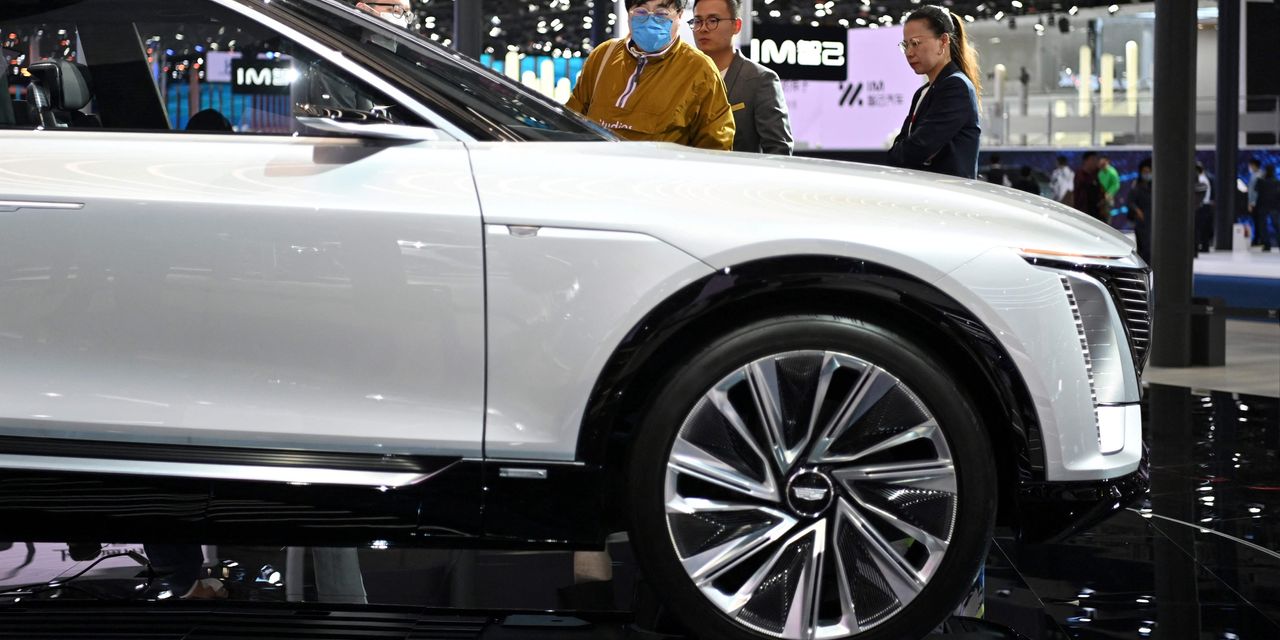

General Motors Co. shares fell nearly 3% in midday trading Tuesday after the auto maker reported mixed second-quarter results and reiterated its guidance for the year, with Wall Street analysts viewing the auto maker’s next few months as crucial for its growth plans.

GM

GM,

earlier Tuesday said it earned an adjusted $1.14 a share on revenue of $35.8 billion, compared with FactSet consensus for adjusted earnings of $1.23 a share on revenue of $33.2 billion.

Higher costs and supply-chain problems “were the clear albatross in the quarter continuing a common theme seen at GM over the past year,” Dan Ives with Wedbush wrote in his note.

The next six to nine months are “a major ‘fork in the road’” for GM as it has to “show strong execution on its key EV strategy despite macro headwinds and a supply chain crisis that remains front and center,” Ives said.

“Any further shortfalls and stumbles could start to derail the broader EV strategy as the company heads into a pivotal year ahead.”

Related: Whirlpool slashes annual guidance, seeing demand slowdown

GM reiterated its 2022 earnings guidance that includes earnings before interest and taxes (EBIT)-adjusted between $13 billion and $15 billion.

Joseph Spak at RBC Capital said that GM is likely to treat the midpoint of the guidance as a “base” case.

The guidance reiteration was not a surprise as GM had told investors it was keeping it intact earlier this month, but Tuesday’s move included a positive tone for the second half of the year, “seeing strong production/wholesales in 2H,” Spak said.

GM struck a similar “cautious” tone that many cyclical companies have adopted in face of continued recession worries, analysts at Evercore ISI said in their note.

See also: EV maker Faraday Future postpones EV launch as it seeks more cash from investors

GM told Wall Street it was limiting hiring to “critical needs” and cutting down on spending.

Shares of GM have lost 43% so far this year, compared with losses of around 17% for the S&P 500 index.

SPX,

Read more: Tesla stock rises after EV maker reports better-than-expected Q2 profit, jump in sales