It’s been a nice few days for the stock market, with the S&P 500

SPX,

rising three of the last four sessions, including 4% over just the last two days. So the question, as third-quarter earnings season revs up, is just how long the good times can last.

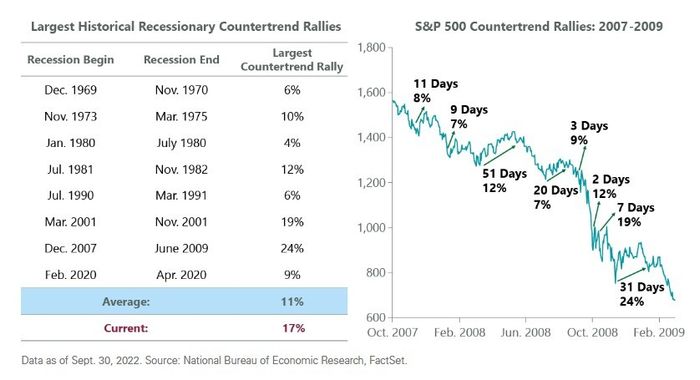

Jeffrey Schulze, investment strategist at ClearBridge Investments, went down memory lane to look at the history of countertrend rallies, which he defines as rallies that ultimately give way to a lower low during bear markets. In fact, he says, there was one this summer, the 17% advance before Federal Reserve Chair Jerome Powell’s hawkish speech at Jackson Hole.

Two of the past three recessions saw even bigger countertrend rallies before the final lows were established.

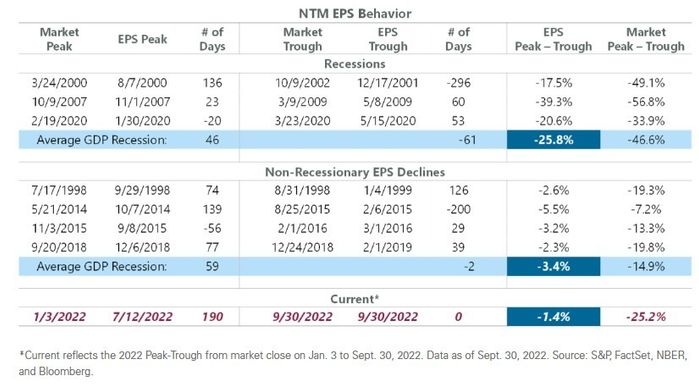

He finds that there usually isn’t a market bottom until almost two-thirds of the way through a recession. “Recent labor market data suggests the recession has not even begun, meaning markets are likely to remain volatile as unknown risks start to unfold,” says Schulze.

Through Sept. 30, the peak-to-trough decline in earnings per share estimates was just 1.4%. During a recession, EPS declines reach an average of 25.8%, whereas outside of recessions, EPS declines are just 3.4%. Perhaps there’s good reason EPS estimates have not been marked down by much so far— a recent Duke University survey of chief financial officers found a record gap between the perception of their own companies versus that of the broader economy.

Schulze, however, is pessimistic, noting the rising risks from his firm’s recession risk dashboard (though it’s given false signals before). “We expect further weakening in the coming months as the lagged effects of Fed tightening continue to bite and the Fed continues to raise rates in its quest to curb high inflation,” he said.

“For equity investors, this could mean a recovery that sees false starts followed by subsequent selloffs. As a result, we continue to favor portfolio tilts toward quality and defensives until a clearer path forward for economic activity and earnings emerges.”

The markets

U.S. stock futures

ES00,

NQ00,

turned lower after an early rise. The yield on the 10-year Treasury

TMUBMUSD10Y,

climbed over the 4% mark again, reaching 4.11%. Oil futures

CL.1,

were trading higher.

The buzz

Netflix

NFLX,

shares jumped 11% in premarket trade after posting surprisingly strong subscriber numbers. Netflix also said it would stop giving guidance on subscriber gains.

United Airlines

UAL,

rose 5% after reporting better-than-expected earnings.

Wednesday’s earning slate included Procter & Gamble

PG,

which also topped estimates, and after the close, Tesla

TSLA,

and IBM

IBM,

ASML

ASML,

the microchip equipment maker, reported stronger-than-forecast earnings and said it only expects a limited impact next year from new U.S. restrictions on sales to China. Separately, Taiwan Semiconductor Manufacturing

TSM,

is considering expanding production in Japan, according to The Wall Street Journal.

Housing starts fell more sharply than forecast in September, reflecting the pain in the industry as mortgage rates have climbed. The Fed’s Beige Book of economic anecdotes is due at 2 p.m.. U.K. inflation accelerated to a 10.1% year-over-year clip, matching the fastest pace in 40 years.

The White House is set to issue a notice for the sale of 15 million barrels of oil from the Strategic Petroleum Reserve, and that it will repurchase crude oil when prices are at, or below, the $67 to $72 range.

Best of the web

The IRS is raising tax brackets and the standard deduction by 7%, the largest adjustment since indexing started in 1985.

Since military call-ups started, the men of Moscow are noticeably missing.

The next pandemic could come from melting glaciers.

Top tickers

Here were the most active stock-market tickers as of 6 a.m. Eastern.

| Ticker | Security name |

|

TSLA, |

Tesla |

|

GME, |

GameStop |

|

NFLX, |

Netflix |

|

AMC, |

AMC Entertainment |

|

APE, |

AMC Entertainment preferreds |

|

AAPL, |

Apple |

|

BBBY, |

Bed Bath & Beyond |

|

AMZN, |

Amazon.com |

|

TWTR, |

|

|

DWAC, |

Digital World Acquisition Corp. |

Random reads

McDonald’s ‘adult Happy Meal’ toys are being listed for up to $300,000 on eBay.

How to make the egg-yolk omelet that had sent late-night talk-show host James Corden into a frenzy.

Coffins are dangling in the air after the collapse of a building in Naples.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton.