The results won’t be clear until Tuesday night or possibly for days, but the U.S. midterm-election outcome is poised to be a significant event for financial markets.

With Republicans favored to win control of both chambers of Congress, based on ABC News’ FiveThirtyEight online election-forecast site, one of the biggest consequences of such an outcome would be the chances of a renewed fight over the debt ceiling. That’s the legal limit on how much national debt the U.S. Treasury can incur and if the ceiling isn’t raised on time, the U.S. could theoretically default.

Treasury could approach the roughly $31.4 trillion debt limit during the current quarter, though economists note that “extraordinary” fiscal maneuvers would allow the government to avoid hitting the ceiling until some time in 2023.

“The threat of a renewed debt ceiling cliff-edge is not simply speculation,” said Henry Allen, a research analyst at Deutsche Bank. “A number of senior Republican officials have openly advocated using the debt ceiling as leverage with the Democrats in order to extract policy concessions, as they did in 2011.”

The potential financial-market consequences of a renewed fight over the debt limit “are still underappreciated,” Allen wrote in a note on Monday.

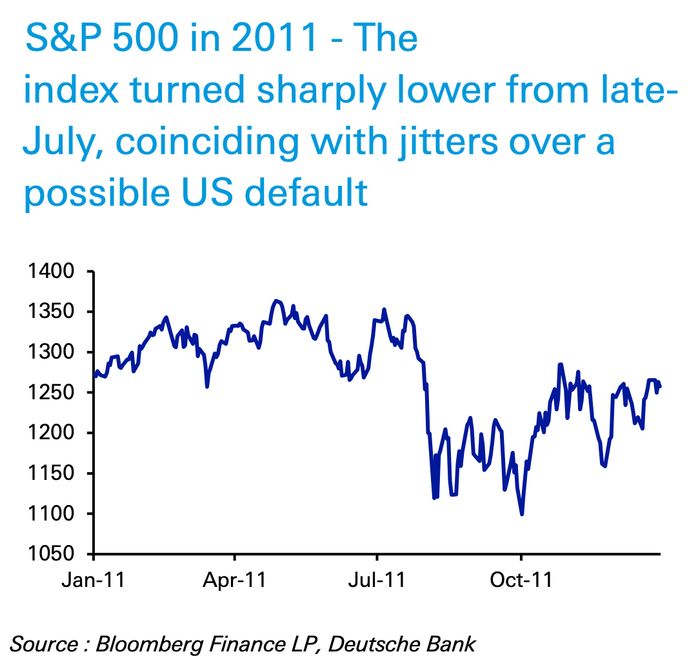

One needs to go back more than a decade to see what happened during the last major showdown over the debt ceiling: Based on the performance of the S&P 500 in 2011, the biggest slump of that entire year occurred from late July into August amid jitters that the U.S. might default on its obligations, according to Deutsche Bank. The slump in the S&P 500

SPX,

was accompanied by a sharp decline in the Conference Board’s consumer-confidence indicator, so the potential for future volatility this time around “is clear,” Allen said.

Source: Bloomberg, Deutsche Bank

Rather than constraining federal spending, the debt ceiling — if set below the level needed to meet the government’s borrowing needs — theoretically puts the full faith and credit of the U.S. at risk by preventing Treasury from paying the government’s bills.

Read: U.S. Treasury expects to borrow $550 billion in fourth quarter

According to a Nov. 1 note by analyst Joseph Abate, Barclays expects Treasury to start using extraordinary measures and cash reserves in December. But Abate says that both will likely run dry next September.

“We estimate that its current extraordinary measures give the Treasury an additional $350 billion in above-limit borrowing capacity,” Abate wrote. “Depending on how long the debt ceiling negotiations drag on in Congress, the Treasury can add to this total” through other actions.

For now, the most immediate impact to markets of a big win by Republicans is that it could provide a short-term pop for stocks, according to Mike Wilson, Morgan Stanley’s chief equity strategist. Though he remains bearish over the long term for stocks, Wilson has an upside target in the 4,000-to-4,150 range for the S&P 500, which traded around 3,836 as of Tuesday morning.

Democrats currently hold a slim House majority and control the Senate through the tiebreaking vote of Vice President Kamala Harris. Republicans would likely “throw a wrench into the aggressive fiscal spending plans the Democrats would still like to get done,” Wilson said. So a Republican takeover of at least one chamber of Congress has the potential to boost the appeal of long-dated Treasurys and pull down yields, which move in the opposite direction of prices.

As of Tuesday morning, all three major stock indexes

DJIA,

COMP,

were headed higher, extending gains seen on Monday and Friday. Meanwhile, most Treasury yields, with the exception of rates on 3- and 6-month bills, were lower — led by a decline in the 7-year yield

TMUBMUSD07Y,