The U.S. office property outlook has grown increasingly dark in recent months as big companies make plans to formalize a roll back of more than two 1/2 years of mostly remote work.

Early results, following a post-Labor Day burst of office visits, indicate that U.S. commercial real estate landlords and investors should brace for a tough road ahead, given the embrace of flexible work arrangements, maturing property debt and higher borrowing costs.

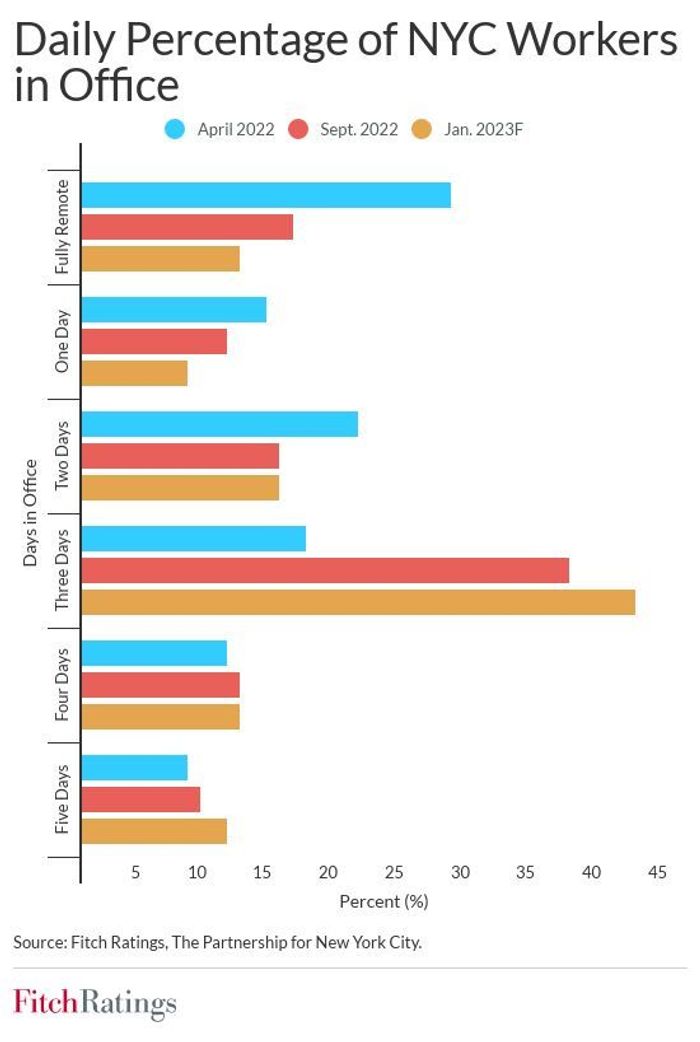

New York City, the largest U.S. office market, saw only 9% of Manhattan office workers reporting to jobs in-person five days a week (see chart), according to a survey of major employers conducted by The Partnership for New York City, a group of the city’s key real-estate developers and business leaders.

The survey was conducted over two weeks, ending in mid-September, and found that while half of workers showed up in the office in an average week, only 37% were in three days a week, the largest category among returning workers.

Only half of Manhattan office workers reporting to the office in a typical week in September. Now Meta is joining Twitter in downsizing.

Fitch Ratings, The Partnership of New York City

Head count in offices matter for property owners and tenants alike, because it helps gauge actual office use, potential future office-space needs and rent levels.

While the office utilization has been improving, it isn’t expected to “return to pre-pandemic conditions,” according to a new Fitch Ratings report, which pegged utilization near 70% before the pandemic.

Tracking office building access swipes also has become a popular gauge of office use during the pandemic.

On that front, the Kastle Systems’ weekly 10-city index last pegged occupancy near 47%, up from a pandemic low of under 20%, but still far below full occupancy levels preferred by lenders to refinance property debt.

Office ‘apocalypse’

Meta Platform Inc.

META,

this week became the latest big technology player to announce plans to shrink its office space, while putting roughly $2.4 billion in property debt exposure in the spotlight, according to Barclays analysts.

Twitter Inc.

TWTR,

announced a similar move in July.

But office buildings have yet to flash the sort of warning signs that became a hallmark of the pandemic’s early months, as tourists and business travelers abandoned hotels and shopping malls stayed dark.

That’s partially been due to record corporate earnings, which only lately have been pegged to retreat, but also to the prevalence of long, 10-year office leases taken out by many big companies.

Those factors helped keep delinquencies on office loans low during the pandemic, even though Deutsche Bank researchers expect to potentially see lower payoff rates in the next few years as some $21.5 billion of office debt in bond deals comes due through 2024, in a higher rate environment.

“It hasn’t hit a point yet where there’s clarity on where deals are going to get done,” said Shlomo Chopp, a specialist in distressed commercial real estate restructurings and a managing partner at CPS, by phone.

Still, Chopp said property borrowers and lenders both worry about office buildings that might now be leased up, but still sit largely empty. “If you have a 20,000 square foot office floor plate in Manhattan that’s empty, you can’t put a bedroom in the middle of a trading floor,” he said.

A working paper released by the National Bureau of Economic Research in September warned of an office property “apocalypse,” with New York City office buildings expected to tumble a 39.2% in value due to remote work, or a $49.6 billion loss over the long-run.

The paper, which has yet to be peer reviewed, pegged the national toll for office buildings over time as likely near $453.6 billion.

The damage already done to households and financial markets has been sharp this year as the Federal Reserve has aggressively raised interest rates to fight inflation at a 40-year high. The Dow Jones Industrial Average

DJIA,

joined the S&P 500 index

SPX,

in a bear market in September, while the benchmark 10-year Treasury rate

TMUBMUSD10Y,

briefly topped 4% last week before pulling back to 3.6%.

Higher borrowing costs for landlords, plus potentially slower cash flow growth, led BofA Global strategists in September to suggest that commercial property values could fall by as much as 20%-30% over the next few years.

The cloudy backdrop has meant slower loan originations, particularly in the office sector, “for a lot of the obvious reasons,” said D.J. Lucey, senior portfolio manager, fixed income at SLC Management, by phone.

Lucey also said investors in commercial mortgage bonds now benefit from higher yields, roughly approaching 10% on debt with BBB- ratings, when looking at pools of different property loan types, but also that deals have more conservative underwriting standards than in the run-up to the global financial crisis.

The question is whether that will be enough if an office apocalypse comes to Wall Street.