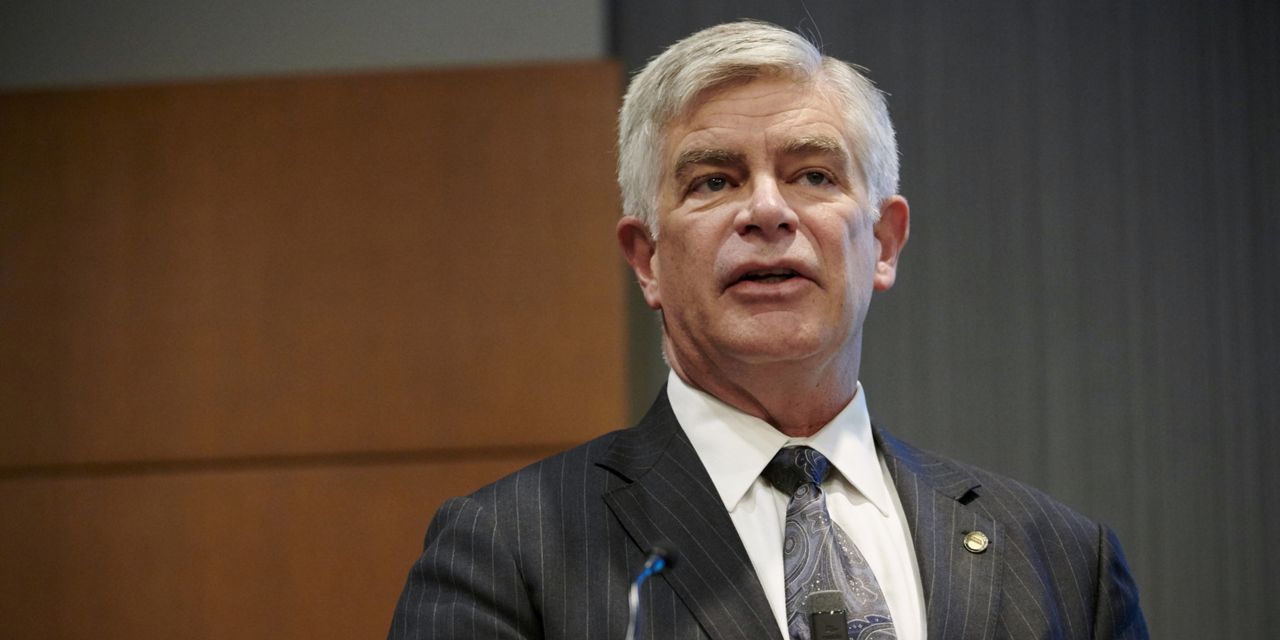

Inflation will only come down slowly over the next 14 months despite the Federal Reserve’s strong resolve to cool it down, said Philadelphia Fed President Patrick Harker, on Thursday.

“We…need to recognize that this will take time: Inflation is known to shoot up like a rocket and them come down like a feather,” Harker said, in a speech to the Greater Vineland, New Jersey, Chamber of Commerce.

“Inflation will come down, but it will take some time to get to our target,” he said.

The Fed’s favorite measure of inflation – the personal consumption expenditure index, rose at a 6.2% annual rate in August, the latest available data.

Harker projected inflation will inch down to 6% this year and only decline to 4% by the end of 2023. Inflation won’t hit the central banks 2% target by the end of 2024, he added.

The Philadelphia Fed president will be a voting member of the Fed’s interest rate committee next year.

The Fed’s benchmark interest rate is currently in a range of 3%-3.25%. Harker said that rate will soon go higher.

“Given our frankly disappointing lack of progress on curtailing inflation, I expect we will be well above 4% by the end of the year,” he said.

Sometime in 2023, the Fed is going to stop raising rates, he said.

“At that point, I think we should hold at a restrictive rate for a while to let monetary policy do its work. It will take a while for the higher cost of capital to work its way through the economy,” Harker added.

U.S. stocks

DJIA,

SPX,

were higher on Thursday with a focus corporate earnings reports and on the decision by UK Prime Minister Liz truss to resign. The yield on the 10-year Treasury note

TMUBMUSD10Y,

rose to 4.16%, moving past a 14-year high set in the prior day’s session.