Associated British Foods’ (ABF) stock fluctuated on Wednesday after UBS downgraded the Primark owner over operational expenditure concerns.

Shares in ABF

ABF,

opened over 2% lower on Wednesday morning trading in London, but pared that to a drop of around 0.1% later.

Cutting the firm to neutral from buy in a research report published on Wednesday, UBS analyst Sreedhar Mahamkali cited expected pressures on Primark’s margin in the medium term due to challenging sourcing conditions from the exchange rate, and sustained higher operation spending from energy costs and rising fabric costs.

Mahamkali said he did like Primark’s “strong competitive position,” which could strengthen over the next year due to the retailer’s decision not to raise prices any further.

“We see potential from expansion and alternative distribution channels like ‘Click and Collect’” he added.

Primark aside, UBS expected “broadly stable trajectory” across ABF’s food business as the price increases from inflation would offset any drop in volume and high expenditure in the medium term.

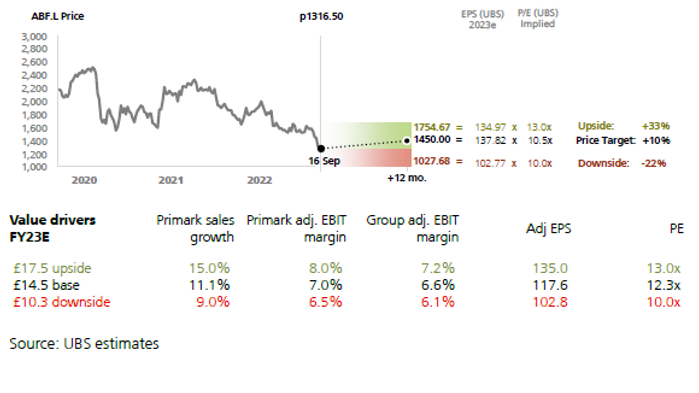

UBS research forecast on ABF

“All in we see a balanced risk/reward and expect the shares to be range bound until encouraging Primark margin/revenue trends emerge,” Mahamkali concluded.