PayPal Holdings Inc. said earlier this week that a policy change indicating users could be fined up to $2,500 for spreading misinformation was published erroneously—but not before the company faced online backlash.

See more: PayPal apologizes for policy notice saying users could face $2,500 fines for misinformation

Some high-profile Twitter users, including former PayPal

PYPL,

president David Marcus, called out the company, while other Twitter users rallied around online calls to boycott the payments service. Search queries for how to delete a PayPal account rose sharply.

Read: ‘Delete PayPal’ searches spike after $2,500 misinformation fine controversy

Shares of PayPal lost 7.9% over the course of Monday and Tuesday, underperforming the S&P 500

SPX,

which fell 1.4% during those two days, but Jefferies analyst Trevor Williams said he wasn’t sure that the controversy would spark a mass exodus from the PayPal platform.

He noted in a Wednesday report to clients that data from ListenFirst, which does social-media analytics, indicated that only 70,000 accounts tweeted, retweeted, or liked a tweet with the #DeletePayPal hashtag over the span of Saturday to Monday. For context, PayPal Chief Executive Dan Schulman disclosed on the company’s earnings call that PayPal had “nearly 400 million consumer accounts.”

“If action taken by consumers in response to the policy update/retraction is isolated to those that voiced displeasure via social media (or even a multiple of those that did), we would not expect there to be any noticeable impact on net new active accounts,” Jefferies’ Williams wrote.

He acknowledged that the “only lingering risk” for PayPal would be if the controversy “prompts a broader politically motivated boycott, the likelihood of which is impossible to measure.” But the Twitter ire “faded significantly on Monday,” Williams wrote, suggesting that the episode was unlikely to escalate into something bigger.

The backlash comes during a tough year for PayPal, which has seen its shares fall by half over the course of 2022 as the management team reset expectations numerous times. Executives backtracked on rosy pandemic-era projections for medium-term growth and also pulled back on annual targets.

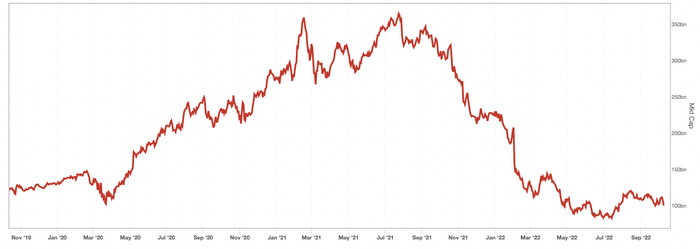

While PayPal shed $8.2 billion in market value over the course of trading Monday and Tuesday, Sentieo research director Nick Mazing highlighted that such a decline is “tiny compared to the market cap loss since the peak.” PayPal was worth more than $360 billion at its July 2021 peak, but it was only worth $104 million as of Friday’s close. The market value dipped to $96 billion by the end of Tuesday’s session.

PayPal’s market value has fallen from a peak of over $360 billion in July 2021 to under $100 billion currently.

Sentieo

Despite the recent challenges, Bank of America analyst Jason Kupferberg is feeling upbeat about the company’s prospects, writing that he sees an “attractive risk/reward” setup heading into PayPal’s third-quarter earnings report. He thinks that the company could realize upside to revenue from other valued-added services, stemming from rising interest rates, and he also flagged the potential for a positive surprise on margins as PayPal has been focused on cost cuts.

He noted in his Wednesday report that PayPal is his “top pick.”