Since roughly 40% of S&P 500 companies’ sales are generated abroad, equity strategists expect the strong U.S. dollar will weigh heavily on corporate earnings as the third-quarter corporate reporting season begins in earnest this week.

The ICE U.S. Dollar Index

DXY,

a gauge of the dollar’s strength against a basket of its main rivals, rose 7.2% during the third quarter, marking its best quarterly performance in seven years. The index has risen more than 18% since the start of the year through Wednesday, according to FactSet data.

Analysts presently expect S&P 500 index members to see earnings growth of 2.4% this quarter, according to FactSet. Wall Street forecasts tend to be conservative, and companies tend to overshoot, like they did last quarter.

But if earnings end up being in line with the consensus, it would mark the worst quarterly earnings performance since the third quarter of 2020, according to John Butters, senior earnings analyst at FactSet. And the strong dollar would be among the factors most to blame.

Typically, companies that generate a large chunk of their sales abroad are more vulnerable to fluctuations in exchange rates.

And there are some S&P 500 component companies that generate nearly all of their sales abroad. A list of the S&P 500 components with the largest foreign sales exposure can be found below.

| Company name | Ticker | % of sales from abroad |

| Philip Morris International Inc. |

PM, |

99.7 |

| Newmont Corporation |

NEM, |

99.5 |

| Monolithic Power Systems, Inc. |

MPWR, |

97.0 |

| Qualcomm Incorporated |

QCOM, |

95.8 |

| AmerisourceBergen Corporation |

ABC, |

94.3 |

| Lam Research Corporation |

LRCX, |

93.3 |

| NXP Semiconductors NV |

NXPI, |

91.3 |

| Applied Materials Inc. |

AMAT, |

91.2 |

| KLA Corporation |

KLAC, |

89.9 |

| Arista Networks Inc. |

ANET, |

89.9 |

Source: FactSet

The companies listed above include constituents of the S&P 500 consumer staples sector, the health-care sector, materials and the information technology sector — with semiconductor makers or suppliers (in the case of Applied Materials) representing a majority of the names on the list above.

Huw Roberts, head of analytics at Quant Insight in London, found that semiconductors tend to be among the industries most vulnerable to a strong dollar.

Roberts calculated that for every increase of one standard deviation in the value of the dollar against the yuan and a trade-weighted basket of rivals, the iShares Semiconductor ETF

SOXX,

should decline by 3.2%.

Looking at the dollar’s impact on a sector-by-sector basis, CFRA Chief Investment Strategist Sam Stovall said in a note to clients that the tech-heavy communications services sector could see the biggest impact from a strong dollar among the S&P 500’s 11 sectors.

Stovall said in a note to clients that the strong dollar could shave “at least 600 to 800 basis points” off the performance of the communications services sector as a whole.

This has already largely been factored into analysts expectations. According to Stovall, analysts see earnings contracting 13.8% on an annualized basis, the worst expected performance among the index’s 11 sectors.

Stovall also expects large restaurant chains, which are a subset of the consumer discretionary sector, to see some blowback from the strong dollar as it eats into earnings gleaned from their restaurants abroad.

“Companies with significant international exposure will likely face meaningful headwinds, given the continued strength in the dollar and the weaker macro

backdrop abroad,” he said.

A small percentage of S&P 500 companies have already reported their earnings for the quarter ended Sept. 30. Of those, several have cited the dollar as a headwind, according to FactSet’s Butters.

These include McCormick & Co.

MKC,

Conagra Brands

CAG,

and Nike Inc.

NKE,

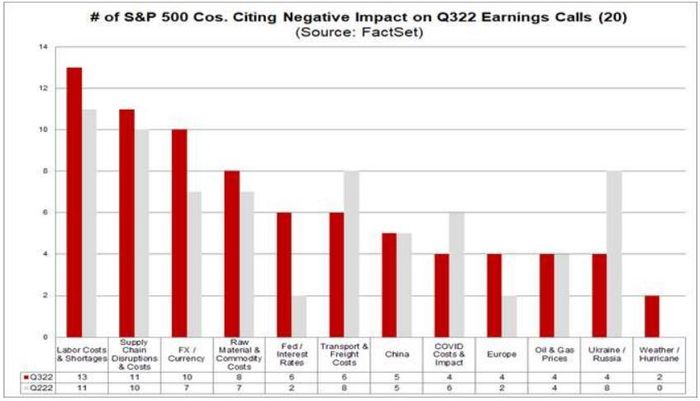

Because of this, the strong dollar already ranks among the top concerns for early-reporting companies, with the number citing the dollar as a headwind increasing to 10, up from 7 during the same period last quarter, according to Butters.

Source: FactSet

Large exporters are also at risk of seeing blowback from the strong dollar due to sales of domestically produced goods, according to a team of analysts at Glenmede.

Among the two largest exporters in the U.S., only one, the packaging maker International Paper Company

IP,

is included in the S&P 500 (the other is the privately-led Koch Industries, according to data from Statista).

Meanwhile, a team of analysts at Deutsche Bank expect megacap growth companies like Meta Platforms Inc.

META,

and Apple Inc.

AAPL,

will see a significant negative earnings impact from the dollar.

Investors looking for shelter from the exchange-rate impact should consider buying small- or mid-cap companies or stock indexes focused on those companies like the the S&P SmallCap 600 Index

SML,

or the S&P MidCap 400

MID,

Stovall said.

But within the S&P 500, only a couple of sectors are domestically-focused enough to offer succor from the rampaging dollar.

“Only the more domestic-focused sectors, such as real-estate and utilities, are less exposed to these effects,” the Glenmede analysts wrote.