Forget about buying the dip, for a while.

That’s John Duffy, founder and CEO of Trending Stocks, about why he thinks the stock market could be in for a long, early 2000s-style unwind akin to what happened in the wake of the dot-com bust.

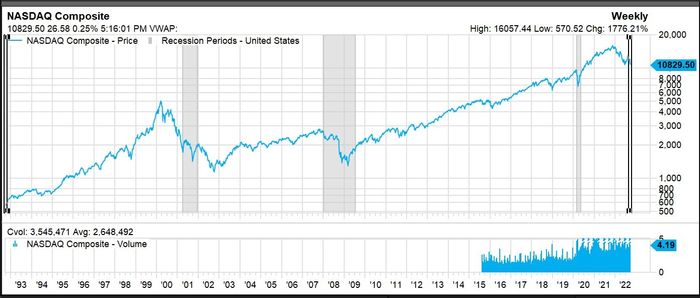

Duffy, who launched his investing platform this spring, pointed to similarities between this year’s Nasdaq-led rout in stocks and the implosion that followed the run-up of internet and technology stocks in the mid-1990s.

For one thing, billions of dollars were spent on technology roughly two decades ago as businesses and the U.S. government rushed to fortify computer and communications systems against the Y2K “bug,” a glitch where the year 2000 threatened to crash vast platforms running on the old 2-digit date model.

Similarly, the pandemic helped the technology sector book record profit as companies around the globe switched suddenly to remote work. Both periods saw tech spending skyrocket, propelling the stock market to fresh highs. Giddiness around the digital world even boosted shares of unprofitable companies, until tech became a drag became a drag on stocks.

“All the sudden, the fire behind the market went out,” Duffy said, in a phone interview.

Indeed, the S&P 500’s communication services sector was down about 38% on the year through Wednesday, according to FactSet, outpacing the roughly 23% fall for the broader S&P 500 index

SPX,

and the 30% decline of the Nasdaq Composite Index

COMP,

in 2022.

This year’s selloff has been attributed largely to the Federal Reserve’s reversal of easy-money policies to tackle inflation near a 40-year high, but also to concerns that it could go too far and throw the economy into a recession.

Read: Fed officials are in rare unanimity on bringing inflation back down to 2% target, Kashkari says

Fed Chairman Jerome Powell warned last week that the housing market will “probably go through a correction to get back to a better balance,” as the central bank works to get inflation down to its 2% annual target.

The Fed now has begun to pencil in a higher fed-funds rate of 4.5%-4.75% in 2023 to reach its goals. The central bank’s benchmark rate hit about 6.5% in 2000 before it was slash to about 1% in 2003 to help juice the economy.

Duffy warned that after 2000 it took almost three years (see chart), plus about a dozen faded rallies, for the Nasdaq to find a bottom nearly 77% below its prior peak. It then float higher until the 2007 housing market crash.

Dot-com bust 2.0?

FactSet

“People put money back in, and it crashed again,” said Duffy said. “It wore everybody down and had everybody depressed.”

While Duffy doesn’t think another housing crash is in the works or that the Nasdaq needs to fall as dramatically as it did two decades ago, he expects “a bumpy road ahead” and that “the market could have a long way down to go.”

That view has Duffy sitting on the sidelines, potentially until after the November midterm elections. Also, his positions already triggered stop losses, or a sell order designed to mitigate losses when a stock falls to a certain level. That isn’t something offered by all brokers, but it is a feature his Chicago-based platform recommends on each trending stock.

“If you want to invest, we say: here’s a stop-loss to protect your downside.”

Read: Bond-market volatility touches one of highest levels since 2007-2009 financial crisis and recession