U.K. government bonds rallied strongly on Tuesday, forcing yields down from multi-year highs, as the selloff sparked by the government’s tax-cutting budget ran out of steam after the Bank of England and Treasury tried to calm markets.

The 10-year U.K. gilt yield

TMBMKGB-10Y,

plunged 16 basis points to 4.119% in early London action.

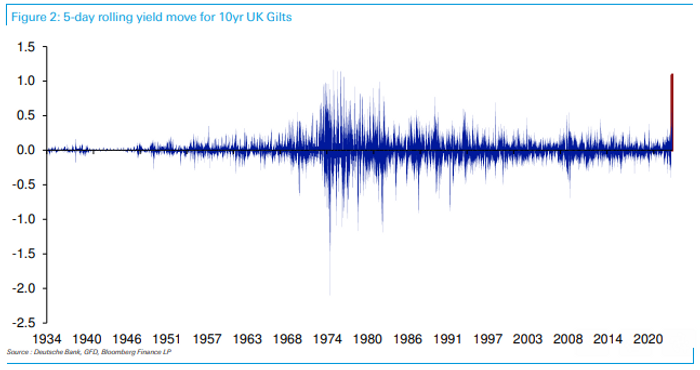

The benchmark had endured savage selling over recent sessions – the yield hitting a 14-year high of 4.28% amid the biggest surge since 1976 – as investors fretted that new finance minister Kwasi Kwarteng’s proposal to cut taxes, while increasing spending on energy subsidies, placed the government’s finances on an unsustainable trajectory.

Source: Deutsche Bank

Traders also worried that looser fiscal policy alongside inflation running at a 40-year high just shy of 10% would cause the Bank of England to hike interest rates faster than expected, and this pushed the yield on the monetary policy-sensitive 2-year gilt above 4.5% at the start of the week.

“The financial markets are expecting that the Bank of England will be forced to raise the official bank rate to 6%, to counter the inflationary effect of the Treasury’s mammoth tax cuts,” said Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown.

Still, on Tuesday, the 2-year yield

TMBMKGB-02Y,

fell 21 basis points to 4.319%. The calmer tone in bonds helping sterling

GBPUSD,

recover some ground. After touching a record low south of $1.04 early on Monday, the pound traded around $1.08.

The recovery in gilts and the pound came after the government and central bank tried to steady nerves in statements released late in London on Monday.

The Treasury said it would set out in November a new medium-term fiscal plan detailing how it would reduce government debt over time. Kwarteng had previously said the plan would not be publsihed until the new year.

The Bank of England dashed some expectations for an emergency rate rise to support sterling, but Gov. Andrew Bailey stressed he would “not hesitate to change interest rates” to keep inflation under control and he would undertake a full assessment of the government’s new fiscal policy at the BoE’s next monetary policy meeting in November.

“The Bank of England reiterated its commitment to raising interest rates further, although this fell short of an emergency move which some had expected. Even so, the statement restored some relative calm, with an expectation that the next rate rise in November could be substantial, thus providing some support to the beleaguered currency,” said Richard Hunter, head of markets at Interactive Investor