As Europe’s energy crisis and slowing economy weigh on the euro, Deutsche Bank’s George Saravelos noted Wednesday that “safe haven” demand has driven the U.S. dollar to its strongest level against the shared currency in more than 20 years.

Since markets are pricing in multiple Federal Reserve interest rate cuts in 2023, after raising rates this year to combat inflation, expectations about interest rate differentials may no longer be driving the dollar, Saravelos argued in a research note. In that sense, the dollar has “decoupled” from interest rates and inflation expectations.

“Beyond Europe, our currency framework in recent months has relied on a risk premium approach to the USD: currencies have decoupled from central bank policy and the dollar is instead being driven by a global safe-haven premium,” said Saravelos of Deutsche Bank Research, a longtime macro strategist who has worked at several global investment banks.

But as recession fears continue to intensify in both Europe and the U.S., Saravelos can’t help but wonder if this trend will drive the dollar past the point of parity with the euro.

How much more room does the dollar have to climb? Saravelos said that the euro could soften to US 0.95-0.97 cents before the end of the year. He based that view on four separate models for how trading in the euro-dollar pair might evolve.

The ‘risk premium’ approach

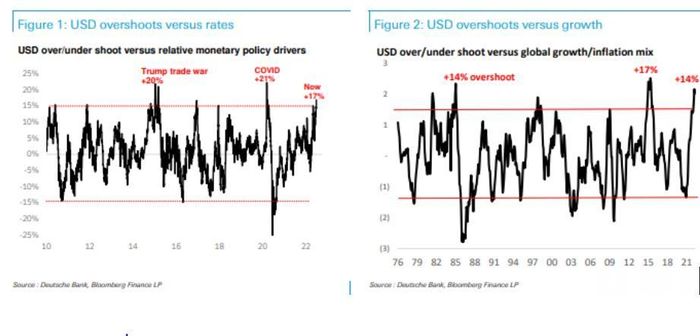

Saravelos modeled two different scenarios: the dollar’s moves relative to central bank policy, and its moves relative to current global economic growth and inflation.

Both models can be seen in the chart below:

Here’s how much further the dollar could rise if history is any guide. SOURCE: DEUTSCHE BANK

What’s more, both models project that the dollar could rally another 3% to 4% if it were to match the record overshoots seen during COVID, the Trump trade war with China and the mid-1980s.

The ‘Volcker’ approach

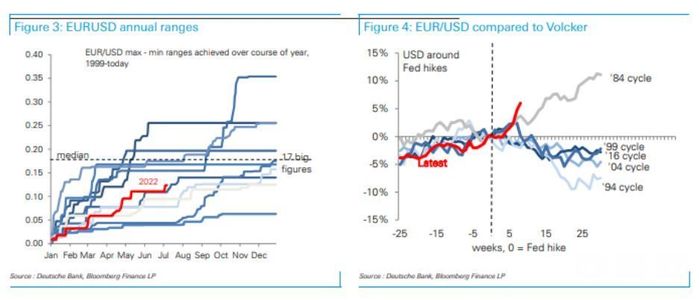

While every Fed tightening cycle is unique, Saravelos said it’s useful to benchmark the current cycle of dollar strength to other similar periods in the past. And in the years since the collapse of the Bretton Woods currency regime, the most appropriate period would be the dollar strength of the mid-1980s, which accompanied the aggressive monetary tightening orchestrated by then-Fed Chairman Paul Volcker.

To match the scale of the dollar’s move during that cycle, the greenback would need to strengthen by another 5% against the euro.

The dollar would need to continue to strengthen to match the scale of its move from the mid-1980s.

The ‘technical’ approach

Saravelos also looks at the euro-dollar pair’s move from a technical perspective. Since 1999, the median annual range has been 17 “big figures” on the currency pair. For those who aren’t familiar with this trader lingo, one “big figure” is equivalent to one cent on the euro-dollar currency pair.

Since January, the pair has only moved by about 12 “big figures”. Should the dollar strengthen by five more big figures against the euro, that would weaken the shared currency to about 97 cents.

Purchasing power parity

Looking at extremes in the history of purchasing power parity, it’s worth exploring how the dollar’s valuation when measured against real effective exchange rates and purchasing power parity.

Saravelos found that according to both of these measures, the dollar would need to strengthen another 7% against the euro to match its most stretched valuations since in the mid-1980s, long before the birth of the shared currency. Saravelos used a basket of European currencies in place of the euro.

The dollar still has more room to strengthen relative to other periods of strength since the collapse of Bretton Woods. SOURCE: DEUTSCHE BANK.

“Bringing all the approaches together leads to the conclusion that a move down to as low as 0.95 in [euro-dollar] would match or indeed exceed the historical all-time extreme dislocations seen in currency markets since the end of Bretton Woods,” Saravelos wrote.

And given the relative weakness in the European economy compared with the U.S. economy, it’s possible that the dollar could move past parity with the euro before the year is over.

The dollar traded at its strongest level against the euro in more than 20 years on Wednesday as the shared currency weakened to below $1.02 dollars, inching increasingly closer to parity, a level that the euro hasn’t reached since the early days of its history. The euro

EURUSD,

has weakened more than 10% against the dollar so far this year, falling from roughly $1.14 to less than $1.02.