You can forgive Jeffrey Gundlach, a long-suffering Buffalo Bills fan, if he has the NFL on his mind now that the team he supports looks like the Super Bowl favorite. The chief executive of DoubleLine Capital says he recalls an ad for Crown Royal whisky, in which a referee tells drinkers to take a water break.

“The tagline is ‘stay in the game,’” said Gundlach, in a Twitter Spaces conversation hosted by Jennifer Ablan, the editor in chief of Pension and Investments. “[The Fed] started partying — which is a euphemism for tightening — one shot, two shots, back-to-back three shots, and now three more … like dude, have a water, you know? Slow down.”

Gundlach says there’s a serious risk the Fed will overtighten, and overshoot on the downside just as it overshot on the upside, particularly as it’s also reducing the size of its balance sheet through quantitative tightening. “Since they’re trying to get [inflation] down 700 basis points, the overshoot may be even bigger,” he says. “Maybe it moves down to negative 4% on CPI, or negative 2%.”

He says that’s what the bond market is saying with inflation running at between 8% and 9%. “Why is anyone buying a 3.50%-ish 30-year Treasury

BX:TMUBMUSD30Y

? The only logic that squares the circle is that inflation will overshoot to the downside.”

Gundlach says the S&P 500

SPX

will fall to as low as 3,000, and maybe “3,400 — either way, lower than where it is today.” And, perhaps not surprising from the man known as the bond king, he sees tons of opportunities in the fixed income space. “Bonds are wickedly cheap to stocks,” he said. “And this is from somebody who said in January, stock markets are way overvalued, but was cheap to bonds. Not anymore.”

“This is a very good time to buy bonds, and one of the ways I know that, is nobody wants to do it,” he said.

For investors with low risk tolerance, he said a bank loan fund made sense. He said the spread to short-term interest rates is about 300 basis points. So if the Fed takes rates to 4%, the investor gets a yield of 7%, but can buy the bonds below 95, with a default rate of less than 1%.

“The way it goes wrong is if the Fed collapses interest rates down to zero again, and then you’re going to have a lower income stream, but for the time being, it’s a very easy way of getting income,” said Gundlach.

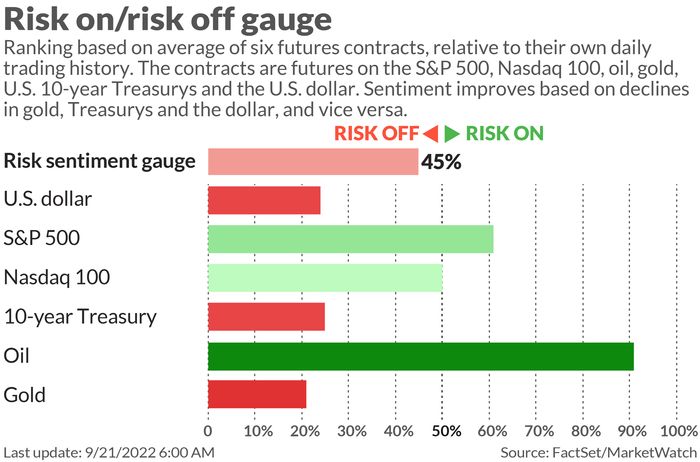

The market

U.S. stock futures

ES00

NQ00

edged higher before the Fed decision. Bonds, gold

GC00

and oil

CL

caught on a bid on concerns over Russia’s mobilization of troops. The yield on the 10-year Treasury

BX:TMUBMUSD10Y

slipped to 3.54%, and the dollar

DXY

continued to march higher.

The buzz

Russian President Vladimir Putin ordered a partial mobilization of reservists, accused the West of nuclear blackmail and implicitly threatened to use nuclear weapons.

The Federal Open Market Committee rate decision is at 2 p.m. Eastern, with expectations settling that the rate hike will be 75 basis points. Economists at Deutsche Bank expect the dot plot, released at the same time as the FOMC statement, to show a 2022 median fed funds forecast of 4.1%, a 2023 forecast of 4.3% and a 2024 forecast of 3.9%. The press conference with Fed Chair Jerome Powell starts at 2:30 p.m.

Ahead of that, existing home sales are due at 10 a.m. Eastern.

Dr. Doom — Nouriel Roubini — says stocks may drop 40%. (subscription required)

General Mills

GIS

is due to report fiscal first-quarter results, and after the close, builder Lennar

LEN

reports third-quarter results.

Best of the web

Newly released FBI files show how Bernie Madoff reacted when the feds finally caught on.

The early returns on a pilot four-day workweek find bosses, as well as employees, liking it.

What a Quebec lithium mine says about the future of electric cars.

Top tickers

Here were the most active stock-market ticker symbols as of 6 a.m. Eastern.

| Ticker | Security name |

| TSLA | Tesla |

| GME | GameStop |

| AMC | AMC Entertainment |

| BBBY | Bed Bath & Beyond |

| AAPL | Apple |

| NIO | Nio |

| AMZN | Amazon.com |

| NVDA | Nvidia |

| HKD | AMTD Digital |

| F | Ford Motor Co. |

Random reads

Universal Studios will offer non-fungible tokens at their theme parks.

A flub by a German lawmaker and a Simpsons episode has QAnon supporters worried about Sept. 24.

The actor Tom Hardy secretly entered, and then won, a Jiu-Jitsu competition.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.