Record low affordability and a dearth of houses to buy have credit analysts at BofA Global cutting their outlook for U.S. home price growth to zero in 2023, while also warning that prices could stay flat through 2026.

Home prices rose 2% to 5% annually since the 1980s, but now look likely to remain on hold for the next few years, the team said, pointing to the Federal Reserve signaling a willingness to “overshoot” in its fight to bring 8% annual inflation down to its 2% target.

“This implies a higher risk of a hard landing,” including unemployment reaching 5.6% by next year, the team of BofA residential credit analysts led by Pratik Gupta wrote, in a weekly client note. But they also argued that “this is no 2008,” in terms of foreshadowing a housing market collapse.

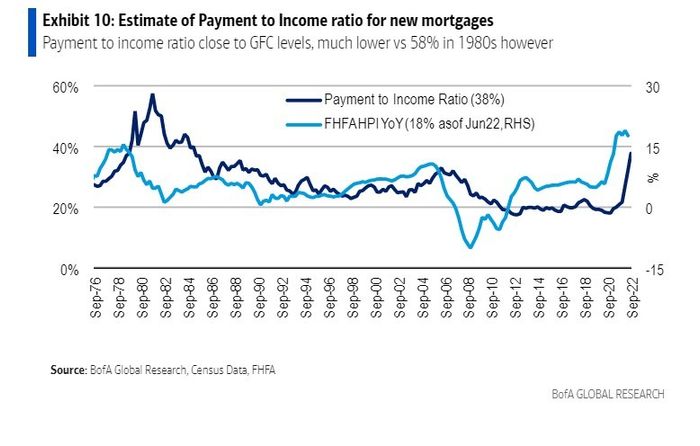

For one thing, the BofA team said housing affordability was nearing 2006 levels, after two years of skyrocketing prices and the 30-year fixed mortgage rate now hovering near 7%. But they pegged the ratio of payments on new mortgages to income around 37% (see chart), or well below the near 60% level in the 1980s.

Mortgage payments are rising with rates and home prices, but they aren’t as high as in the 1980s as a ratio of income.

BofA Global, Census data, FHFA

Of note, with new mortgage rules put in place in the wake of widespread abuse uncovered after the 2007-’08 global financial crisis, lenders now must make a good-faith effort to determine whether a borrower can actually afford a new mortgage.

Another positive of the housing market includes about 95% of the mortgage market now having a coupon of less than 5%, or “golden handcuffs,” according to BofA, with the average weighted-average coupon around 3.5%.

About 30% of mortgages in the run-up to the global financial crisis were adjustable-rate loans with teaser rates that later ballooned, paving the way for a wave of borrower defaults and foreclosures.

There also now is a record of about $30 trillion of home equity built into the housing market, providing a significant cushion to households, or about 63% of the population living in their own homes.

Finally, the team also said mortgage loan servicers remain more willing in this cycle to provide relief to distressed borrowers, including offering loan modifications, before turning to more drastic options like foreclosures.

All told, banks a decade ago provided some $50 billion in borrower relief after settling with state attorneys generals in the so-called “robo signing” scandal.

To that end, the BofA team also remains bullish on mortgage credit, adding that despite recession fears and some selling in riskier mortgage bonds sold by Freddie Mac

FMCC,

and Fannie Mae,

FNMA,

that total returns in the sector have been roughly flat this year, outperforming double-digit losses in the S&P 500

SPX,

and in many other parts of fixed income.

See: Credit carnage spurs bargains on bonds tied to $16 trillion pile of U.S. household debt

Read: Home-buying sentiment hits all-time low, as mortgage rates surpass 7%, Fannie Mae says