Global stocks have risen 11% from the lows of March, but strategists at JPMorgan say the gains can continue through the end of the year.

Strategists led by London-based Mislav Matejka are optimistic even with expectations that purchasing managers’ indexes have more room to fall, and that analysts will further downgrade earnings per share estimates. In fact, they say, the good news is bad, as it will lead to a policy pivot.

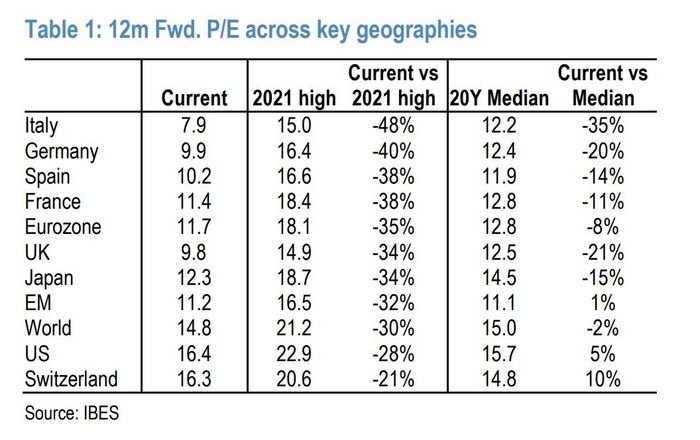

Valuations, they note, are particularly attractive outside the United States, where they trade at 12.6 times forward earnings, a 20% discount from the historical average. The dividend yield minus the bond yield is still above average in Japan, the eurozone and the U.K., they add. The JPMorgan strategists say bond yields could keep stalling in the near term, given expectations of rough economic data.

Analysts at JPMorgan say stocks outside the United States are particularly cheap.

The other reasons the strategists are bullish on stocks:

- The technical backdrop for stocks, including positioning, appears favorable.

- Investor sentiment is overly bearish

- The Fed is likely reaching peak hawkishness.

- The dollar could be peaking.

- Robust bank balance sheets will allow them to keep supporting the business cycle.

- Earnings will see only a modest pullback.

- The consumer is cushioned by excess savings and a strong labor market.

- China will behave countercyclically to developed markets in the second half.

The S&P 500

SPX,

has dropped 13% this year, while the largest overseas stock ETF, the Vanguard Total International Stock ETF

VXUS,

has dropped 16%.