It’s been raining caution on Wall Street, with Goldman Sachs and BlackRock the latest big names to turn cool on equities.

Days after cutting their year-end S&P 500 index target to 3,600 from 4,300, Goldman

GS,

downgraded equities to underweight for the next three months, citing downward pressure on valuations and negative earnings forecast revisions likely into year-end in the wake of the Federal Reserve’s rise in interest rates.

Stocks “tend to suffer in the last phase of a hiking cycle i.e. 3 to 6 months before the peak in U.S. 2 year yields,” said a team led by Christian Mueller-Glissmann, head of asset allocation strategy at the bank, in a note to clients on late Monday. The Dow industrials

DJIA,

joined the S&P 500 in bear market territory to start the week, though stock index futures indicated a bounce was in store for Tuesday.

And from one of the world’s biggest asset managers, BlackRock

BLK,

came this advice on Monday: “Many central banks aren’t acknowledging the extent of recession needed to rapidly reduce inflation. Markets haven’t priced that so we shun most stocks.”

Last week’s interest rate-hike blitz implies a clear chain of events — “overtighten policy first, significant economic damage second and then signs of inflation easing only many months later,” said a team led by Jean Bolvin, head of BlackRock Investment institute in the asset managers weekly commentary.

“We don’t see a ‘soft landing’ outcome where inflation returns to target quickly without crushing activity. That means more volatility and pressure on risk assets, we think,” said Bolvin. And like much of Wall Street, he said they also prefer investment grade credit “as yields better compensate for default risk. Plus high quality credit can weather a recession better than stocks.”

BlackRock said they prefer inflation-linked bonds and are staying cautious on long-term nominal government bonds due to persistent inflation.

Similar sentiment was seen from Goldman, which lifted credit to “neutral” over three months, maintaining an “up in quality” bias, as they said investment-grade credit yields look attractive in both absolute terms and relative to equities. Morgan Stanley has also recently recommended IG bonds.

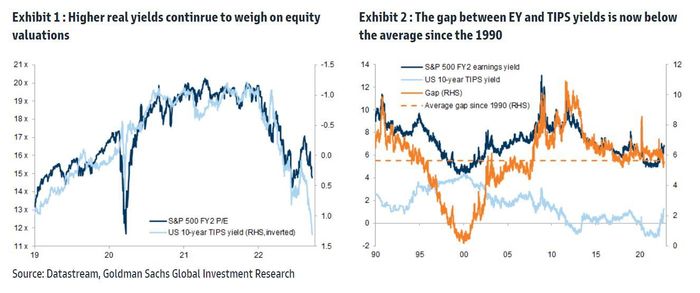

Goldman said that rising real bond yields are continuing to be a major headwind for valuations across assets. Current equity valuations may not fully reflect the risks that are out there and “might have to decline further to reach a market trough,” said Mueller-Glissmann.

Explaining its view, Goldman said that since the Great Financial Crisis of 2008, a TINA (There Is No Alternative) strategy by investors has been a key support for stocks, as they were more attractive than bonds. But investors are now facing TARA (There Are Reasonable Alternatives), with the situation reversed.

Goldman Sachs

Read: Morgan Stanley’s Mike Wilson sees a dollar-fueled crisis brewing.

And: Stock market ‘on cusp’ of important test: Watch this S&P 500 level if 2022 low gives way, says RBC