Yields are rising in the U.S. and around the world, driven by the imperative need of central banks to get tough on inflation — which is leaving the once-perennially popular trade that favors stocks over other asset choices dead for now.

That trade, known as TINA — an acronym for ‘there is no alternative’ to equities — has long been talked about as being vulnerable since the 2020 pandemic era began. Only now, rates on the 1-year Treasury bill

TMUBMUSD01Y,

and 2-year note

TMUBMUSD02Y,

are testing 4%, a level seen as likely to send shivers throughout the financial market, and a dozen central banks are all poised to come out with decisions over the next 48 hours as part of a worldwide tightening campaign.

The yield on the 10-year gilt

TMBMKGB-10Y,

the U.K. counterpart to Treasurys, hit a new 11-year high on Tuesday, while 5- to 30-year real U.S. yields, which impact the true cost of capital for corporations after factoring in inflation, have soared to the highest level in years.

Read : Farewell TINA? Why stock-market investors can’t afford to ignore rising real yields.

Stocks took another beating on Tuesday, with Dow industrials dropping as much as 459 points at the session’s low, a day ahead of the Federal Reserve’s widely expected rate decision. Investors are mostly bracing for another aggressive 75-basis-point rate hike, which would lift the fed-funds rate target to between 3% and 3.25%, as well as indications of more to come. Already, all three major U.S. stock indexes

DJIA,

COMP,

are down around 16% to 27% for the year — joining their Asian and European counterparts in the red.

Traders see a good chance that the fed funds target range gets to as high as 4.25% to 4.5% by December — above prior expectations — which will likely hit the price-to-earnings ratio of stocks.

With the Fed still raising rates into a weakening economy, “TINA is dead for time being,” said John Silvia, founder and chief executive of Dynamic Economic Strategy in Captiva Island, Fla. “The rise in Treasury bill rates, the 2-year yield, and rates on quality corporate debt has now become competitive with S&P earnings. So if I’m an investor, then my return on T-bills and corporate debt is equal to my earnings on my stock portfolio.”

Meanwhile, real or inflation-adjusted yields, as reflected by rates on 5- and 10-year Treasury inflation-protected securities, soared to 1.3% and 1.2%, respectively, as of Tuesday morning — the highest levels in more than 11 years, according to Tradeweb data.

Rising real rates reflect a cost of borrowing. But they will probably need to rise another one to two full percentage points each, “which is a significant challenge because that’s the real cost of financing, whether it’s for a single family residence or a company buying equipment,” Silvia said via phone Tuesday.

Indeed, strategists at Goldman Sachs

GS,

warn that shrinking profit margins could pose a downside risk for stock-market returns, while Morgan Stanley’s Michael Wilson suggests that “reality” has not been priced in yet.

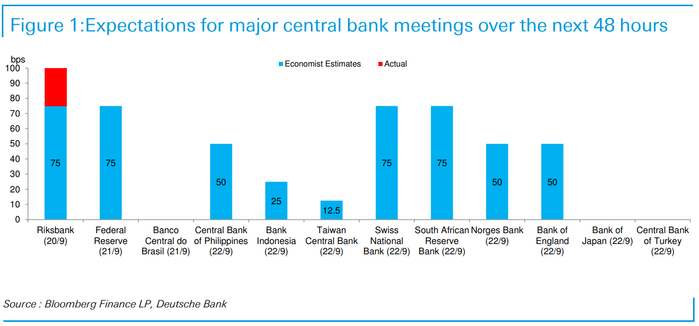

All this comes as a dozen central banks worldwide are scheduled to convene this week, with Tuesday bringing a surprise 100-basis-point rate hike by Sweden’s central bank. Deutsche Bank’s Jim Reid estimates that a combined 500 basis points worth of global rate hikes will be occurring over the next 48 hours, starting as of Tuesday morning — which he describes as “an unprecedentedly hawkish period for central banks.”

Source: Bloomberg, Deutsche Bank

The result is “a very difficult environment, with many central banks all tightening at the same time — something that we’ve not really had for many, many years,” Silvia, the former chief economist at Wells Fargo Securities, told MarketWatch. “That’s creating an uncertain environment for the global economy, an uncertain path of policy changes, uncertainty over whether there will be a financial breaking point, and the feeling that anything could happen. You are like Indiana Jones out in the Colombian jungle and don’t know what the hell is around the corner.”

He sees a one-in-five to one-in-ten chance of a financial crisis showing up “pretty quickly” and being transmitted by the financial market amid continued corporate profit warnings and a refinancing shock to highly leveraged corporations.

In April, when the 10-year real yield went intermittently above zero for the first time since the pandemic began in 2020, Silvia warned that such a development would amount to bad news for investors of risky assets like stocks. All three major U.S. indexes have dropped since.

In June, Silvia said financial markets and the Fed would have to either accept higher inflation or the idea of policy makers pursuing higher interest rates to combat inflation.

Then in July, as financial markets began trading on the view that inflation had hit its peak, Silvia said investors were likely underestimating the persistency of inflation. His remarks came ahead of a hotter-than-expected U.S. consumer-price index reading for August.

— Isabel Wang contributed to this article.