Despite worries about inflation and an impending recession, there is at least one sign that some bullish market technical analysts might latch onto.

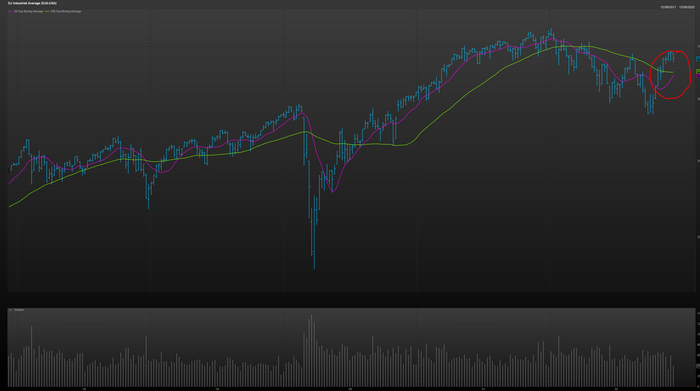

An upbeat golden cross appears to be forming in the Dow Jones Industrial Average

DJIA,

more than nine months after a bearish death cross formed back in March, as the hawkish agenda of the Federal Reserve shattered bullishness on Wall Street.

A golden cross occurs when the 50-day moving average for an asset price trades above the 200-day MA, while a death cross, comparatively, is when the 50-day falls below the long-term average.

The 50-day moving average for the Dow stands at 32,200.32, at last check Friday afternoon, while the 200-day sits at 32,460.71, a roughly 260-point difference that could be traversed in the coming week or two, based on its current trajectory.

FactSet

A golden cross would mark the first for the Dow industrials since 2020 of August, according to Dow Jones Market Data.

The bullish chart formation also would appear at an odd time for investors, with an apparent uptrend materializing in the stock market, even as the threat of a recession in 2023 grows.

See: Goldman Sachs CEO says recession is likely, with 35% chance of a soft landing

BlackRock, the world’s largest asset manager, is anticipating a unique recession unlike others that we’ve seen in U.S. history.

“The new macro regime is playing out. We think that requires a new, dynamic playbook based on views of market risk appetite and pricing of macro damage,” wrote BlackRock’s Investment Institute team led by Jean Boivin.

The BlackRock team said markets aren’t necessarily pricing in the recession that is being predicted.

“Central banks appear set on doing ‘whatever it takes’ to fight inflation, making recession foretold, in our view,” the team at BlackRock wrote.

As MarketWatch’s Tomi Kilgore notes, crosses, overall, aren’t necessarily good market-timing indicators.

Check out: MarketWatch’s live blog of the market

On top of that, MarketWatch columnist Mark Hulbert concludes that the U.S. stock market on average has performed no better in the wake of a golden crosses as it did at other times.

In many cases, a golden cross can help put an asset’s move into perspective, however, they tend to be well telegraphed.

Interestingly, the recession is also being widely predicted and some don’t think investors are getting the memo. As BlackRock notes, investors aren’t reflecting the damage that is to come, particularly as earnings expectations from American companies are right-sized.

So, it might be worth it for investors to take any golden crosses in assets with a grain of salt.

So far, the Dow industrials have outperformed over the past three months, up about 5%, compared with a decline of 2.5% for the S&P 500

SPX,

and an 8.2% drop for the Nasdaq Composite

COMP,

Over the past three months, the Dow industrials have recent in aggregate on the back of gains in shares of Caterpillar

CAT,

Boeing Co.

BA,

Merck & Co.

MRK,

IBM

IBM,

and Travelers Cos.

TRV,

For the year so far, the Dow is down 7%, while the S&P 500 is off 17% and the Nasdaq is down nearly 30%.