Pain in the battered stock market may continue to intensify this year as companies face headwinds from weak consumer confidence and a drop in new manufacturing orders relative to inventory levels, according to Morgan Stanley’s wealth management business.

“The bear market bottom may still be 5% to 10% away,” said Lisa Shalett, chief investment officer of Morgan Stanley Wealth Management, in a note Monday. “Pursue maximum asset-class diversification.”

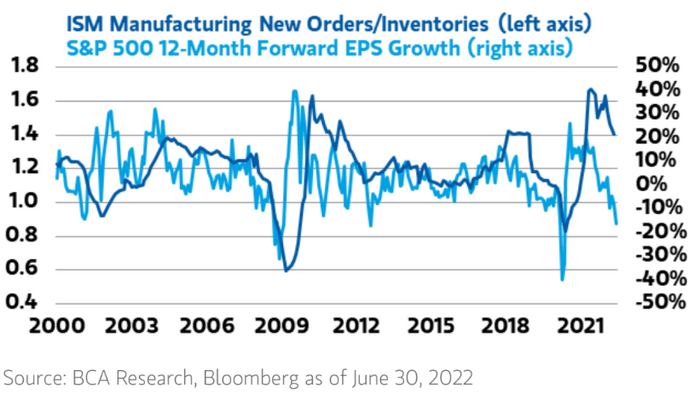

New manufacturing orders have been falling relative to inventories, with the ratio near pre-pandemic levels as global supply chain pressures have eased, Shalett said. That may not bode well for company profits, she warned, pointing to the “strong historic correlation between forward profit growth and the orders/inventory ratio.”

She tracked the S&P 500’s 12-month forward earnings-per-share growth against demand indicators from the Institute for Supply Management to illustrate her concern in a chart.

MORGAN STANLEY WEALTH MANAGEMENT REPORT DATED JULY 11, 2022

“One of the faster-moving developments of the past month has been the drop in new manufacturing orders relative to inventories,” said Shalett. That “could be a harbinger of a significant hit to corporate profits 12 months forward.”

Companies are entering earnings season for their second-quarter results, which investors will be poring over in the coming weeks as they look for signs of how well businesses have been holding up amid an economic slowdown and high inflation. Investors will also be looking for forward guidance from companies.

“While valuation multiples have reset lower, corporate earnings have not recalibrated for the new regime of higher costs of capital and higher inflation,” said Shalett. “We look for second and third-quarter earnings guidance to reset expectations downward, which will likely be a short-term headwind for stocks.”

The U.S. stock market was trading mostly lower Monday afternoon amid concerns over China tightening restrictions to curb the spread of COVID-19, with The Wall Street Journal reporting July 10 that Macau was set to enter a citywide lockdown.

The S&P 500

SPX

was down 0.6%, while the technology-heavy Nasdaq Composite

COMP

was trading 1.5% lower and the Dow Jones Industrial Average

DJIA

was up less than 0.1% after losses earlier in the session, FactSet data show, at last check.

The S&P 500 has dropped more than 18% this year through Friday, amid fears over the Federal Reserve becoming more aggressive in its battle to bring soaring inflation under control.

“Even if inflation linked to commodities and supply chains is easing, overall inflation may be slower to come down,” cautioned Shalett. “Inflation is far from tamed.”

In May, the cost of living rose in the U.S. to an annual rate of 8.6%, the highest since 1981 based on the consumer-price index. All eyes will be on the inflation reading for June, which is scheduled to be released Wednesday.