Stagflation is coming, but with that comes a silver lining for some equities if history is any guide.

That’s according to strategists at Bank of America, who see a macro backdrop that continues to reflect the dreaded economic combo of high inflation and stagnant growth.

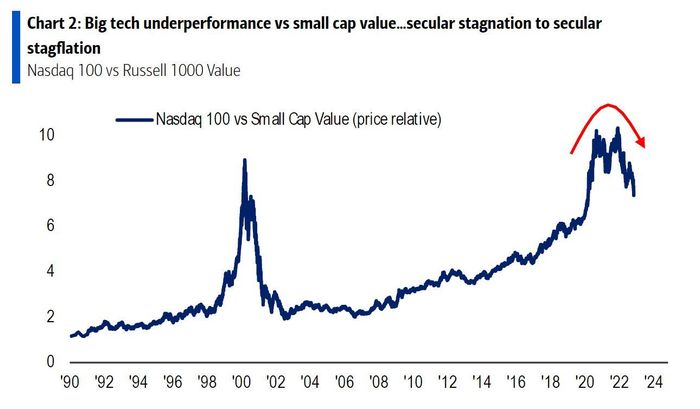

“Inflation and stagnation was ‘unanticipated in 2022…hence $35 trillion collapse in asset valuations; but relative returns in 2022 have very much mirrored asset returns in 1973/74, and the 70s remain our asset allocation analog for 2020s,” said a team led by Michael Hartnett in the bank’s Flow Show note on Friday.

Those preferred assets include long positions on commodities, volatility, value, resources, emerging markets, and small-caps, with short positions in stocks, bonds, growth and technology.

Zeroing in on smaller companies, Hartnett and the team said that stagflation persisted through the late 1970s, but the inflation shock had ended by 1973/74, when the asset class “entered one of the great bull markets of all-time.” And they see small-caps set to keep outperforming in the “coming years of stagflation.”

BofA

The Russell 2000 small-cap stock market index

RUT,

is down 20% so far this year, versus an 11% drop for the Dow industrials

DJIA,

and 21% and 33% drops, respectively, for the S&P 500

SPX,

and Nasdaq Composite indexes

COMP,

BofA rattled off several reasons why investors should expect small-caps to outperform:

- Small-caps suffer less from inflation as they are “price-takers, not price makers”

- Localization and fiscal stimulus often favors smaller companies

- Profits from smaller companies are less likely to be a source of funds for governments

- Outperformance of small-caps typically starts in a recession

- U.S. small-caps are often more correlated with leadership in the next bull market

BofA

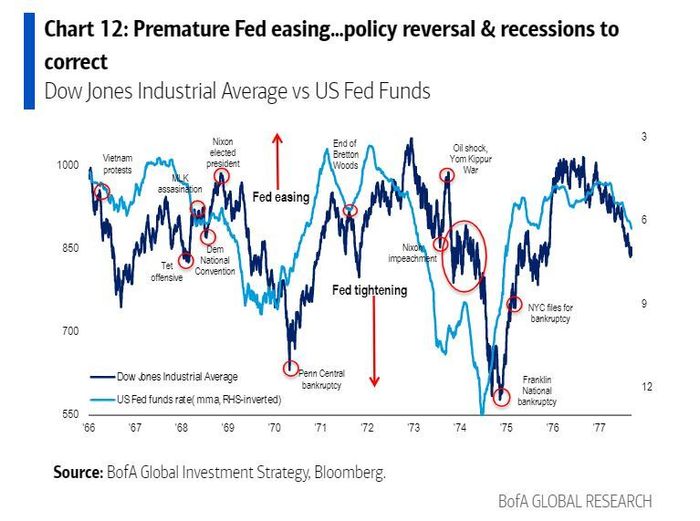

And while the Fed disappointed markets this week, as Chairman Jerome Powell gave a clear signal that the central bank isn’t ready to soften its stance on higher interest rates, BofA says don’t give up on that pivot.

After tightening interest rates through 1973/74 amid inflation and oil shocks, the central bank first cut in July 1975 as growth turned negative, notes Hartnett. A sustained pivot began in December of that year, and crucially, the unemployment rate surged from 5.6% and 6.6% that same month.

The “following 12 months, the S&P 500 rose 31%; lesson is job losses catalyst for 2023 pivot,” said Hartnett and the team.

The next big update on U.S. jobs is looming for Friday, with stock futures

ES00,

higher ahead of an expected slowdown in employment growth.

BofA

Read: The U.S. jobs market is too ‘strong,’ the Fed says. So expect rising unemployment