Follow the herd.

Getty Images

Don’t buy shares of Facebook parent Meta Platforms Inc. until at least some Wall Street analysts begin to revise their earnings estimates.

That’s the implication of research into how investors can take advantage of analysts’ behavior. For several reasons, they have herd-like behavior. So when a few are brave enough to go against the consensus, the rest follows suit. In Meta’s

META,

case, that should precipitate a rally.

There’s no way of knowing how long it will be before the consensus on Meta will begin to turn. For the moment, because no analyst tracked by FactSet has recently issued an upward revision of their earnings estimate, it would be risky for even a gutsy contrarian to start buying.

After the market closed Wednesday, Meta reported a 52% drop in third-quarter profit, a decline in sales and a ballooning of costs and expenses. Meanwhile, the company’s bet on the metaverse has brought in little revenue. The reaction was swift and sharp: The stock tumbled more than 20%.

The source of analysts’ herding, according to a number of academic studies, is that they are conservative. Because the noise-to-signal ratio is high when it comes to all the developments that potentially could impact Meta’s future earnings, most analysts are slow to react.

Another source of the analyst community’s sluggishness is that only a small number of them have an impressive tracking record at issuing earnings estimates that are better than a coin flip. The remaining analysts tend to follow those superstars, but want to avoid the impression that they’re simply following others’ lead. So when they do follow, which they almost always do, they do so with a healthy time lag.

As a consequence, analyst earnings revisions tend to come in waves. A shrewd strategy is to wait until that wave has begun and then jump on board.

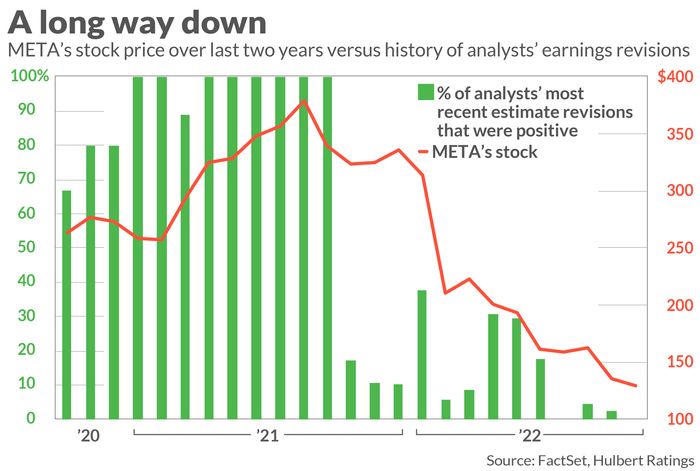

This wave-like behavior of analyst earnings revisions is illustrated in the accompanying chart, above. For each month over the past two years, it plots the percentage of Meta analysts whose recent earnings revisions were upwards. Notice the wave of upward revisions at the beginning of this two-year window, which precipitated an impressive rally in Meta’s stock that lasted until the summer of 2021. But notice the subsequent wave of downward revisions, which began early in Meta’s decline which, at least so far, has taken some 75% off its market capitalization.

In the meantime, the implication of the research into analyst behavior is that you should sit on your hands. By waiting for the analyst consensus on Meta to begin to turn, you won’t catch its stock’s exact bottom. But, if history is any guide, you will be riding a wave that still has a lot of momentum.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at [email protected].