Senate Democrats are cobbling together a deal to increase taxes on wealthy Americans to help buttress the dwindling Medicare trust fund and guarantee hospital stay insurance for U.S. seniors through 2031, according to reports in the Washington Post and Associated Press.

The reports cite unnamed Democratic aides who say that Senate Democrats are submitting their plan to the chamber’s parliamentarian, who will decide if it can be included in a budget reconciliation package the party seeks to pass before the end of September.

The plan includes expanding the current 3.8% Medicare surcharge that applies to wealthy Americans’ investment income to also apply to income derived from ownership of a so-called pass-through businesses.

The tax would apply to business owners’ income above $400,000 per year or $500,000 per year for couples, and is expected to raise $203 billion over 10 years. That money would be sufficient to ensure Medicare Part A’s hospital insurance fund will remain solvent through 2031, the AP reported.

Pass through businesses include limited partnerships and S corporations that are not subject to corporate income tax. Instead, that income “passes through” to individual owners and is taxed as part of their personal income taxes.

The move to send this provision to the Senate parliamentarian, Elizabeth MacDonough, comes after news that her office is already reviewing a proposal to raise revenue by allowing Medicare to negotiate down the price they pay for some prescription drugs.

Analysts say these developments suggests Democrats are getting serious about passing a party-line vote to raise taxes on wealthy Americans to fund investments in health care and clean energy.

The parliamentarian must review legislation that is being advanced under a process called budget reconciliation, which enables the Senate to pass a budget-related bill with a simple majority rather than the 60 votes required normally.

The Senate parliamentarian gets the final say on whether any particular provision has a direct impact on the federal budget and can therefore be included in a reconciliation bill.

The bill under consideration in the Senate is a radically scaled-down version of the ambitious Build Back Better bill that passed the House last year, which called for roughly $2 trillion in new taxes and spending over the next decade.

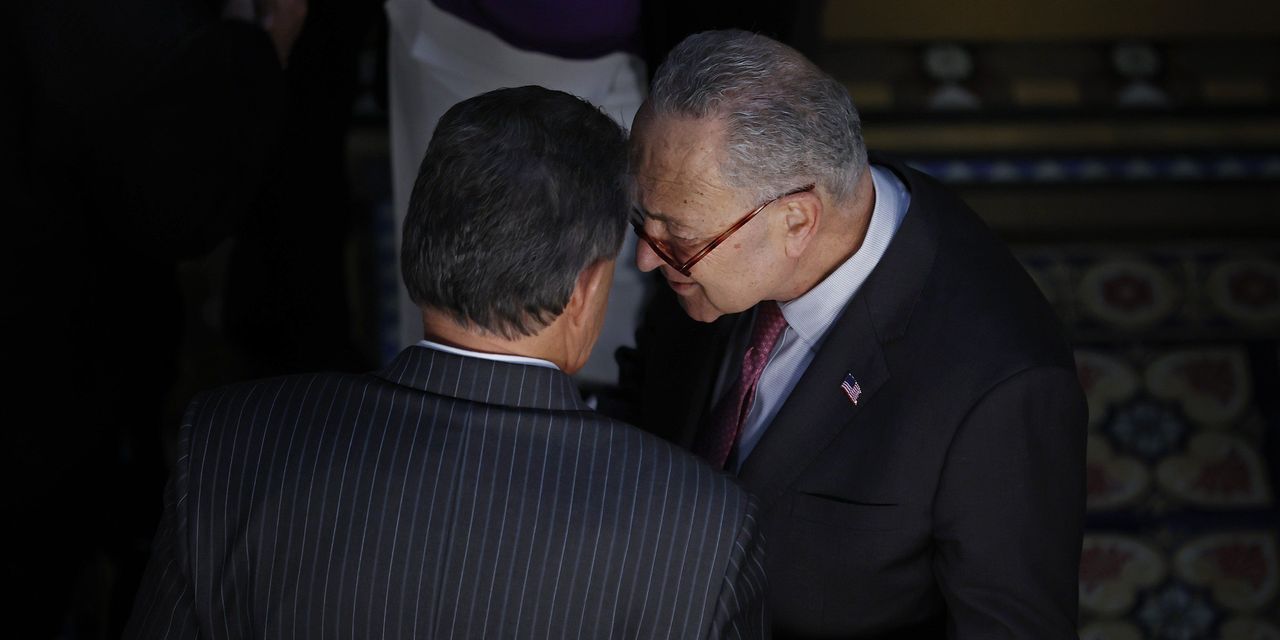

That legislation was put on hold after moderate Democratic Sen. Joe Manchin signaled he could not support the bill out of fear that it would fuel inflation. The current iteration of the bill is reportedly being hammered out by Democratic Senate Majority Leader Chuck Schumer, in close consultation with Manchin.