It’s midterm day in America, so pack your weapon (where legally permitted), have your local election lawyer on speed dial and get out the popcorn. U-S-A, U-S-A. More on that later.

The company lost $2.7 billion in the third quarter, though its earnings are notoriously volatile, and the losses were down to swings in derivatives and investments. Operating earnings rose 20% during the quarter, and it has $109 billion in cash to play with. Surely it’s worth giving Buffett a pass, right?

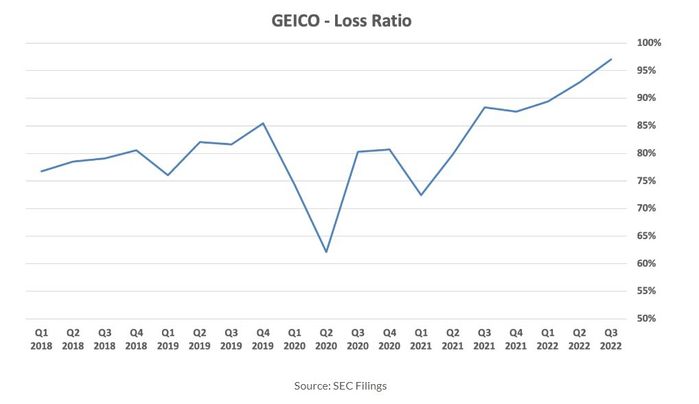

Well, maybe not. The blog The Rational Walk, a long-time Buffett watcher, dived into Berkshire’s latest earnings, and found that the conglomerate’s cash cow, auto insurer Geico, is struggling.

Granted, Geico has had a terrific decade, and it thrived during the pandemic because people weren’t driving — easy money for an auto insurer. But it’s paying for it now, not just because people are driving again, but because auto accidents are more expensive to repair, due to inflation.

Rival auto insurer Progressive

PGR

also is saying the impact of inflation not just increases the valuation of used vehicles — bad news when you have to pay to replace them — but its total loss and repair costs.

The Rational Walk

The other point worth noting is that Geico has been cutting costs — laying off workers, and reducing advertising. Given that the industry is incredibly competitive, reduced advertising may have weighed on policies in force, and could do so in the future.

“While a few quarters of adversity do not necessarily indicate a turning point in Geico’s long term prospects, recent results compare unfavorably with Progressive. The reason I’ve spent more time on Geico’s results is because it is clearly the most troubled operation in Berkshire’s insurance group and shareholders will want to watch future developments carefully,” the blogger says.

The markets

U.S. stock futures

ES00

NQ00

were pointing to a third day of gains in what seems to be an act of buying the rumor ahead of the midterms. The major market action was in the crypto space, where bitcoin

BTCUSD

was reeling amid trouble at the token used by cryptocurrency exchange FTX.

The buzz

As voters head to the polls, the U.K. betting site Smarkets assigned a 90% probability that Republicans would take control of the House of Representatives, and a 68% probability the GOP will control the Senate as well.

Lyft

LYFT

shares tumbled in premarket trade after its active rider numbers fell short of expectations, and the midpoint of its revenue guidance also was below estimates.

TripAdvisor

TRIP

shares slumped on an earnings miss. Take-Two Interactive

TTWO

declined after cutting its bookings outlook.

After the close, Walt Disney

DIS

reports results. DuPont

DD

shares rose as the chemicals company topped analyst estimates.

Nvidia

NVDA

is making an alternative microchip for China to comply with U.S. export hurdles.

The $1.9 billion Powerball drawing has been delayed.

Best of the web

Where would you store billions of dollars worth of stolen bitcoin? Apparently, on a single-board computer submerged in a popcorn tin.

The United Nations climate summit is off to a poor start, according to activists.

The hedge-fund manager who exposed accounting fraud at Luckin Coffee

LKNCY

is now backing the Chinese chain.

Top tickers

These were the most active stock-market tickers as of 6 a.m. Eastern.

| Ticker | Security name |

| TSLA | Tesla |

| GME | GameStop |

| DWAC | Digital World Acquisition Co. |

| AMC | AMC Entertainment |

| NIO | Nio |

| AAPL | Apple |

| META | Meta Platforms |

| AMZN | Amazon.com |

| MULN | Mullen Automotive |

| BBBY | Bed Bath & Beyond |

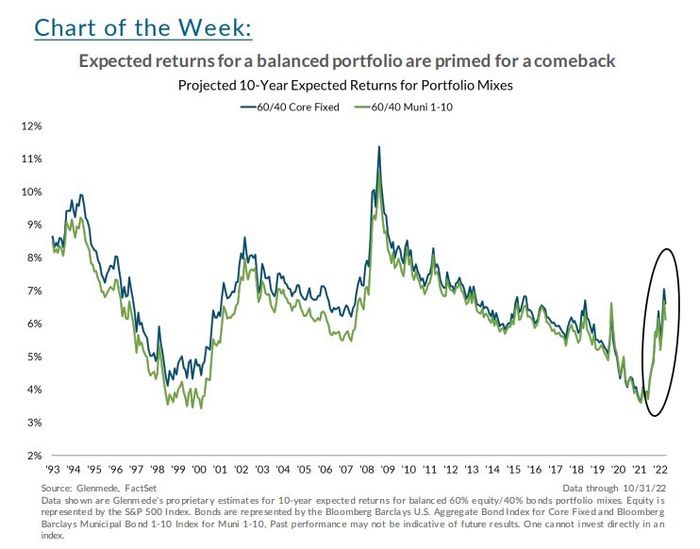

The chart

The 60/40 model has been having a horrible year as both stocks (the 60 part) and bonds have slumped. But it’s too early to throw in the towel, argue analysts at the asset manager Glenmede, whose model for the next decade forecasts average annual gains of near 7%. Michael Reynolds, vice president of investment strategy, said the firm’s model uses valuations and yields as the primary basis for projecting returns. “Glenmede’s empirical research has shown that, while valuations are a poor market timing tool in the near-term, they’re one of the best determinants of longer-term expected returns out there for investors,” he said over email.

The stock-market valuations are based on a mix of normalized price-to-earnings, price-to-cash flow and price-to-book ratios, as well as dividend yields, which are then adjusted for the level of interest rates. The fixed income model is mostly driven by inflation expectations and the likely forward path of fed funds with associated term premia.

Random reads

The hot culinary trend … is to wear black gloves.

These crypto enthusiasts bought an English soccer club, with what has to be said disastrous results.

The founder of Oculus, now held by Meta Platforms, created a virtual reality headset that will kill the user if dead in the game.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton