An ongoing selloff in long-dated Treasurys pushed the benchmark 10-year yield closer to 4% on Tuesday, while the 30-year yield rose to its highest since January 2014 as traders finally came around to the higher-for-longer theme for interest rates.

What’s happening

-

The yield on the 10-year Treasury

TMUBMUSD10Y,

3.948%

advanced 8.5 basis points to 3.963% from 3.878% on Monday. Tuesday’s level was the highest since April 6, 2010, based on 3 p.m. yields, according to Dow Jones Market Data. - The yield on the 2-year Treasury BX:TMUBMUSD02Y rose less than 1 basis point to 4.308% after factoring in new issue levels.

-

The yield on the 30-year Treasury

TMUBMUSD30Y,

3.827%

rose 13.2 basis points to 3.829% from 3.697% on Monday. Tuesday’s level was the highest since Jan. 9, 2014.

What’s driving markets

Aggressive selling resumed in the longer end of the Treasury yield curve on Tuesday, pushing up rates on 7- through 30-year maturities. Selling of U.K. assets also returned again after a savage slump Friday and Monday triggered broader market angst at the start of the week.

The yield on the 10-year U.K. gilt BX:TMBMKGB-10Y surged to a roughly 14-year high on Tuesday as investors worried that the British government’s new tax-cutting budget left the country’s finances on an unsustainable path.

Meanwhile, the 10-year U.S. benchmark yield threatened to break above 4% for the first time in at least 12 years amid sustained concerns about aggressive Federal Reserve interest rate hikes to combat inflation.

Read: 10-year Treasury yield is knocking on the door of 4%, raising jitters in financial markets

Investors remain wary, particularly as Federal Reserve speakers continue to stress the central bank will remain aggressive in its battle to tame inflation. On Tuesday, Minneapolis Fed President Neel Kashkari, said Fed officials are in rare agreement on the goal of bringing inflation down to the 2% target. His colleague, Chicago Fed President Charles Evans, gave a spirited defense of the Fed’s interest-rate projections, saying rates may need to plateau next year.

Markets are pricing in a 63% probability that the Fed will raise interest rates by another 75 basis points to a range of 3.75% to 4% on Nov. 2. The central bank is mostly expected to take its fed-funds rate target to at least between 4.5% to 4.75% by March, according to the CME FedWatch tool.

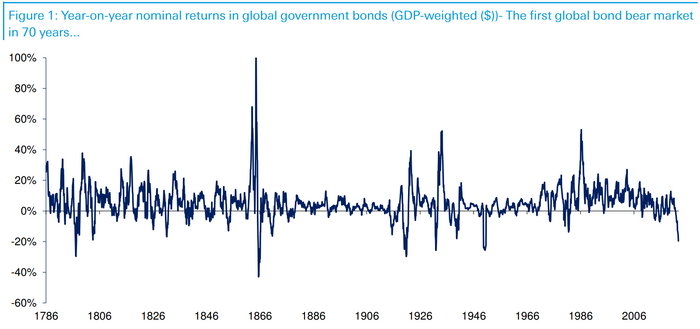

The Fed’s shift over the past several months from a loose monetary policy to an increasingly tight one has contributed to delivering the first global bond bear market in more than 70 years, according to researchers at Deutsche Bank.

Source: GFD, Deutsche Bank

In addition, one popular bond-market recession gauge may go further below zero than anytime since Paul Volcker’s reign in the early 1980s, according to a team at BNP Paribas.

U.S. data released on Tuesday shows that durable goods orders fell 0.2% in August, mainly because of decline in bookings for large aircraft. The U.S. S&P CoreLogic Case-Shiller 20-city house price index fell a seasonally adjusted 0.4% in July. And U.S. consumer confidence jumped to a five-month high in September, thanks to falling gas prices.

Treasurys continued to selloff on Tuesday following a $44 billion auction of 5-year notes.

What analysts are saying

“Bond yields continue to push higher on expectations of further central bank

tightening,” according to Mark Haefele, chief investment officer for UBS Global Wealth Management, and others. “Rising yields in part reflect the unwinding over the last month of expectations for an early pivot in central bank, and particularly Federal Reserve, policy. But we think the rise in longer-term yields may not accurately reflect the risks facing the economy.”