China saw a sharp slowdown in its commodities imports in June as the economy saw a slow recovery from the widespread COVID-19 lockdowns, but a report from Capital Economics said the weak imports might be close to a trough.

Chinese imports of key commodities grew by only 1% in June from a year earlier, missing a 3.9% forecast and slowing from May’s 4.1% expansion, the country’s customs data showed on Wednesday.

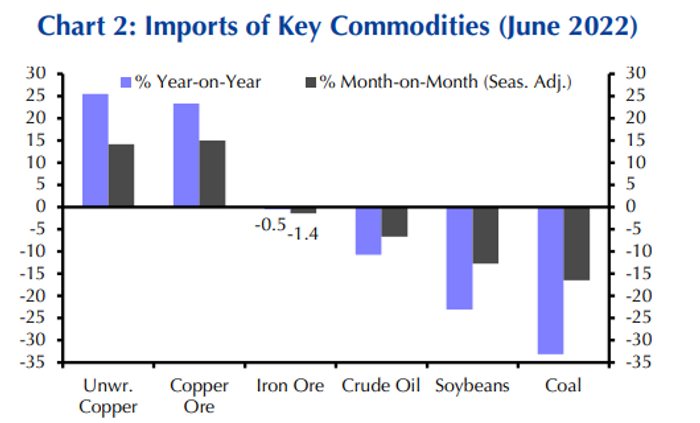

“Commodity import volumes were generally weak in June,” wrote Caroline Bain, chief commodities economist at Capital Economics, in a report on Wednesday. “We think some of this reflects the lingering impact of lockdowns on demand, but it also points to subdued activity in heavy industry and construction.”

Read more: China’s First-Half Exports Rose 13.2% in Yuan Terms

“June may prove to be a low point for commodity imports, but we think demand will remain soft this year,” wrote Bain.

China’s crude oil imports in June fell 11% year-over-year (see chart) to the lowest level since 2018 as traders continued to see slackening energy demand due to lockdowns and travel restrictions, but according to Bain, this was also attributed to “weakness in the construction and heavy industry sectors.”

Sources: Refinitiv, Capital Economics

Crude oil fell sharply this week in light of the recession fear and the potential for further pandemic restrictions in China. A sharp selloff sent the U.S. and global benchmarks below $100 a barrel on Tuesday, their lowest since April. West Texas Intermediate crude

CL.1,

CLQ22,

for August delivery rose 47 cents, or 0.5%, to $96.32 a barrel on Wednesday on the New York Mercantile Exchange. Global benchmark September Brent crude

BRN00,

BRNU22,

rose 11 cents, or 0.1%, to $99.62 a barrel on ICE Futures Europe.

Read more: Gold prices shake off losses to finish higher after U.S. June inflation number

In other commodities, Chinese customs data showed its copper imports rose 15.5% month-on-month in June. Copper is seen as an important economic bellwether due to its heavy usage in construction, household appliances and electric vehicle.

“One bright spot in the commodities trade data is imports of unwrought copper and copper ore, both of which were up strongly in June and year-to-date,” said Bain in the report. “We think some of the Chinese copper buying was to take advantage of the arbitrage opportunity between Shanghai and London copper prices.”

Copper futures HGU22, +1.00% for September delivery climbed 3 cents, or nearly 1.1%, to $3.3225 per pound on Wednesday.

Read more: Commodity price declines may shape Fed’s rate-hike path, says economist