It’s a mega earnings day, with some big names, especially on the tech side, rolling out. We’ll also get some housing data, with the state of that market a hot-button topic for investors as mortgage rates keep climbing.

Last week, existing-home sales marked an eight-straight monthly fall, the first such streak since 2007. That’s as a recent UBS survey showed five big U.S. cities featured as overvalued.

Our call of the day from Jeffrey Kolitch, the portfolio manager of the Baron Real Estate Fund

BREFX,

who sees rare bargains among “best in class” related companies thanks to a big pullback for those stocks this year.

So much so, that if the current downturn leads to a recession, real-estate companies will be at a good starting point, Kolitch said in his recent third-quarter shareholder letter. And while he’s wary about the near term, thanks to central-bank hikes and political risks, he’s more optimistic about the two-to-three view.

Over the first nine months of 2022, many real-estate companies have seen 30% to 60% corrections that have factored in low valuation multiples and expectations for slower growth, said Kolitch, adding that their fund is now “chock-full of real-estate stocks that are unsustainably cheap.”

Kolitch is optimistic due to strong business fundamentals and healthy balance sheets he sees for many companies, along with signs of hope for the overall economy — moderating inflation, plentiful jobs, central bank hiking that’s likely mostly done and a China rebound that’s just getting started.

He also notes that they’ve seen no signs of excessive use of leverage and overbuilding that marked the housing bust of 2008. “We always have our attenae up for warning signs in the real-estate sector,” he said.

Onto his “best-in-class” picks, which must meet criteria that includes: ownership of unique and well-located assets in markets with high barriers to entry, strong long-term growth prospects, sector leaders, conservative and liquid balance sheet and solid management.

Looking at real-estate investment trusts (REITs), Kolitch highlights Invitation Homes

INVH,

the biggest institutional owner of single-family rental homes, focused in neighborhoods with decent schools and employment opportunities. Equity Residential

EQR

is another, the biggest U.S. apartment REIT with high-quality units in choice coastal markets.

Global carrier and cloud-neutral data center operator Equinix

EQIX

and industrial REIT giant Prologis

PLD

also get mentions.

Among residential-related picks are some familiar names, including home builders Lennar

LEN

and Toll Brothers

TOL

and home-improvement retailer Lowe’s Companies

LOW,

who each get the nod for cheap valuations, along with hard-surface flooring specialist Floor & Decor

FND.

Among alternative asset managers, Kolitch notes Brookfield Asset Management

CA:BAM

is valued at a more than 50% discount to management’s own assessment, while biggie Blackstone

BX

is valued at a “modest premium” to the S&P 500 index despite “far superior long-term growth prospects.”

Under the travel-related real estate umbrella, the manager likes casino group MGM Resorts International’s

MGM

“compelling” value, along with mountain resorts giant Vail Resorts

MTN.

The markets

MarketWatch

Stock futures

ES00

NQ00

are lower after the S&P 500 saw its best close in a month, with bond yields

BX:TMUBMUSD10Y

BX:TMUBMUSD02Y

edging lower, the dollar

DXY

up slightly and oil prices

CL

BRN00

are down a second day on demand concerns. Bitcoin

BTCUSD

is trading around $19,356.

The buzz

Earnings are rolling in from some big names. GE

GE

is down on a profit miss, along with Xerox

XRX,

while Coca-Cola

KO

is up on forecast-beating results, along with UPS

UPS

and Raytheon

RTX

and Biogen

BIIB.

3M

MMM

is falling on mixed results.

After the bell, we’ll hear from Microsoft

MSFT

(preview), Alphabet

GOOGL

(preview), Twitter

TWTR

and Texas Instruments

TXN

on the tech front. Elsewhere, Visa

V,

Chipotle

CMG,

Spotify

SPOT

and Mattel

MAT

are also in the late lineup.

Canopy Growth said it will create a U.S. holding company and exchangeable share structure

Shares of Weber

WEBR

are up 24% in premarket, matching the premium offered by its biggest shareholder to buy the grill maker’s remaining stock for $6.25 each.

The S&P Case-Shiller and Federal Housing Finance Agency will release August home-price indexes at 9 a.m. Eastern, followed by a consumer confidence index.

Adidas

XE:ADS

has ended its partnership with rapper Kanye West over his recent slew of antisemitic remarks that also have led to his talent agency dropping him and bans by Twitter

TWTR

and Instagram.

Best of the web

TikTok plans to use your data to fuel its multibillion-dollar shopping mall

Mud, the environmentally friendly beauty all-star that may save us all. (subscription required)

Doctor who survived Ebola, says we have a few months to get ready for the next pandemic

The chart

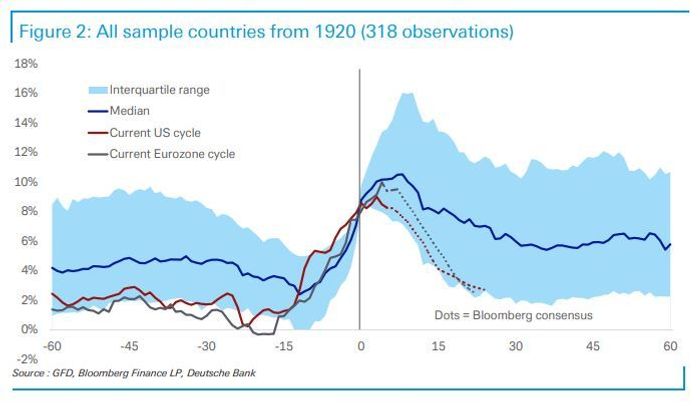

How sticky is high inflation? A team of strategists at Deutsche Bank, led by Jim Reid, have taken a look at consumer price inflation from 1920 (where available) onward for 50 developed and emerging market countries, when inflation reaches 8%.

Deutsche Bank

“Looking at this full history, the evidence shows that once inflation spikes above 8%,

median inflation takes around 2 years to even fall beneath 6%, before settling

around that level out to 5 years after the initial 8% shock. This is around 2pp above

the pre-shock median of c. 4%,” said the strategists. U.S. CPI hit 8.5% in March.

As they point out, current consensus expects inflation to be back or even below 3% just two years after that first breach of 8%. While “history never repeats exactly,” when inflation normally breaches these thresholds, history shows it’s fairly sticky, especially in post-1970 periods,” said Reid and the team.

Top tickers

These were the top-searched tickers on MarketWatch as of 6 a.m. Eastern:

| Ticker | Security name |

| TSLA | Tesla |

| MULN | Mullen Automotive |

| GME | GameStop |

| NIO | NIO |

| AMC | AMC Entertainment |

| APE | AMC Entertainment preferred shares |

| BABA | Alibaba |

| AAPL | Apple |

| BBBY | Bed Bath & Beyond |

| TWTR |

Random reads

New Zealand is struggling to fill this “dream job” on a UNESCO heritage site

Swedish archaeologists unearth a long-lost 17th-century warship

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton