U.S. consumers continue to face the highest prices in decades for gasoline and other products, but if they’re in a state that allows sales of cannabis, at least they’re paying less for legal weed.

Amid price rivalries — not only between legal cannabis companies but also against sales from the illicit market — the cost of wholesale pot has plunged and supply has climbed.

The evidence is clear in the country’s largest legal cannabis market, California, which notched a whopping $1 billion in sales in the past year.

California has seen cannabis prices as low as $100 a pound, a fraction of the average cost of $786 for an untrimmed, dried pound in the state, according to a report released Tuesday by Leafly.

As farmers in California increased pot production by 63 metric tons, the value of the state’s weed harvest has dropped in the face of price competition.

“Consumers are seeing unheard-of-bargains in 2022, with $20 retail eighths [of an ounce] now the norm,” Leafy said in its Cannabis Harvest Report.

Leafly

Currently 19 states and the District of Colombia allow sales of cannabis to adults, and initiatives are on the ballot in five more states.

While cheaper prices make cannabis more affordable for consumers, they’re not considered good news for cannabis operators.

One of the largest U.S. cannabis companies, Green Thumb Industries Inc.

GTBIF,

earlier this week reported lower price compression its third-quarter results.

Citing industry data from BDSA Analytics, Green Thumb CEO Ben Kovler said U.S. cannabis sales are up 3% while unit sales have risen 22%. That pricing dynamic “shows you the the price deflation” in cannabis, Kovler told MarketWatch.

“Price deflation at a time with massive inflation it makes it hard to operate when costs go up,” Kovler said.

Also read: Sean Combs seeks to boost minority representation in cannabis with $185 million deal

To soften the impact of lower prices, Green Thumb focuses on the more lucrative premium end of the market. It has also worked to increase wholesale production efficiency and has taken an aggressive approach on procurement and goods purchases.

The efforts helped the company generate gross margins slightly above its internal 50% target in its third-quarter results, even as it continues to face inflationary pressure on packaging and labor.

Fighting price competition

As legal cannabis companies compete for market share while absorbing a range of costs including regulatory compliance efforts and taxes, sellers on the illicit market — who pay none of those costs — continue to undercut them.

The U.S. Cannabis Council, an industry advocacy group, this week launched a Buy Legal campaign with backing from cannabis businesses — some of them minority-owned — to encourage adult cannabis consumers to purchase only from state-licensed businesses.

The effort has drawn support from New Jersey Gov. Phil Murphy as well as NBA veteran and cannabis entrepreneur Al Harrington, who is CEO of Viola.

“Now more than ever it’s imperative to educate consumers on the importance of buying regulated, safe products,” Harrington said in a statement.

The Buy Legal effort was unveiled just ahead of the Black CannaBiz Expo in New Orleans, which held a panel on the topic with Anacostia Organics Owner and CEO Linda Mercado Greene, as well as Josephine & Billies CEO Whitney Beatty and Keya Kellum, director of marketing and procurement at Harvest of Ohio.

An industry with big numbers

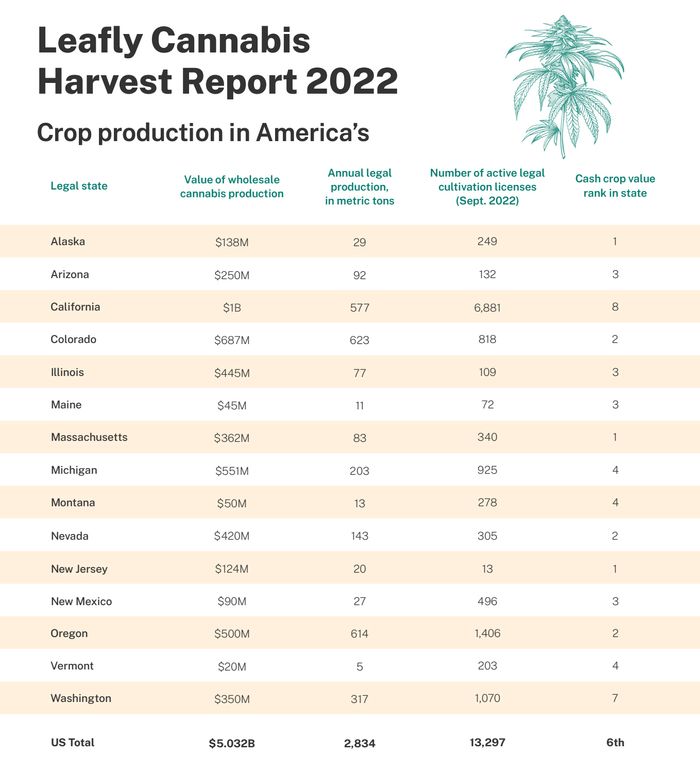

All told, legal U.S. cannabis farmers grew 2,834 metric tons of cannabis, according to the Leafly Cannabis Harvest Report 2022. The wholesale value of the market was about $5 billion.

That figure makes cannabis the sixth-largest cash crop in the country after corn, soybeans, hay, wheat and cotton.

After California, the states that generate the most dollars from legal wholesale cannabis are Colorado ($687 million), Michigan ($551 million) and Oregon ($500 million), according to the Leafly study.

The 15 U.S. states that currently allow adult-use cannabis stores contain 13,297 active legal cannabis farms with tens of thousands of full-time workers, the study said.

“The story in 2022 is all about rising production and falling prices,” the Leafly study said. “As the legal harvest continued to ramp up in legal states, the average price of cannabis fell over the past twelve months.”

Jeremy Owens contributed to this article.

Also read: Cannabis edibles company Wyld builds national footprint as it keeps hiring