U.S. stock indexes fell back from recent highs Wednesday as bulls held their fire ahead of the release of the minutes of the Federal Reserve’s last policy meeting later in the session while digesting July retail sales data.

How are stocks trading

-

The Dow Jones Industrial Average

DJIA

fell 165 points, or 0.5%, to 33,985. -

The S&P 500

SPX

dropped 30 points, or 0.7%, to 4,275. -

The Nasdaq Composite

COMP

declined 160 points, or 1.2%, to 12,941.

On Tuesday, the Dow Jones Industrial Average rose 240 points, or 0.71%, to 34152, the S&P 500 increased 8 points, or 0.19%, to 4305, and the Nasdaq Composite dropped 26 points, or 0.19%, to 13103. The Nasdaq Composite is up 23.1% from its mid-June low but remains down 16.3% for the year-to-date.

What’s driving markets?

The appetite for additional risky bets was waning as investors took time out to assess the strong summer surge that powered the stock market to three-month highs, and awaited the latest monetary policy update via the minutes of the latest Fed meeting.

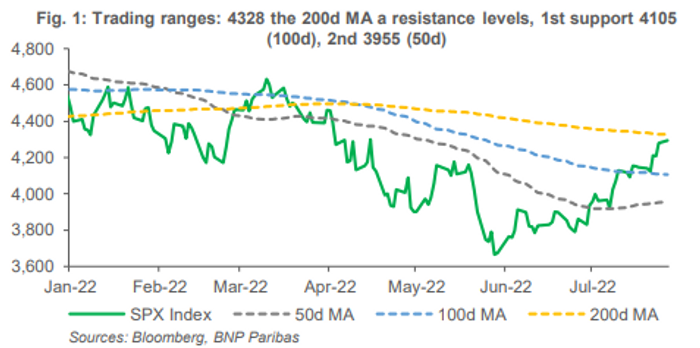

Hopes that inflation may have peaked and that the Fed thus may be able to avoid delivering a hard economic landing has pushed the S&P 500 up 17.4% from its mid-June low, and left the benchmark challenging its 200-day moving average for the first time since April.

“The index traded above its 200-DMA twice this year, once in early February, then late March, but couldn’t hold on to the gains and rapidly sold off,” noted Ipek Ozkardeskaya, senior analyst at Swissquote Bank.

“We will see if the third time is a charm; earnings and the FOMC minutes will be decisive for the short-term direction,” she added.

Source: BNP Paribas

The Federal Reserve is due to release the text from its late July rate-setting meeting at 2 p.m. Eastern and traders will be keen to see whether the discussion matches current market expectations for the pace of rate hikes.

“I am expecting 75 basis points from the next Fed meeting on Sept 21, but that depends on what Treasury bond yields are. If 10-year treasury bond yield fell to 2.6%, maybe they’ll use 50 basis points,” said Louis Navellier, chairman and founder of Navellier & Associates, as Treasury yields remain inverted.

Earlier, investors received more clues as to the health of the U.S consumer. Following better-than-expected results on Tuesday from Walmart

WMT

and Home Depot

HD,

it was the turn of retailing peers Target

TGT

and Lowe’s

LOW

to deliver earnings. Target’s numbers disappointed, after higher markdowns led to lower margins, but Lowe’s figures were well-received.

“In the wake of Walmart and Home Depot, I think Wall Street had much higher expectations for Target,” Navellier said in an interview.

“We believe kind of a rally in technology was hopeful, kind of Fed pivot and that we’re near the end of interest rate tightening cycle,” said Andy Tepper, managing director at BNY Mellon Wealth Management on Wednesday. “And quite frankly, we think that may be a little bit premature, that there still is some worrisome stickier inflation that the Federal Reserve needs to deal with.”

In economic data, U.S. retail sales were unchanged overall in July, though largely due to falling gasoline prices and fewer purchases of new cars and trucks. Economists polled by Dow Jones Newswires and The Wall Street Journal forecasted a 0.1% growth.

Retail sales minus autos rose 0.4% in July, while retail sales excluding autos and gas climbed 0.7% in July.

“We got another data point this morning confirming what we already know; the US economy is not currently in recession,” Cliff Hodge, Chief Investment Officer, Cornerstone Wealth, in Charlotte NC, wrote. “Consumers remain resilient in the face of sticky inflation. The beat on the Retail Sales Control Group is a harbinger for economic reacceleration in the third quarter as it flows directly into GDP, but in an environment where good economic news is bad news for markets the argument for a new bull market is further diminished.”

See: Stock-market rally faces key challenge at S&P 500’s 200-day moving average

Companies in focus

-

Shares of Target Corp.

TGT

slumped 2% Wednesday, after the discount retailer reported fiscal second-quarter profit that fell well short of expectations, as higher markdown rates led to lower gross margins, but revenue that topped forecasts. -

Shares of Walmart Inc.

WMT

gained 0.3% Wednesday to a three-month high, after the discount retail behemoth on Tuesday reported fiscal second-quarter profit and revenue that beat recently lowered expectations, and raised its full-year earnings outlook. -

Shares of TJX Companies

TJX

gained 4% Wednesday, after the off-price apparel and home fashions retailer reported fiscal second-quarter profit that rose above expectations, while same-store sales fell more than forecast as “historically high inflation” hurt consumer spending, particularly for home goods. -

Shares of Blue Water Vaccines Inc.

BWV

jumped 187% Wednesday after the biopharmaceutical company said it plans to “explore the potential to develop” a new monkeypox vaccine. -

Shares of FuboTV

FUBO

fell more than 12% on Wednesday, despite the profitability road map laid out by the streaming service at its virtual investor day on Tuesday.

How are other assets faring

-

Oil futures were firmer, with U.S. WTI crude

CL

adding 1.1% to $87.54 a barrel, despite hopes an Iran nuclear deal may help the country increase exports. -

The 10-year Treasury yield

BX:TMUBMUSD10Y

rose 8.6 basis points to 2.898% as traders awaited the Fed minutes. -

The ICE Dollar index

DXY

inched up 0.3% to 106.80, and this pressured gold

GC00,

off 0.5% to $1780 an ounce. -

Bitcoin

BTCUSD

fell 2.4% to $23,392. -

Asia markets were broadly firmer after Wall Street moved to a fresh three-month high overnight. Japan’s Nikkei 225

JP:NIK

added 1.2% and Hong Kong’s Hang Seng

HK:HSI

climbed 0.5%. In Europe the mood was more mixed, reflecting the dip in U.S. futures on Wednesday, and the Stoxx 600

XX:SXXP

finished 1% lower.

— Jamie Chisholm contributed to this article.