Is it a false dawn in the stock market or is there something real? The S&P 500 has never lost ground over the following year when advancing volume was at least 85% of volume for two out of three days coming off a 52-week low, according to Jason Goepfert, the founder of Sundial Capital Research. That has happened 13 times.

Here’s another: The S&P 500

SPX

closed higher on Wednesday for the first time since March after a day in which it gained at least 2%. You can now buy the dip without automatically and instantly getting punished.

But our call of the day studies the link between the corporate bond and stock markets. Spreads in both investment grade and riskier high-yield bonds have narrowed rapidly over the last three weeks.

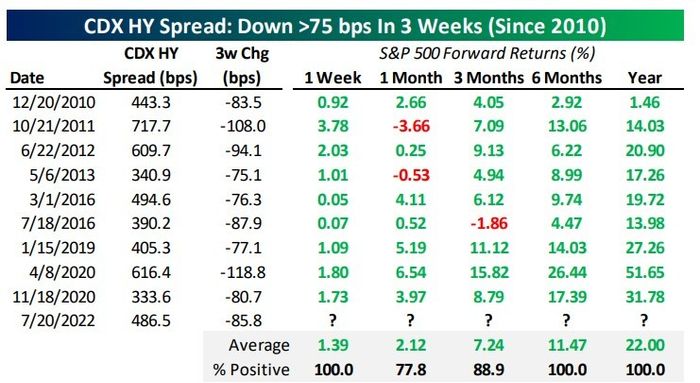

Analysts at Bespoke Investment Group studied the history of such spread compression, though it isn’t a long series since the popular credit-default swap indexes were only invented this century.

Bespoke Investment Group

The signal is incredibly strong on the junk-bond side. In the nine previous times when the CDX HY spreads fell at least 75 basis points in three weeks, the S&P 500 rose over the next week, six months, and year, with 22% average returns over the next year. “It’s awfully hard to come up with a market signal that looks much better than that long-term,” said the Bespoke analysts.

On investment-grade bonds, it is less strong but still positive. When the CDX IG spread has fallen at least 15 basis points over three weeks, and that has happened 14 times since 2005, the S&P 500 rose in a year’s time in 12 of those occasions, with an average gain of 13%.

A word of warning, however. At current pricing, junk bonds

JNK

aren’t pricing in a recession, according to BCA Research. The index is pricing in a default rate of 6.65%. “Given that default rates typically surpass 8% during recessions, there is scope for spreads to widen further if recessionary risks intensify,” said the BCA analysts.

The buzz

Tesla

TSLA

reported earnings above expectations and managed to be cash flow positive for the quarter by selling 75% of its bitcoin

BTCUSD

holdings, at a loss. The electric-vehicle maker also said it plans to begin long-delayed Cybertruck shipments in the middle of next year. Ford

F,

meanwhile, is going to cut thousands of jobs to refocus on EVs, The Wall Street Journal and Bloomberg News reported.

Aluminum producer Alcoa

AA

rallied after stronger-than-forecast results. United Airlines

UAL

missed on earnings and reduced its capacity plans for next year.

The European Central Bank is expected to make its first rate increase since 2011, though analysts are split on whether it will lift rates by a quarter- or half-point. The ECB also will unveil a plan to limit spreads within the eurozone. Weekly jobless claims and the Philadelphia Fed manufacturing index highlight the U.S. economic calendar.

Italy’s Prime Minister Mario Draghi resigned, throwing the eurozone’s third-largest economy into political turmoil and sending Italian bond yields higher.

Russia’s Gazprom resumed sending gas to Germany through the Nord Stream 1 pipeline at the same 40% rate it did before the planned maintenance period. Russia also said it is planning annexation votes in Ukraine regions by Sept. 15. Ukraine devalued its currency, the hryvnia, by 25% against the U.S. dollar.

The market

U.S. stock futures

ES00

NQ00

were pointing to a somewhat weaker start. Crude-oil futures

CL

tumbled, losing about $4 per barrel. The yield on the 10-year Treasury

BX:TMUBMUSD10Y

was holding above 3%.

Top tickers

Here were the most active stock-market tickers as of 6 a.m. Eastern.

Random reads

General Motors

GM

wants to test a self-driving car without a steering wheel or pedals.

A possible Fabergé egg was recovered on a seized Russian oligarch’s yacht.

This bride had to hitchhike to her own wedding.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.