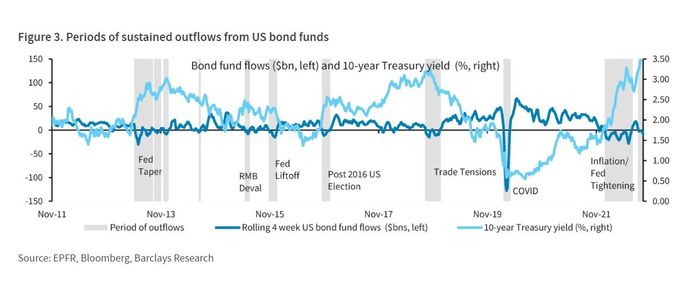

U.S. bond funds have endured the worst stretch of sustained outflows since the 2013 “taper tantrum” panic, with roughly $67.8 billion exiting mutual funds and exchange-traded funds already this year, according to Barclays researchers.

A historically bad patch for U.S. fixed income has been met with dramatic bond fund outflows, starting a year ago in November (see gray area in chart below) when the Federal Reserve began warning that higher interest rates and a smaller balance sheet would be needed to fight high inflation.

Bond funds see worst sustained stretch of outflows since 2013

EPFR, Bloomberg, Barclays Research

The 10-year Treasury yield’s

TMUBMUSD10Y,

surge to above 3.5% has coincided with bond outflows, except for a short stretch this summer when hopes for a Fed policy pivot away from sharply higher rates briefly gripped financial markets.

See: Bond markets facing historic losses grow anxious about Fed that ‘isn’t blinking yet’

“The latest flows bring total year-to-date outflows to $67.8bn, after peaking at $82bn in late June — one of the largest bond outflows of the past decade,” Barclays researchers wrote Tuesday.

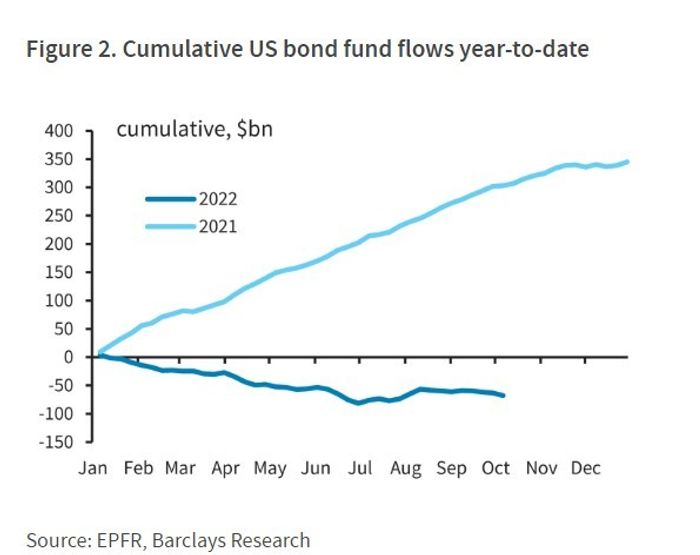

The exodus through Oct. 5 followed last year’s roughly $350 billion in cumulative inflows to bond funds (see chart), with bank loan, inflation-protected and mortgage-backed bond funds seeing the largest outflows so far in 2022, according to Barclays researchers Samuel Earl and Anshul Pradhan.

Funds flush with 2021 inflows see sharp reversal this year

EPFR, Barclays Research

However, with bond yields approaching levels last seen during the 2008 financial crisis, last week also saw inflows to short-term government, long-term corporate and high-yield bond funds, according to the Barclays team.

Yields on the ICE BofA U.S. Corporate Index were pegged at 5.7% to kick of the week, the highest since 2009, but closer to 9% for the high-yield index.

Individuals often gain exposure to corporate bonds through exchange-traded funds. The biggest iShares iBoxx $ Investment Grade Corporate Bond ETF

LQD,

for highly rated debt was down about 23% on the year through Tuesday, according to FactSet. The large iShares iBoxx $ High Yield Corporate Bond ETF

HYG,

for speculative-grade, or “junk” bonds, was down roughly 17%.

The Fed already has raised its policy rate to a range of 3%-3.25% this year, up from 0%-0.25% a year ago, with another large rate increase expected in November.

U.S. stocks were higher Tuesday, with the S&P 500 index

SPX,

up 0.5% and the Dow up 1.2% as investors focused on Thursday’s consumer-price index reading for September, with summer readings showing inflation sticking near a 40-year high.

Read: Fed’s Mester says larger risks come from hiking rates too little