Last goal for 2022? Ending it.

Stock markets would like to just get there without any more meaningful losses, says Navellier and Associate’s chairman and founder Louis Navellier, who adds that “anyone who made bets for a big rally this week is probably folding their tent.”

But after Wednesday’s losses — amid a really poor December — stock futures are showing some green for Thursday, led by none other than tech stocks, as Tesla

TSLA

heads for a second day of gains.

Tech is at the heart of the current downturn, and how the big names perform going forward will be crucial, say some market watchers out there. And others clearly see another domino left to fall.

That brings us to our call of the day, which says Apple

AAPL

indeed could be the bear’s next possible victim. Shares of the iPhone maker have fared slightly relatively better than its big tech brethren, down only 29% year-to-date.

Here’s @TheChartReport‘s Patrick Dunuwila summing up a note by John Roque of 22V Research (thanks to @HarksterHQ for flagging this one).

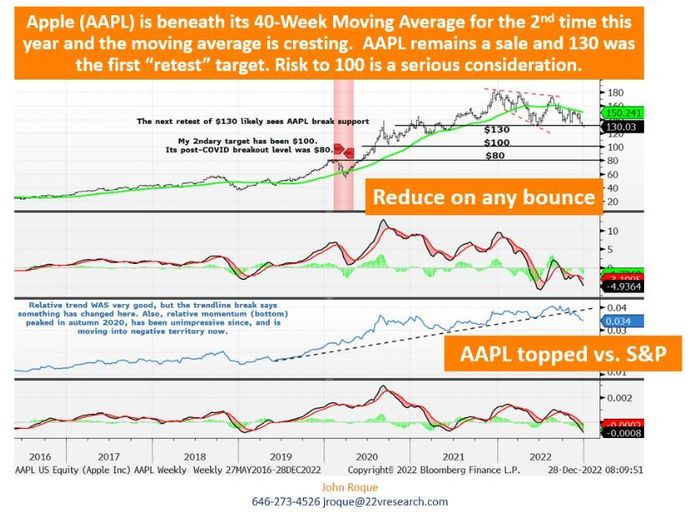

“Apple has held up better than most FAANG stocks this year, however, John points out that it could be the bear’s next victim. The stock closed at a fresh 52-week low today [Wednesday] as it sliced through key support around $130. It’s below a declining 40-week moving average, and it’s already broken down on a relative basis,” says Dunuwila.

“These are the exact same conditions that existed in stocks like $ARKK

ARKK,

$TSLA , $META

META,

and $AMZN

AMZN

before they began to accelerate lower.”

This chart from Roque (@daChartLife) lays out the dangers for Apple, and the “serious” possibility that shares will hit $100.

22V Research

Roque says the overall market won’t stop falling until the “Big 5 index” — made up of Apple, Amazon, Alphabet, Microsoft and Tesla — bottom.

22V Research

Others are also pointing out some crucial technical levels for Apple right now.

“125 is the must hold level for mighty Apple, but the urge to place that longer term buy order fades some when you zoom out and compare to old hotties such as NYFANG or AMZN. Apple is key for the overall market going forward,” notes the blogger behind The Market Ear.

The Market Ear/Refinitiv

Also read on for our chart of the day, that’s got a hopeful message about this stock market.

The markets

MarketWatch

Stock futures

ES00

YM00

NQ00

are higher, as bond yields steady

BX:TMUBMUSD10Y

BX:TMUBMUSD02Y,

while the dollar

DXY

tilts lower. Crude oil prices

CL

are weaker, as were Asian equities

JP:NIK

HK:HSI

as investors weigh up China COVID worries.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Tesla

TSLA

stock is up nearly 5% in premarket trading. CEO Elon Musk reportedly told employees in an email on Wednesday to “not get too bothered by stock-market craziness” and push hard to deliver more cars by the end of the current quarter. Morgan Stanley reportedly cut its price target on Tesla to $250 from $330, but sees a buying opportunity.

Read: Tesla’s stock breaks record-tying losing streak with best daily gain in nearly a month

Shares of Hyzon Motors

HYZN

are surging after a unit of the company and division of Chevron

CVX

agreed to invest in a unit of clean fuels company Raven SR. Cal-Maine Foods shares

CALM

are down in premarket after reporting revenues more than doubling on record egg sales, but costs also rising.

Goldman Sachs

GS

CEO David Solomon reportedly told employees to expect job cuts in early January in his annual year-end letter.

Disney stock

DIS

is selling for the cheapest price of the “Star Wars” era.

Exxon Mobil

XOM

is suing the EU to block a planned tax on high profits sparked by Russia’s invasion of Ukraine.

Weekly jobless claims came in at 225,000, versus expectations for 223,000.

The chart

“The S&P 500 entered a bear market in June and has been stuck since, notes Jeffrey Buchbinder, chief equity strategist for LPL Financial, who says at one year old, the current bear phase is longer than the average post-WWII bear of 11 months.

The good news? “Looking at just the last seven bear markets since the 1987 crash, we have seen the market bounce back an average of 43.6% after dropping 33.1%,” said Buchbinder who says they expect double-digit gains for the S&P in 2023.

LPL Financial

The MarketWatch Quiz — Answers!

Did you take MarketWatch’s 2022 Financial Quiz? If not, you can do so here. If you have taken the quiz, read on and find out the answers below.

1. Through Tuesday’s close, the best-performing stock was Occidental Petroleum

OXY,

up 122%, excluding dividends. The worst performer has been Generac Holdings

GNRC,

down 74%.

2. The Fed made seven interest-rate hikes in 2022, including four consecutive 75 basis point increases. Some economists say the hikes have already succeeded in one way.

3. Inflation reached a four-decade high in 2022. It peaked at 9.1% in June 2022. It’s slowing, but the fight is far from over.

4. President Joe Biden announced in August that his administration planned to cancel up to $10,000 for borrowers earning $125,000 or less and up to $20,000 for borrowers who used a Pell grant in college, but opponents have looked for strategies to mount a legal challenge.

5. The U.S. Justice Department has launched a criminal probe into how $372 million vanished out of FTX-controlled wallets the day that the exchange filed for bankruptcy in November. Former FTX CEO Sam Bankman Fried, who is charged with fraud and currently in jail in the Bahamas, will be transferred to the U.S.

6. Musk bought Twitter in October in a deal valued at $44 billion. He subsequently cut the workforce by 50%, equivalent to approximately 3,700 workers. However, one analyst said, “He sold caviar, to buy a $2 slice of pizza.“

7. The Fed’s ultimate goal is to get long-term inflation back down to 2%. The Fed formally adopted this policy in 2012.

8. The 30-year fixed rate mortgage rate was 6.27% for the week of Dec. 22. It fell below 3% in the summer of 2021

9. Congress passed five major pieces of legislation during the year. 1. The Inflation Reduction Act, a $369 billion bill, was passed in August to combat climate change, and lower prescription-drug costs. 2. Earlier this month, Congress passed legislation requiring states to recognize legal marriages regardless of “sex, race, ethnicity, or national origin.” 3. In June, Congress signed sweeping gun-reform legislation, tightening access to guns. It improves background checks for younger firearm buyers, restricts access for domestic violence offenders, and helps states institute “red flag” laws to keep guns out of the hands of high-risk individuals. 4. In August, Biden signed the Chips and Science Act, including $52.7 billion for domestic manufacturing of chips SMH SOXX. 5. A bipartisan group of senators agreed on changes to the Electoral Count Act, the post-Civil War-era law for certifying presidential elections that lawmakers decided requires revision after the Jan. 6 attack on the Capitol and then-President Donald Trump’s attempts to overturn the 2020 election.

10. Liz Truss became U.K. prime minister in September, succeeding Boris Johnson.

Bonus question: U.K. markets tanked after Truss released her aggressive economic growth and tax plan. She rescinded large parts of the plan, but ultimately resigned after just 44 days, breaking the record for the shortest tenure as prime minister in U.K history. Rishi Sunak, her rival in the initial race for Prime Minister, succeeded Truss.

Related: Take MarketWatch’s 2022 Financial Literacy Quiz. Will you get 10/10?

Random reads

Planes, trains and automobiles. How some stranded Southwest passengers found their way home.

Ice Age. Drone footage shows frozen-over lake homes in Canada

Queuing up for hours. Owning a Tesla in England looks like this

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton.