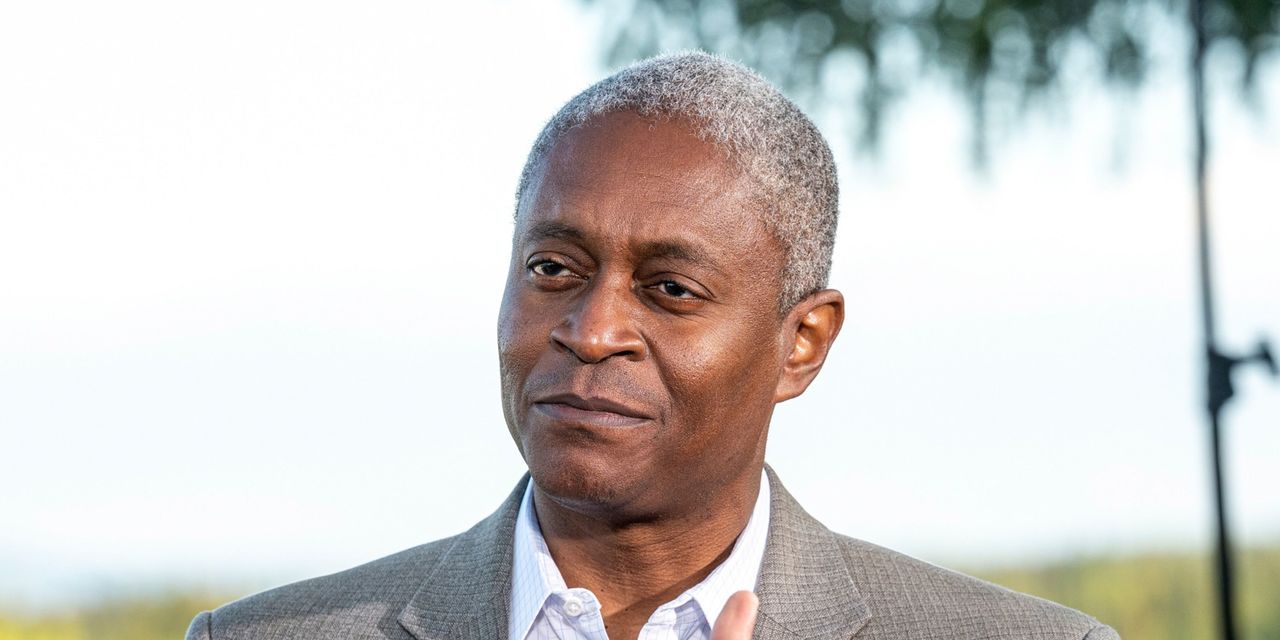

The Federal Reserve hasn’t lost credibility with the broader public beyond Wall Street, Atlanta Fed President Raphael Bostic said Monday.

“I’m heartened as I go around [my] district [that] people … have faith that what we’re doing is going to be effective,” Bostic said during an interview streamed online by the Washington Post.

Bostic said that the public’s long-term expectations for inflation are at or near the central bank’s 2% target.

Bostic said he hears encouragement from the public.

But some noted Fed watchers, including Wharton Professor Jeremy Siegel, have become highly critical of the central bank. They worry that it was late to recognize high inflation and now will raise rates too fast and cause a recession.

“The Fed is just way too tight,” Siegel said on CNBC on Friday.

Read: Fed is making one of biggest mistakes, says Wharton’s Siegel

Last Wednesday, the Fed hiked its benchmark interest rate by three-quarters of a percentage point — its third straight supersized move — and said it expects interest rates to climb to 4.5%-4.75% by next year.

“We’ve got to get inflation behind us. I wish there were a painless way to do that,” Fed Chairman Jerome Powell said at the press conference that followed the rate decision.

In an interview on “Face the Nation” on Sunday, Bostic said the Fed would do all it could “to avoid deep, deep pain.”

New Boston Fed President Susan Collins also spoke on Monday, saying she was hopeful the U.S. economy could avoid a “significant downturn.”

During the Washington Post interview, Bostic stressed that the Fed needed to get inflation under control, adding that extreme views regarding the Fed are driven by the fact that inflation is too high.

Stocks

DJIA,

SPX,

continued to fall in the wake of last week’s Fed meeting, and the yield on the 10-year Treasury note

TMUBMUSD10Y,

rose to 3.86%.