The British pound hit new lows of $1.0349 against the U.S. dollar in the early hours of Monday but has pared losses, after the U.K government revealed the largest tax cut since the 1970s last week.

The pound

GBPUSD,

made a historic dive on Friday after U.K. Chancellor Kwasi Kwarteng unveiled a mini-fiscal budget comprising a number of tax cutting measures to be financed by £62 billion of government borrowing.

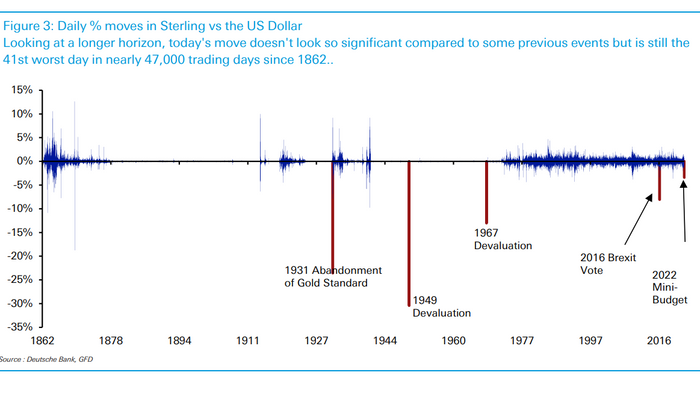

The pound dropped to $1.0850 after the announcement – the lowest level since 1985 and the third worst daily performance since Black Wednesday in 1992, Deutsche Bank analysts noted, topped only by the day the U.K. voted to leave the European Union and when global markets reacted to the emergence of the pandemic in March 2020.

Daily percentage moves in Sterling vs the U.S. Dollar

Deutsche Bank, GFD

Investors were further shaken through the weekend into the early hours as sterling fell 2.5% to $1.0349 – from early trading in Asian markets – but losses were pared back to $1.0728.

Kwarteng remained unmoved about the market movements, and the short term risks to inflation, Reuters reported, citing the BBC.

“As chancellor of the exchequer, I don’t comment on market movements. What I am focused on is growing the economy and making sure that Britain is an attractive place to invest,” he said.

“I’m confident that the Bank is dealing with [inflation], but also what perplexed me was the fact that you don’t deal with people’s rising cost of living by taking more of their money in tax.”

The pound has now dropped 20% on the year.

The yield on the 10-year gilt

TMBMKGB-10Y,

surged another 31 basis points to 4.13%.

Author Paul Krugman has argued that the pound’s depreciation will improve the U.K’s investment position and questioned why the crash would invoke a balance sheet currency crisis.

Analysts like Avatrade’s Naeem Aslam reckon the Bank of England could step in by increasing interest rates by a full percentage point. On Thursday, it raised rates to 2.25%.

“An unexpected announcement is highly anticipated from the Bank, and traders should remain cautious about this,” he said.

Meanwhile, the U.S. dollar has been growing in strength as the Federal Reserve hiked interest rates by 75 basis points last week and said it would hike more.

Elsewhere the euro

EURUSD,

is stable at $0.9685.