Homes and vehicles are two big-ticket items that most American families will require financing to obtain.

There’s some good news — and bad news — when looking at both assets in the next two years, according to Goldman Sachs.

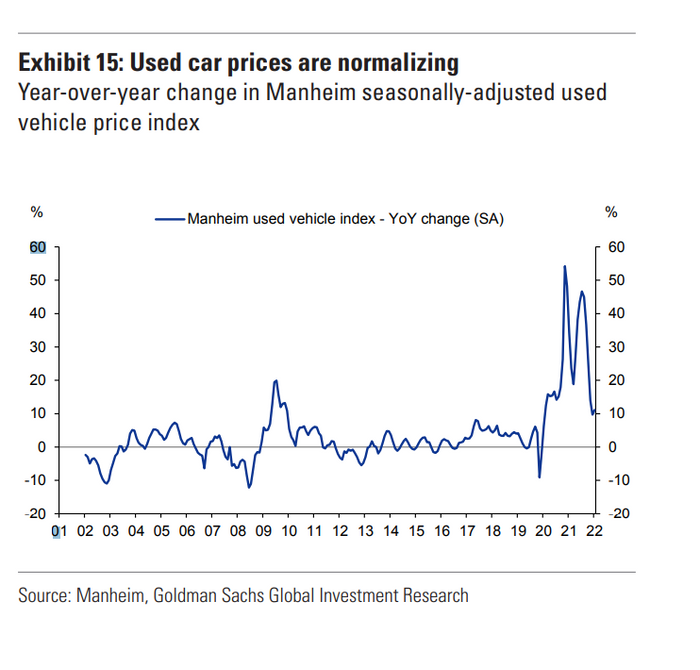

Many forecasters expect U.S. home prices to edge up to new post-pandemic highs, despite a near doubling of the 30-year mortgage rate. On the other hand, prices for used cars already have shown signs of normalizing (see chart) as supply chains untangle and dealer inventories restock.

Used-car prices are showing signs of normalizing after two-year boom

Goldman Sachs Investment Research, Manheim vehicle price index

Easing pressures in the white-hot market for vehicles since 2020 could be an encouraging sign for the Federal Reserve as it prepares to fire off another big interest-rate hike later this month, in a bid to cool inflation that climbed to a 40-year high of 8.6% in May.

The May consumer-price index indicated prices for used-cars and trucks rose 16.1% in a year, with investors nervously awaiting a fresh reading for June due next Wednesday.

Goldman Sachs analysts, in a weekly client note, said they view mortgage credit exposure as more attractive than consumer credit, given their economists forecasting used-car prices to tumble 7% by year’s end and 18% by the end of 2023.

“The risk of a similar correction in the single-family housing market is remote, in our view,” wrote Lotfi Karoui’s credit research team at Goldman.

Economists at the bank forecast home prices to gain 9.4% in the fourth quarter of 2022 from a year before, and another 1.8% in 2023.

Americans have been tapping credit at a rapid pace recently, raising some concerns about the potential for blowback, given that most U.S. consumer debt is sliced-and-diced into bonds that are then sold to investors.

The delinquency rate of subprime auto loans in asset-backed bond deals climbed to 4.35% in June, up 159 basis points on a yearly basis, according to Barclays Research.

DJIA,

were higher Friday, in a choppy session, after a strong June jobs report reignited debate about if the Fed should adopt an even more aggressively rate-hiking path.

Read: Every rose has its thorn: Strong U.S. jobs report contains a few troubling signs