prompted the EU to back a package to cut power use and place a windfall tax on energy companies.

The governing Conservative party in the U.K. is paying the price for financial turmoil. Latest polls show the Labour opposition have a 33-point lead over the Tories, the widest since the 1990s. U.K. bonds

BX:TMBMKGB-10Y

and the pound

GBPUSD

were higher following heavy selling earlier in the week.

Best of the web

Europe’s energy plan: is it enough to get through the winter?

The Blackstone rebellion: taking on the world’s biggest commercial landlord.

Why are companies still hiring when GDP is shrinking?

The chart

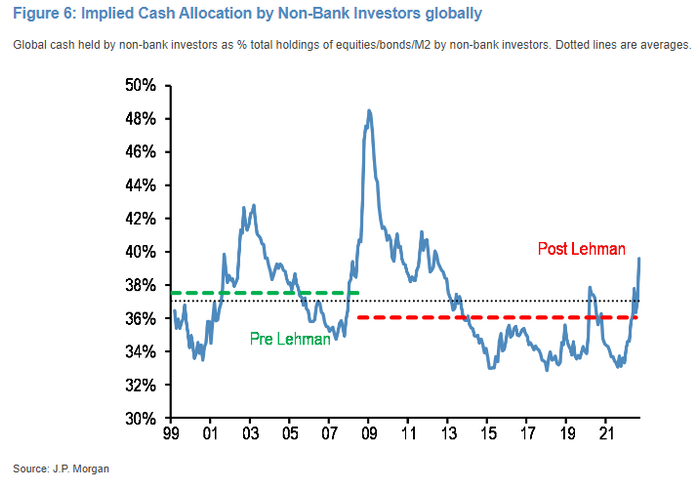

There’s a lot of bad news about. That has encouraged investors to sell stocks and bonds and move into cash. But that, in turn, may prove positive, notes JP Morgan.

“The implied cash allocation of investors globally has risen to its highest level since 2012 and above its level seen at the peak of the pandemic crisis in March 2020. In other words, outside any feedback loop between equity and bond allocations, a backdrop of high cash allocations provides a backstop for both equities and bonds likely limiting any further downside from here.”

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security name |

| TSLA | Tesla |

| GME | GameStop |

| AMC | AMC Entertainment |

| AAPL | Apple |

| NIO | NIO |

| AVCT | American Virtual Cloud Technologies |

| BBBY | Bed Bath & Beyond |

| APE | AMC Entertainment preferred |

| TWTR | |

| DWAC | Digital World Acquisition Corp |

Random reads

Destroy the chocolate bunnies!

T-Rex skeleton may fetch $25 million.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton.