Investors often view real estate investment trusts as a defensive asset in a sinking stock market, but REITS are struggling in 2022 as investors look for places to hide in a year market rocked by soaring inflation and rising interest rates, according to Wells Fargo Investment Institute.

“During past stock market corrections, U.S. investors have often turned to defensive assets such as the U.S. dollar, bonds, and REITs,” said John LaForge, head of real asset strategy at Wells Fargo Investment Institute, in a strategy note dated Oct. 10. “The U.S. dollar has performed spectacularly well in 2022, up 17% year-to-date, but this is not the case for bonds and REITs.”

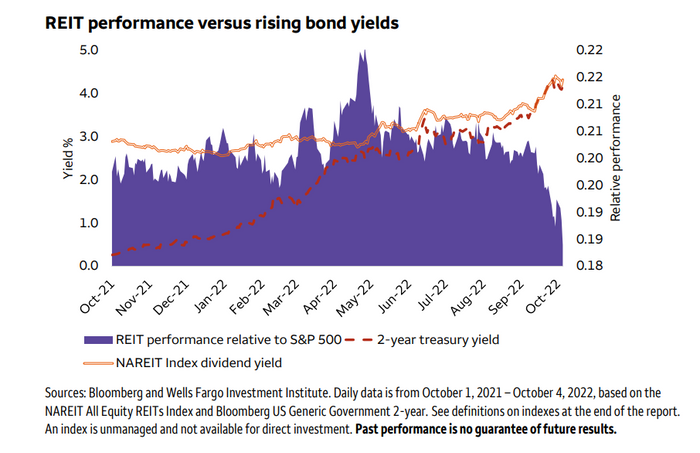

Their losses this year are largely due to the Federal Reserve’s tightening of monetary policy as it aims to tame high inflation through rate hikes, with the Bloomberg U.S. Aggregate Bond Index down 14.1% this year and NAREIT Index sliding 28.5%, according to the Wells Fargo report.

“Rising interest rates increase the cost of capital for REITs,” said LaForge. “Plus rising bond yields have become attractive alternatives to REIT dividend yields.”

WELLS FARGO INVESTMENT INSTITUTE REPORT DATED OCT. 10, 2022

Investors have been weighing yields on the two-year Treasury note against an average REIT dividend yield of 4.25%, according to Wells Fargo. Two-year Treasury yields

TMUBMUSD02Y,

have jumped this year, edging up slightly Tuesday to 4.314%, according to Dow Jones Market Data.

“For income- seeking investors, conscious of risk, the T-bill is most often selected,” said LaForge. “The bottom line is that REITs relative underperformance may continue for a while, as the Fed hiking cycle does not appear over.”

Shares of the iShares Core U.S. REIT ETF

USRT,

were trading up about 1% Tuesday afternoon, after seeing a loss this year of around 31% on a total return basis through Oct. 10, according to FactSet data. The S&P 500 has this year sunk around 23% over the same period, based on total return data.

The U.S. stock market was trading mixed late afternoon Tuesday, with the Dow Jones Industrial Average

DJIA,

edging up 0.1%, while the S&P 500

SPX,

slipped 0.7% and the technology-laden Nasdaq Composite

COMP,

dropped around 1.3%.

Meanwhile, shares of the iShares Core U.S. Aggregate Bond ETF

AGG,

were up 0.1%, according to FactSet data, at last check.

Investors will be looking ahead this week to the consumer-price-index report, due out on Thursday, for a reading on inflation in September as they attempt to gauge the future path of Fed rate hikes.

Read: Fed’s Mester says there’s been no progress on inflation, so interest rates need to move higher