That’s rich: even people making well over six figures say it can be a struggle to stretch their money.

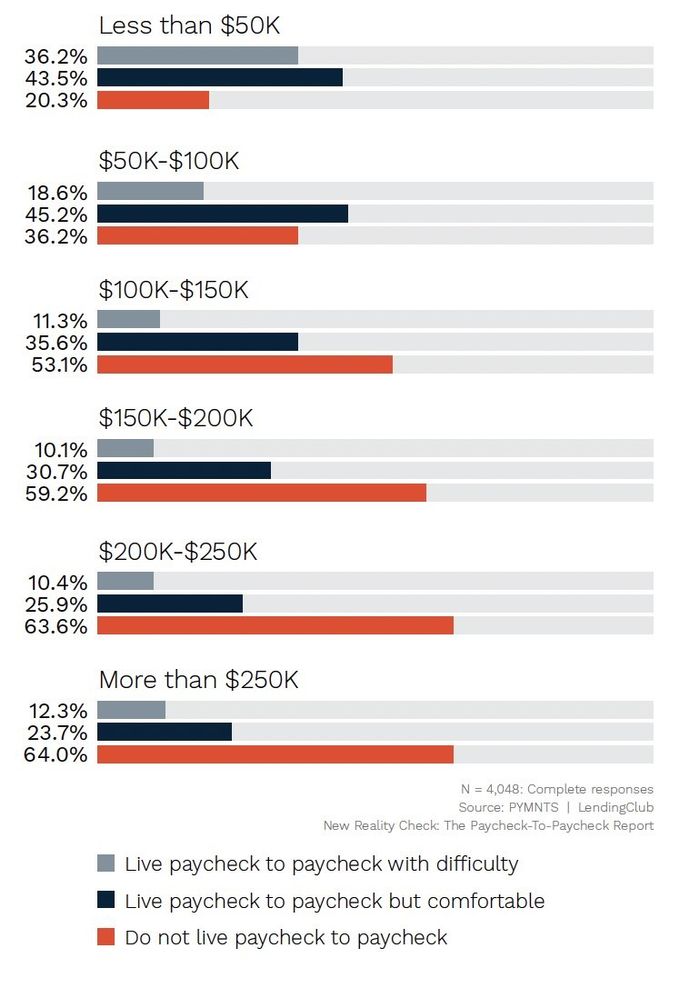

To be exact, 36% of Americans taking home a quarter of a million dollars or more claim to be running out of money again by payday, according to the joint survey of 4,048 respondents taken by data and insights company Pymnts and the LendingClub Corporation. More than 40% of those earning at least $100,000 say the same.

The big picture is bleaker. The report found that 61% of Americans overall were living paycheck to paycheck in April 2022. In other words, almost two-thirds of the U.S. population, or about 157 million people, have little to nothing left over at the end of the month — and that is a nine percentage point increase from April 2021. And most people earning less than $50,000 (just under 80% of them) are living paycheck to paycheck.

“Lower and moderate income households are being squeezed the most by inflation,” Greg McBride, chief financial analyst at Bankrate.com, told MarketWatch. “And we see that in increased debt levels and decreased levels of savings as households try to stretch their dollars further. Even with low unemployment and robust wage gains, it hasn’t been enough to keep pace with costs that are going up at the fastest pace in four decades.”

Read more: California is sending ‘inflation relief’ checks up to $1,050 — here’s who qualifies

And: The top financial priority for most Americans? Just getting by

All of the study participants who said they were living paycheck to paycheck were also asked whether they were getting by “with difficulty” or if they were “comfortable.” Here again, people earning less were struggling more: 19% of middle-income respondents (earning $50,000 to $100,000) and 36% of lower-income respondents (earning less than $50,000) said they were having a hard time paying their bills each month.

In comparison, a much smaller percentage of people earning over $100,000 (between 10% to 12%) who reported living paycheck to paycheck said they were having issues paying their bills, but most reported they were still “comfortable.”

New Reality Check: Paycheck to Paycheck Report

“Earning a quarter of a million dollars a year is more than five times the national median and is clearly high income,” said Anuj Nayar, LendingClub’s financial health officer, in a statement. “The fact that a third of them are living paycheck to paycheck should surprise you.”

So what’s going on here?

McBride at Bankrate noted that it’s important to consider what “living paycheck to paycheck” means. “Defining this may be in the eye of the beholder,” he said.

For example, top earners who says they are living paycheck to paycheck may be using their disposable income to contribute to retirement savings or college funds. So if those deductions are taken out of their paychecks before the balance hits their bank account, then they may feel like they are making less than they are, as this can leave little or nothing left over after other expenses are paid. But in fact, they have a safety net that someone making less than $50,000 probably doesn’t have.

“If you’re saving through payroll deduction for retirement and emergencies, I wouldn’t define that as ‘living paycheck to paycheck,’ because there is a cushion there in the event of income disruption,” he said. “If you are truly living paycheck to paycheck, there is no cushion. In those instances, if the paycheck stops or is disrupted, then something doesn’t get paid.”

“‘If you are truly living paycheck to paycheck, there is no cushion. In those instances, if the paycheck stops or is disrupted, then something doesn’t get paid.’”

But this gets to another important distinction: gross pay versus net pay. Someone earning $250,000 a year probably isn’t taking all of that home. “These [income] numbers are always presented in terms of gross pay, but what pays the bills is net pay,” said McBride.

And high-income households that live in high-cost markets have a bigger gap between gross pay and net pay, especially after federal, state and local taxes take their bite out of the bottom line, he said.

Which gets to location, location, location: A $100,000 or $250,000 salary doesn’t stretch as far in an expensive metro area like New York City or San Francisco. Indeed, plenty of high-income individuals sharing their annual budgets on Reddit have revealed how their expensive rent or mortgage payments, as well as soaring child care costs and utilities in pricey cities, have ballooned their cost of living. MarketWatch readers had a lot to say about this popular story from 2019, which showed how a $350,000 salary in an expensive city might barely qualify as middle class.

“In high-cost markets, everything costs more,” McBride said. “The cost of child care is likely to be more, because the cost of that daycare center’s rent is more.”

Related: A new phase in America’s white-hot housing market: Desperate renters facing bidding wars

But he added that we can’t gloss over the fact that lifestyle creep and “living large” probably play a role in higher-income households running low on dough by the time the next payday comes around. “Households earning more than $250,000 and living paycheck to paycheck, they are probably not driving a used Toyota Corolla,” he said. And there’s plenty of data to suggest that people spend more on subscription services like Netflix

NFLX,

takeout and food delivery apps like Uber Eats

UBER,

and online shopping sites with one-click checkout like Amazon

AMZN,

than they realize.

Brian Marks, a senior lecturer at the Department of Economics & Business Analytics at the University of New Haven, also suggested that wealthy individuals may be living paycheck to paycheck because they are utilizing debt and credit in different ways than those earning less.

“People in higher incomes spend more, in general, and may acquire more debt with the assumption that [their] income will continue to rise, so they’ve invested in a house and leveraged themselves with the expectation that they are going to have these salary increases,” he told MarketWatch.

They use credit card debt to cover bills and purchases and “float” money, for example, since they can bank on their upcoming payday or future bonuses to pay that down. So once their check comes in, much of it goes toward paying off that debt. And this idea is consistent with data from the new paycheck to paycheck survey, which found that individuals making more than $250,000 were also more likely to have made a recent credit card or personal loan payment than those earning $50,000 or less.

Finally, Americans’ soft financial literacy skills could also be a factor. Financial literacy has plummeted since 2009, according to a study from the FINRA Investor Education Foundation, and lacking this knowledge could be leading to financial mistakes, including for those earning $250,000 and above.

“A lot of people would say that [$250,000] is a lot of money. It is a lot of money,” Marks said. “But you have to peel everything back.”