Shares of AT&T Inc. recorded their best weekly performance since 2000 after the telecommunications company offered some reassurance to Wall Street with its latest earnings report.

AT&T’s stock

T,

had been in Wall Street’s “penalty box” recently, a Cowen & Co. analyst wrote ahead of the company’s Thursday earnings report, and the stock suffered its largest quarterly drop in 20 years during the third quarter. But investors — and at least one Wall Street analyst — seem to be warming to the stock more in the wake of AT&T’s most recent report, which not only showed continued subscriber traction, but also offered a bit more optimism around the company’s cash-flow picture.

Shares ended the week up 14.1% to record their largest weekly percentage gain since a March 2020 period when they rose more than 28%, according to Dow Jones Market Data.

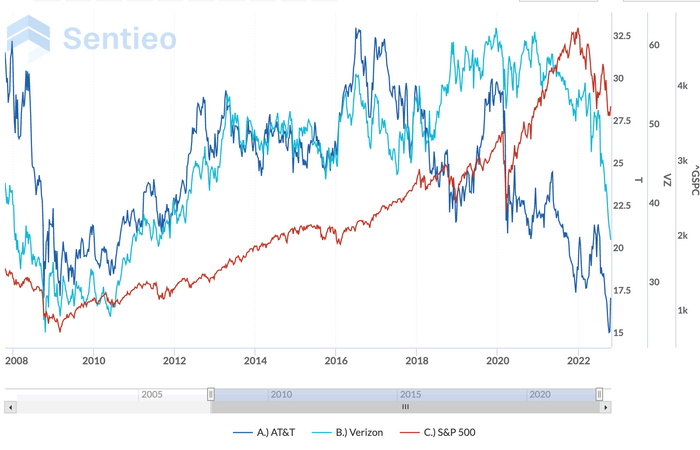

“We are upgrading AT&T following more than 15 years of underperformance now that it has demonstrated an ability to focus on core business as opposed to acquisitions of loosely related companies at market high valuations,” Truist Securities analyst Greg Miller wrote Friday as he lifted his rating to buy from hold and kept his $21 price target steady.

AT&T’s stock has lagged Verizon’s as well as the S&P 500 over a 15-year period.

Sentieo/AlphaSense

Miller said that while AT&T investors have been “disappointed” in the past over what turned out to be false starts of sorts around business improvements, he thinks things could be different now, since AT&T’s “focus has returned to its core competency of basic connectivity (wireless and wireline).”

He also believes that “trends of the past few quarters are increasingly likely to continue to the point where the company is capable of generating $17.8 billion of [free-cash flow] in 2023 and $19.6 billion of [free-cash flow] in 2024.”

For bulls who’d kept the faith about AT&T despite recent pressures, the report served as some vindication.

“We believe the quarter provided evidence that demonstrated management is executing on the business plan, meeting or exceeding most of their operational and financial targets, and improving business performance,” wrote Deutsche Bank analyst Bryan Kraft, who has a buy rating on the stock and raised his price target by a buck to $23.

AT&T’s “strong 3Q performance contrasts against a backdrop of increased investor skepticism after AT&T lowered 2022 FCF guidance last quarter, highlighted concerns over inflation virtually all year to date, and characterized 2022 all along as a ‘back-end weighted year’ despite macroeconomic uncertainty,” Kraft continued in his Thursday note to clients.

Raymond James analyst Frank Louthan IV weighed in with a similarly positive view.

“The current strategy is driving better than anticipated results, and we believe the Street should recognize this,” he wrote. “Additionally, the misperception regarding the health of the business from the Q2 call appears to be put to rest with the company showing strong results and indicating consumer demand is unchanged.”

Louthan rates the stock at outperform, though he cut his price target Friday to $24 from $26.

The crowd of Wall Street analysts covering AT&T’s stock hasn’t been a generally bullish bunch lately — just 10 of the 30 tracked by FactSet rate the shares a buy — but even skeptics were willing to give the telecommunications giant some credit in the wake of its latest earnings report.

AT&T added a net of 708,000 postpaid phone subscribers in the third quarter, building on similarly sized gains earlier in the year. The increase was especially notable as rival Verizon Communications Inc.

VZ,

delivered its third-straight quarter of consumer postpaid phone subscriber losses a day later.

AT&T also posted an increase in wireless average revenue per user, suggesting that the company was having success getting customers to trade up to higher-priced plans and also realizing some benefits from recent price increases on certain plans.

“There is at least a plausible case for optimism,” wrote MoffettNathanson analyst Craig Moffett, who rates AT&T’s stock at market perform with a $17 price target.

He said that the latest numbers “unambiguously offer more good news than bad” even though he saw “an area of concern” around each of the bright spots and particular reason to still be cautious around free-cash flow.

“Remember, it’s not enough for AT&T just to comfortably cover the dividend,” he wrote. “AT&T has to show a clear path to deleveraging their balance sheet lest the credit rating agencies lose patience with a leverage ratio that is far higher than what is normally ‘allowable’ for a company with AT&T’s BBB (S&P)/Baa2 (Moody’s) credit rating.”

Oppenheimer’s Timothy Horan added that AT&T “has done a better job at streamlining distribution and targeting acquisitions to lower customer acquisition cost, which has contributed to the bottom line.” Still, he noted that the company has “a few years of heavy investments ahead, for which the company may need partners.”

See also: AT&T reportedly in talks to create JV focused on fiber optics

Horan kept his perform rating on the stock while saying that he prefers Verizon and T-Mobile US Inc.

TMUS,

for their opportunities in fixed-wireless access.