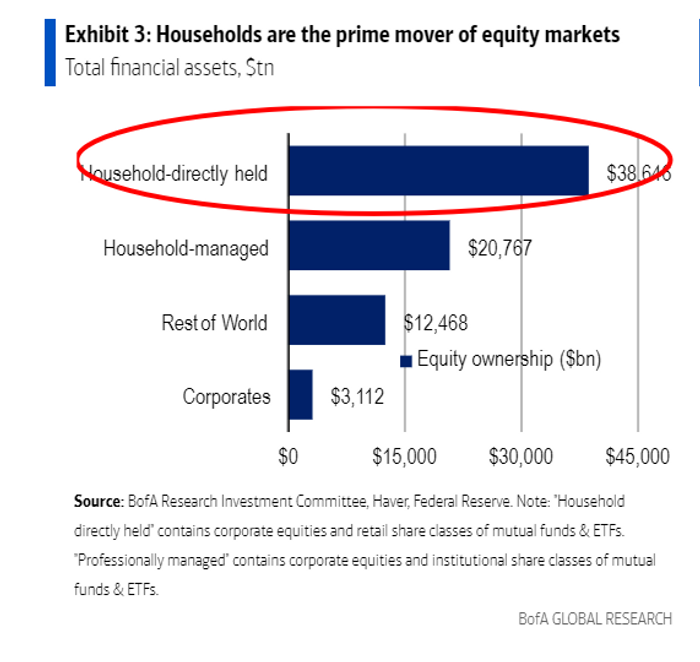

Households, not hedge funds or major corporations, represent the biggest class of owners of the U.S. stock market.

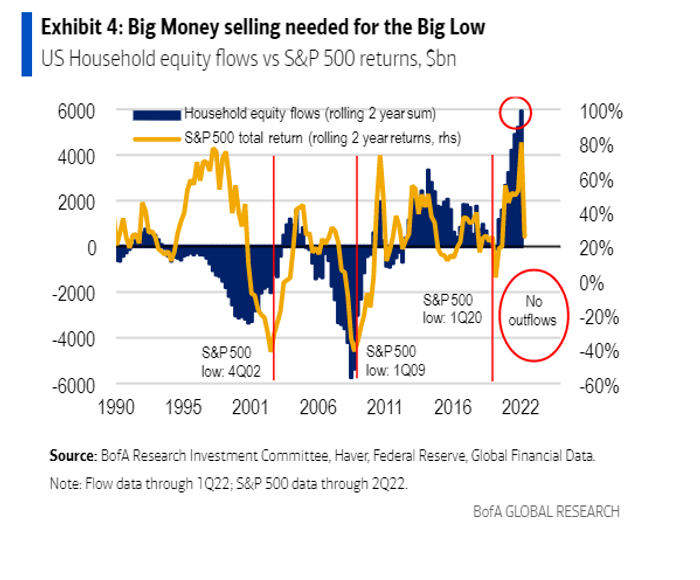

That matters because households, the “placid gorilla” in U.S. stocks, haven’t cut and run despite this year’s sharp selloff, which means stocks haven’t hit a bottom yet, according to a BofA Global.

Collectively, households hold about $38 trillion in equity assets (see chart) through stocks, retail mutual funds and exchange-traded funds, $5.9 trillion of which was added over the last two years, according to a tally from BofA Global.

Households have been holding on to stocks, not selling into weakness in the past two years

BofA Global, Haver, Federal Reserve

U.S. households now own roughly 52% of the stock market. And a look at three major market plunges since 2000 (see chart) shows that equities only bottomed a few quarters after significant selling activity from households occurred.

Watch households to signal when stocks have bottomed

BofA Global, Haver, Federal Reserve

BofA’s research investment team said a common refrain from July investor meetings was: “Everybody’s already bearish, might as well buy.” But they still favor cash, credit, and equities, in that order. Or at least until households, the “decision-maker,” decides to make a move and sell.

U.S. stocks were higher again Thursday, a day after U.S. inflation data showed signs of slowing price gains. The S&P 500 index

SPX,

was trading above the key 4,200 mark, the Dow Jones Industrial Average

DJIA,

climbed back above the 33,000 level and the Nasdaq Composite Index

COMP,

was higher after officially exiting a bear market.