Stocks with attractive dividend yields have received a lot of coverage this year, because many have held up well when compared with the performance of the broad stock market.

Dividends aren’t a guarantee that you’ll make money, of course. But companies that are in the habit of raising their regular dividends every year often are good choices for long-term growth.

True, this strategy wasn’t working out so well for several years of the bull market that lasted through 2021. But everything seems different now that interest rates are higher and the world economy in flux.

The S&P 500 Dividend Aristocrats Index

XX:SP50DIV

is made up of 63 companies in the S&P 500

SPX

that have raised their regular dividends for at least 25 consecutive years. It makes no difference how high the current dividend yield is. The index is equally weighed and rebalanced quarterly. The current dividend yields for the index components range from 0.23% to 4.95%.

The S&P 500 Dividend Aristocrats Index is tracked by the ProShares S&P Dividend Aristocrats ETF

NOBL.

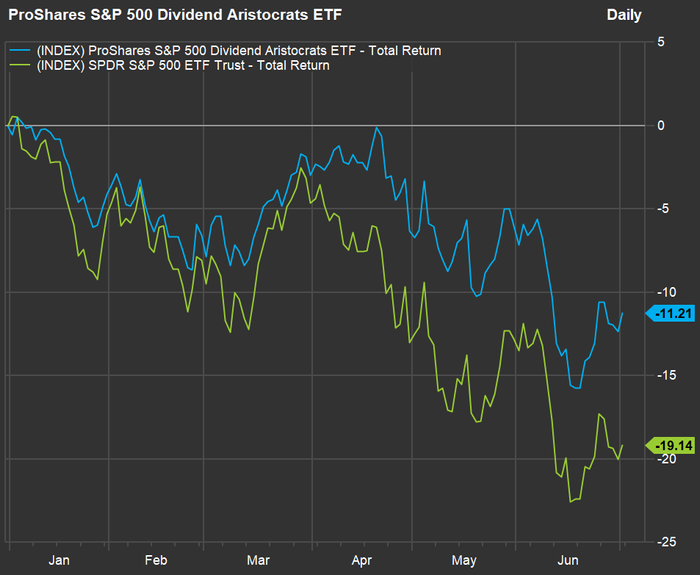

As this chart shows, its performance, with dividends reinvested, lagged that of the SPDR S&P 500 ETF

SPY,

for the five years through 2021:

FactSet

This year, both ETFs have declined, but the Dividend Aristocrats ETF has fallen less:

FactSet

Exchange-traded funds offer diversification

One obvious way to invest in the Dividend Aristocrats as a group is to buy shares of NOBL. With its equal weighting, this actually diversifies a stock portfolio. After all the S&P 500 is weighted by market capitalization, which means that Apple Inc.

AAPL,

Microsoft Corp.

MSFT,

Amazon.com Inc.

AMZN,

Alphabet Inc.

GOOGL

GOOG

and Tesla Inc.

TSLA

together make up 21% of SPY’s portfolio.

You can even diversify further, with two more groups of Aristocrats tracked by S&P Dow Jones Indices:

-

The S&P 400 Dividend Aristocrats Index has 48 stocks of companies that have raised dividends for at least 15 consecutive years, drawn from the full S&P Mid Cap 400 Index

MID.

It is tracked by the ProShares S&P MidCap 400 Dividend Aristocrats ETF

REGL. -

The S&P High Yield Dividend Aristocrats Index

XX:SPHYDA

is made up of the 119 stocks in the S&P Composite 1500 Index

XX:SP1500

that have increased dividends for at least 20 straight years. It is tracked by the SPDR S&P Dividend ETF

SDY.

The S&P Composite 1500 itself is made up of the S&P 500, the S&P Mid Cap 400 and the S&P 600 Small Cap Index

SML.

So the S&P High Yield Dividend Aristocrats Index includes all the stocks in the S&P 500 Dividend Aristocrats Index. But it excludes some that are in the S&P 400 Dividend Aristocrats Index. The name of the High Yield Dividend Aristocrats Index is confusing, because the yields aren’t necessarily high — they range from 0.23% to 5.00%.

Don’t fall for Dividend Aristocrats with the highest current yields

For those looking to pick among the Dividend Aristocrats, one option is to focus on those with the highest current dividend yields, especially if you are looking for income right now.

Those current yields are attractive when compared with 10-year U.S. Treasury notes

BX:TMUBMUSD10Y

that yield less than 3%.

If we combine the three groups of Dividend Aristocrats and remove duplicates, we have a list of 136 companies. Here are the 10 with the highest current dividend yields:

| Company | Ticker | Current dividend yield | Total Return – 5 Years |

| Mercury General Corp. | MCY | 5.70% | 6% |

| Leggett & Platt Inc. | LEG | 5.00% | -19% |

| Walgreens Boots Alliance Inc. | WBA | 4.95% | -42% |

| Franklin Resources Inc. | BEN | 4.92% | -31% |

| National Retail Properties Inc. | NNN | 4.77% | 44% |

| International Business Machines Corp. | IBM | 4.68% | 22% |

| 3M Co. | MMM | 4.64% | -28% |

| V.F. Corp. | VFC | 4.53% | -7% |

| Telephone and Data Systems Inc. | TDS | 4.48% | -3% |

| Source: FactSet | |||

Click on the tickers for more about each company.

But dividends are only part of the story. Look at the five-year total returns through July 1, which include reinvested dividends. They are lousy when compared with returns of 72% for SPY and 66% for NOBL.

If you are looking for high current income, here’s a list of dividend stocks with yields of 5% and whose payouts are well supported by companies’ expected cash flow.

History lesson: The best dividend compounders

Another investing strategy is to look at the growth of the payouts. You might be able to grow a large income stream over time as companies you own pay you more, and rapid compounding of dividends might be tied to excellent long-term performance.

Among the 79 Dividend Aristocrats that had dividend yields of at least 2.00% five years ago, these 10 have had the highest compound annual growth rates (CAGR) for dividends:

| Company | Ticker | 5-year dividend CAGR | Dividend yield on shares purchased 5 years ago | Dividend yield 5 years ago | Current dividend yield | Total Return – 5 Years |

| Lowe’s Cos. Inc. | LOW | 20.7% | 5.37% | 2.10% | 2.37% | 150% |

| AbbVie Inc. | ABBV | 17.1% | 7.79% | 3.53% | 3.67% | 166% |

| T. Rowe Price Group | TROW | 16.1% | 6.39% | 3.04% | 4.16% | 81% |

| Williams-Sonoma Inc. | WSM | 14.9% | 6.37% | 3.18% | 2.77% | 165% |

| Fastenal Co. | FAST | 14.1% | 5.63% | 2.91% | 2.49% | 161% |

| Aflac Inc. | AFL | 13.2% | 4.08% | 2.19% | 2.84% | 63% |

| Automatic Data Processing Inc. | ADP | 12.8% | 4.06% | 2.23% | 1.95% | 131% |

| Abbott Laboratories | ABT | 12.1% | 3.86% | 2.18% | 1.71% | 146% |

| Target Corp. | TGT | 11.7% | 8.21% | 4.71% | 3.03% | 210% |

| NextEra Energy Inc. | NEE | 11.6% | 4.87% | 2.81% | 2.11% | 158% |

| Source: FactSet | ||||||

Nine of the 10 stocks beat the five-year total return of 72% for SPY — seven of them more than doubled the S&P 500’s return.

The best dividend compounder in this group has been Lowe’s Cos.

LOW.

Five years ago, the shares had a dividend yield of 2.10%. But if you held the stock over that time, your five-year-old shares would now have a dividend yield of 5.37%, based on your cost.

Further down the list you can see much higher yields for five-year-old shares of AbbVie Inc.

ABBV,

T. Rowe Price Group

TROW

and Target Corp.

TGT.

How about a look ahead?

The problem with this list, of course, is that it looks back. So let’s look for those that are expected to increase their dividends most rapidly from here.

Lets begin again with our expanded list of 136 Dividend Aristocrats and narrow it down to the 75 companies that have current dividend yields of at least 2%. Here are the 10 that are expected to raise their payouts the most through 2024, based on consensus estimates among analysts polled by FactSet:

| Company | Ticker | Current dividend yield | Current annual dividend rate | Estimated dividend – 2024 | Two-year estimated dividend increase |

| Perrigo Co. PLC | PRGO | 2.54% | $1.040 | $1.31 | 26.0% |

| Stanley Black & Decker Inc. | SWK | 2.95% | $3.160 | $3.91 | 23.6% |

| NextEra Energy Inc. | NEE | 2.11% | $1.700 | $2.05 | 20.4% |

| Essential Utilities Inc. | WTRG | 2.26% | $1.073 | $1.28 | 19.8% |

| General Dynamics Corp. | GD | 2.25% | $5.040 | $6.01 | 19.3% |

| Aflac Inc. | AFL | 2.84% | $1.600 | $1.90 | 18.8% |

| Atmos Energy Corp. | ATO | 2.36% | $2.720 | $3.20 | 17.6% |

| Bank OZK | OZK | 3.27% | $1.240 | $1.45 | 16.9% |

| Air Products and Chemicals Inc. | APD | 2.67% | $6.480 | $7.50 | 15.7% |

| Southwest Gas Holdings Inc. | SWX | 2.82% | $2.480 | $2.86 | 15.4% |

| Source: FactSet | |||||

Two companies made both the five-year list of best dividend compounders and the list of those expected to have the best expected dividend growth through 2024: NextEra Energy Inc.

NEE

and Aflac Inc.

AFL.

Click here for Tomi Kilgore’s detailed guide to the wealth of information for free on the MarketWatch quote page.